Blog

Audit Access: Access & Action Logs in Audit Trails

Audit Access: Access & Action Logs in Audit TrailsJanuary 20, 2026

audit-trailsaccess-logscomplianceLearn how access & action logs strengthen email governance by tracking who viewed or exported archived emails—supporting compliance, investigations, and audit readiness.

Fast Recovery in Search & Retrieval: Email Restore Use Case

Fast Recovery in Search & Retrieval: Email Restore Use CaseJanuary 20, 2026

search-and-retrievalemail-restorebusiness-continuityExplore how fast recovery and email restore capabilities help organizations quickly retrieve deleted or inaccessible emails for audits, legal needs, and business continuity.

Handling Multiple Cards: Managing Reconciliation at Scale for Large Corporations

Handling Multiple Cards: Managing Reconciliation at Scale for Large CorporationsJanuary 20, 2026

multiple-cardsexpense-managementscalabilityDiscover how Creodata's Expense Management Automation helps large corporations manage reconciliation at scale when employees hold many physical and virtual corporate cards.

Mobile Reconciliation: On-the-Go Matching for Modern Workforces

Mobile Reconciliation: On-the-Go Matching for Modern WorkforcesJanuary 20, 2026

mobile-reconciliationexpense-managementcorporate-cardsSee how Creodata's mobile-first expense workflows let employees capture receipts and reconcile transactions on the go, improving accuracy, visibility, and user experience.

Tailored Access for Every Role: Role-Based UI Access in User Management & RBAC

Tailored Access for Every Role: Role-Based UI Access in User Management & RBACJanuary 20, 2026

rbacuser-managementrole-based-accessSee how role-based UI access (RBAC) tailors Creodata Mail Journaling to each role—Admin, Viewer, Auditor—reducing risk and improving clarity with least-privilege access.

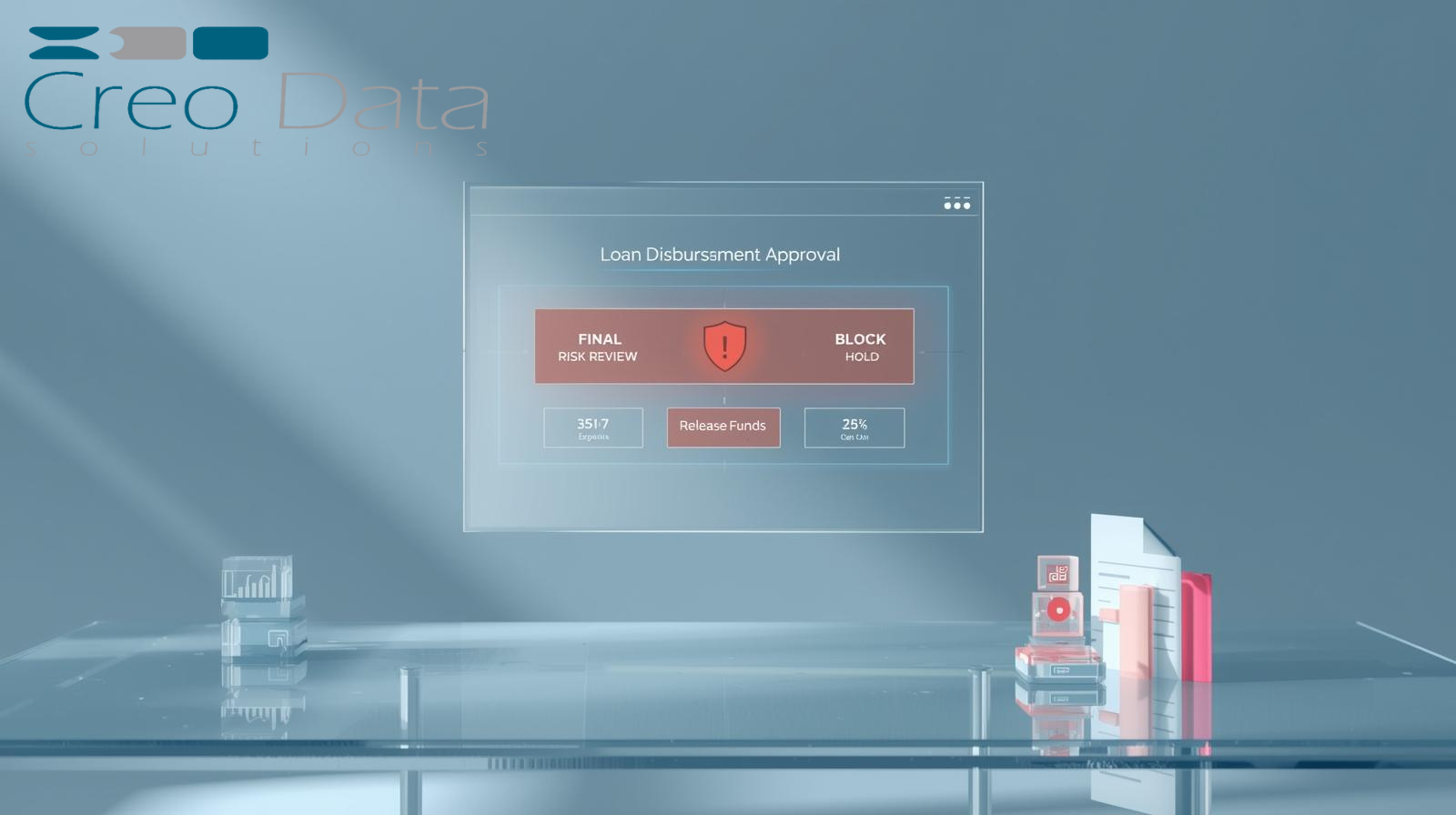

Review & Compliance – Feature: Risk Oversight

Review & Compliance – Feature: Risk OversightJanuary 20, 2026

risk-reviewloan-managementrisk-oversightSee how Creodata's Loan Management System embeds risk review checkpoints into the loan lifecycle so risk officers can block disbursements when red flags appear.

Guided Setup – Quick Onboarding via Azure Marketplace Deploy

Guided Setup – Quick Onboarding via Azure Marketplace DeployJanuary 15, 2026

quick-onboardingazure-marketplaceguided-setupSee how Creodata's guided Azure Marketplace deploy enables quick onboarding for Mail Journaling, letting organizations start compliant email archiving in hours, not days.

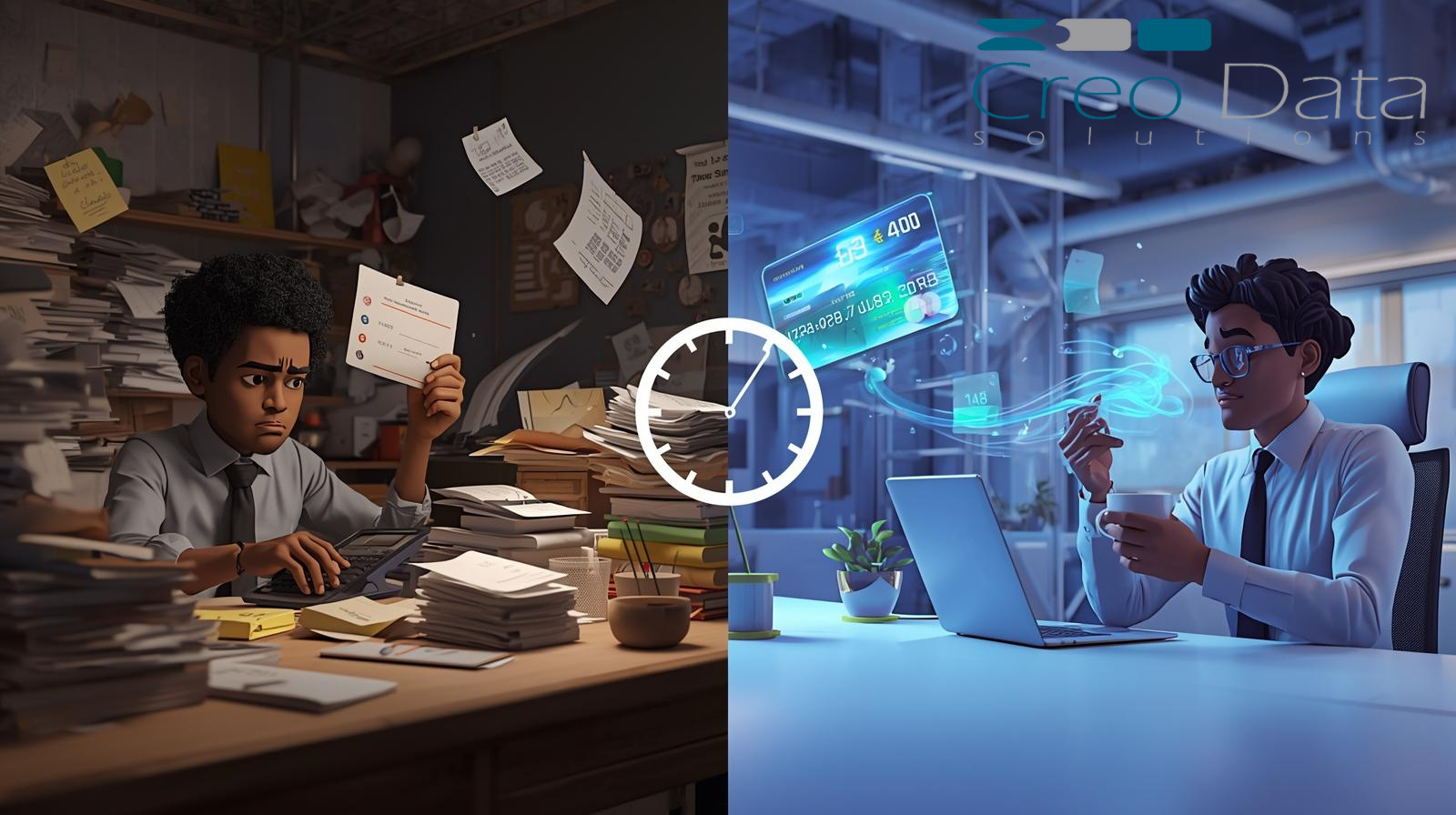

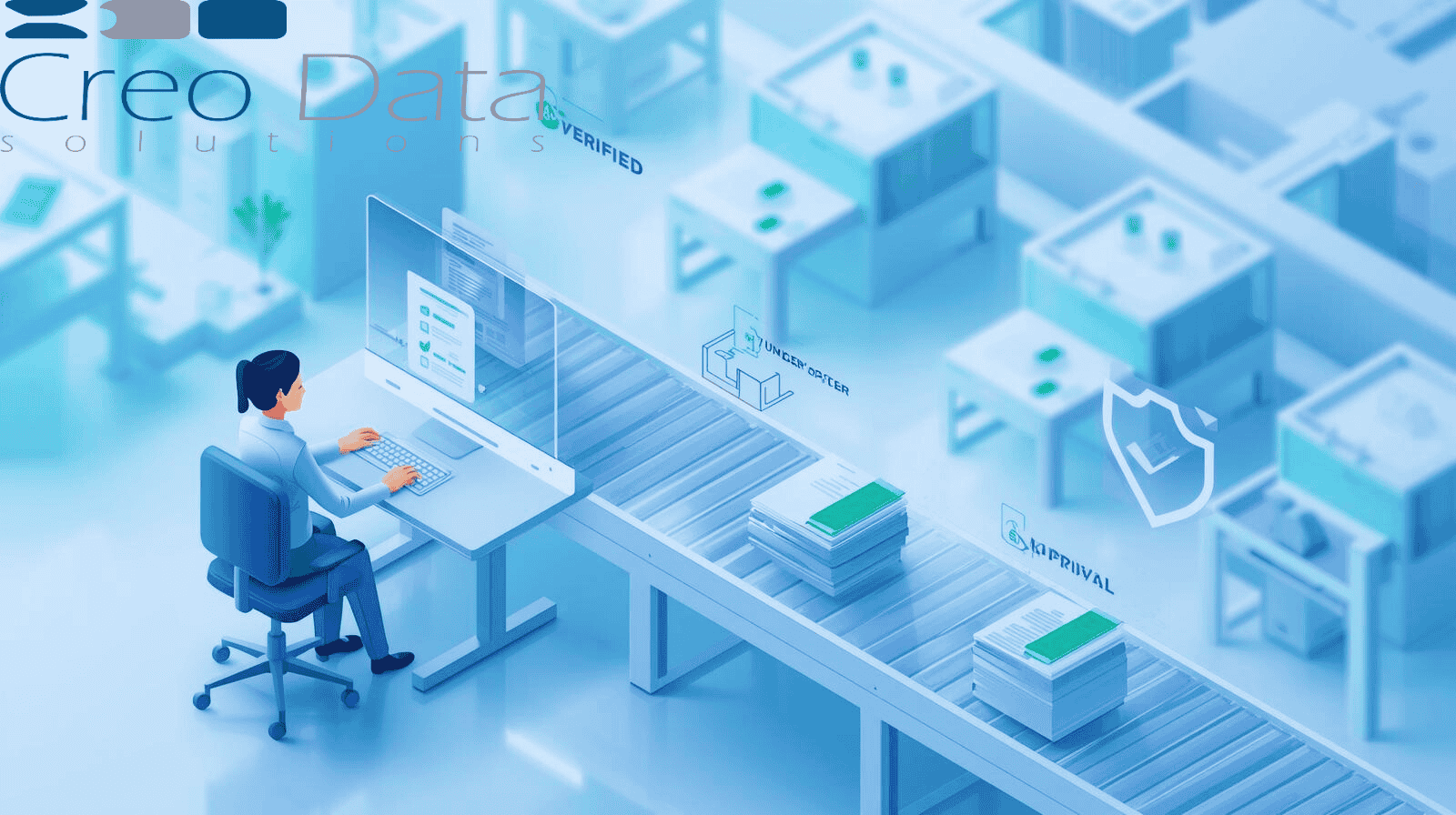

Reduce Manual Workload – Boost Finance Team Productivity via Labor Reduction

Reduce Manual Workload – Boost Finance Team Productivity via Labor ReductionJanuary 15, 2026

finance-productivitylabor-reductionexpense-managementSee how Creodata's Expense Management Automation reduces manual reconciliation work so finance teams can focus on higher-value analysis and control.

Legal Review: Strengthening Compliance Through Documentation and Conditions

Legal Review: Strengthening Compliance Through Documentation and ConditionsJanuary 15, 2026

legal-reviewloan-managementcomplianceLearn how Creodata's Loan Management platform enables legal teams to check documentation for compliance, attach conditions, and ensure every loan agreement meets regulatory requirements.

Litigation Hold — Preserve Emails for Legal Cases

Litigation Hold — Preserve Emails for Legal CasesJanuary 15, 2026

litigation-holdlegal-holdmail-journalingLearn how litigation hold and freeze-deletions in Creodata's Mail Journaling solution preserve critical email evidence for legal cases and regulatory investigations.

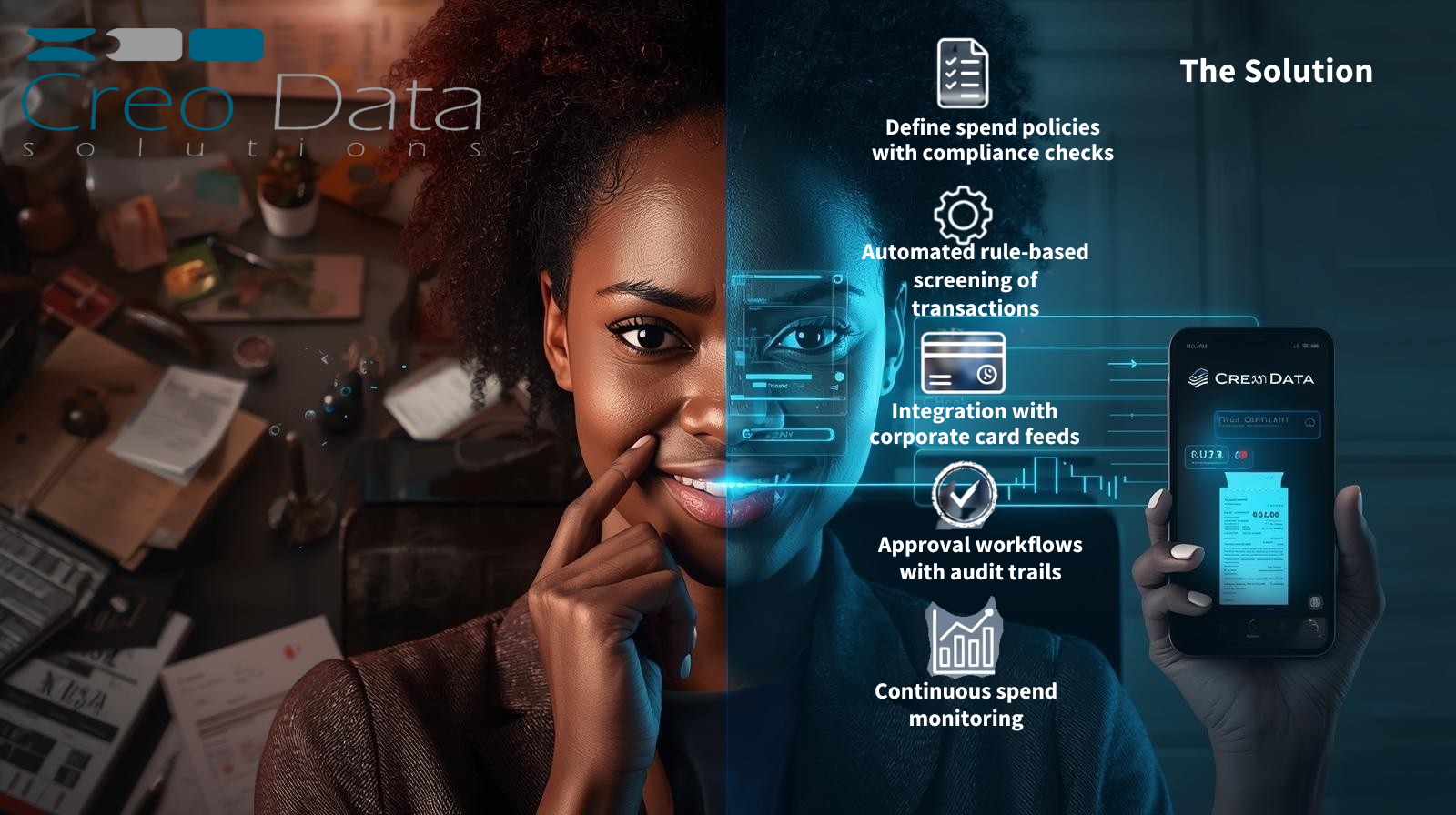

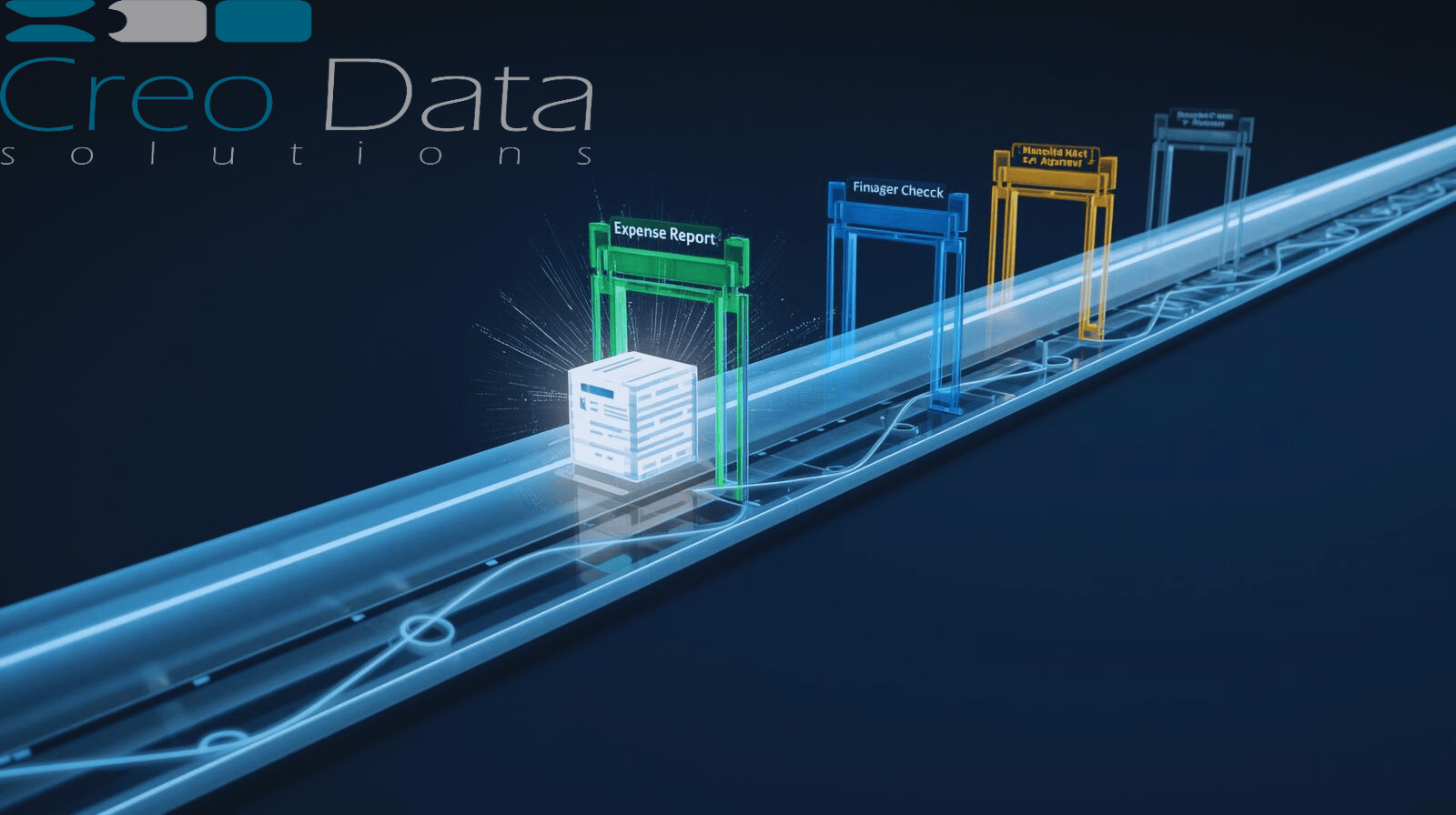

Improve Policy Compliance: Enforcing Spend Policies with Compliance Checks

Improve Policy Compliance: Enforcing Spend Policies with Compliance ChecksJanuary 15, 2026

policy-complianceexpense-managementcorporate-cardsDiscover how automated compliance checks in Creodata's Expense Management solution ensure only policy-compliant card transactions become valid expenses.

Auto-Import Magic: Card Feed Import in Expense Data Ingestion

Auto-Import Magic: Card Feed Import in Expense Data IngestionJanuary 14, 2026

expense managementcard feedscorporate cardsDiscover how automated card feed import in Creodata's Expense Management solution streamlines expense data ingestion, reconciliation, and financial control.

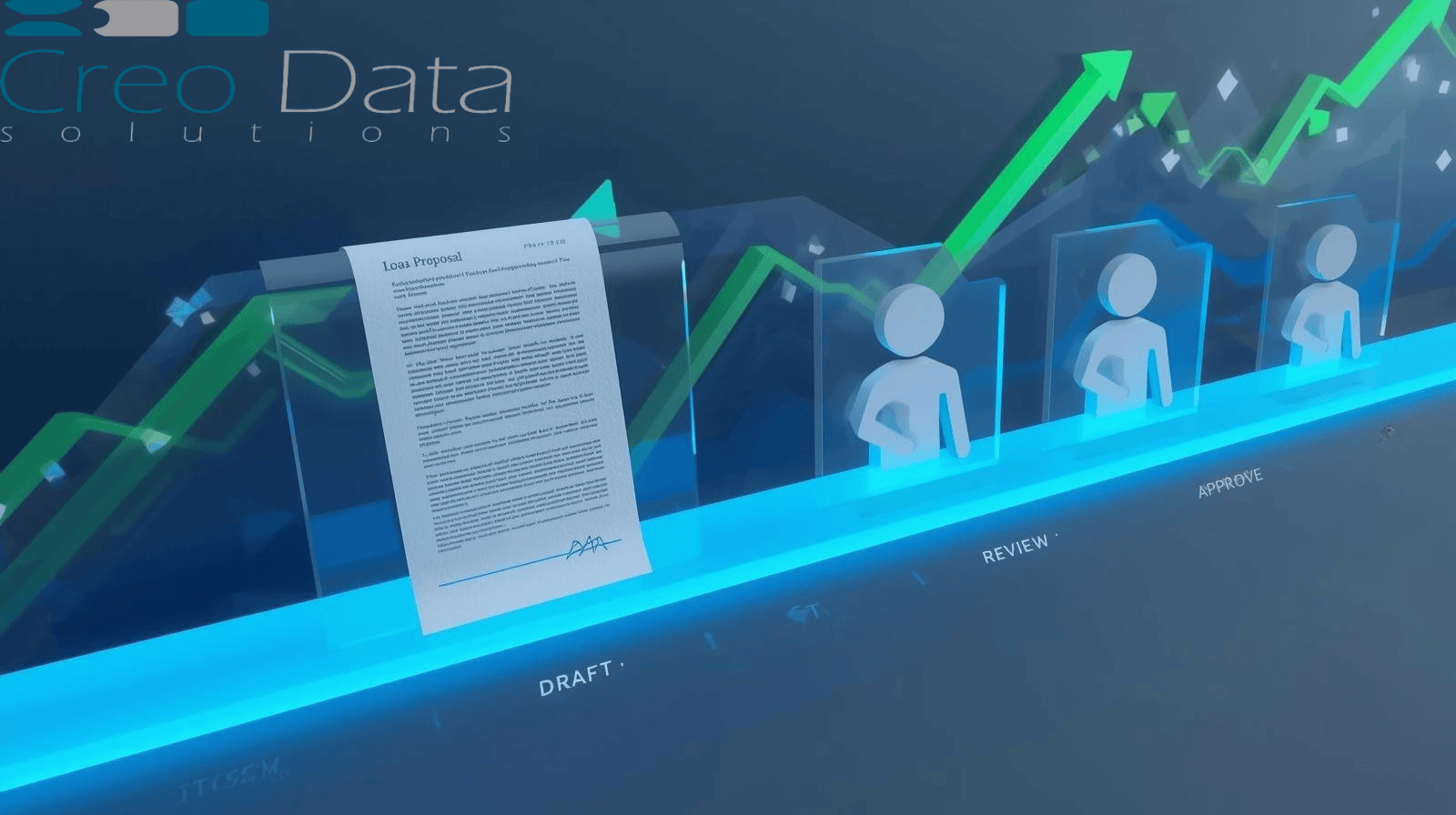

Credit Proposal Workflow: From Approval to Formal Agreement in the Credit Department

Credit Proposal Workflow: From Approval to Formal Agreement in the Credit DepartmentJanuary 14, 2026

loan managementcredit proposalcontract automationSee how a structured credit proposal workflow in Creodata's Loan Management system bridges approved credit decisions and legally binding agreements with full auditability.

Execution Workflow: Disbursement in Loan Management

Execution Workflow: Disbursement in Loan ManagementJanuary 14, 2026

loan managementdisbursementexecution workflowHow a robust disbursement workflow in Creodata's Loan Management solution turns approved credit decisions into compliant, traceable fund releases.

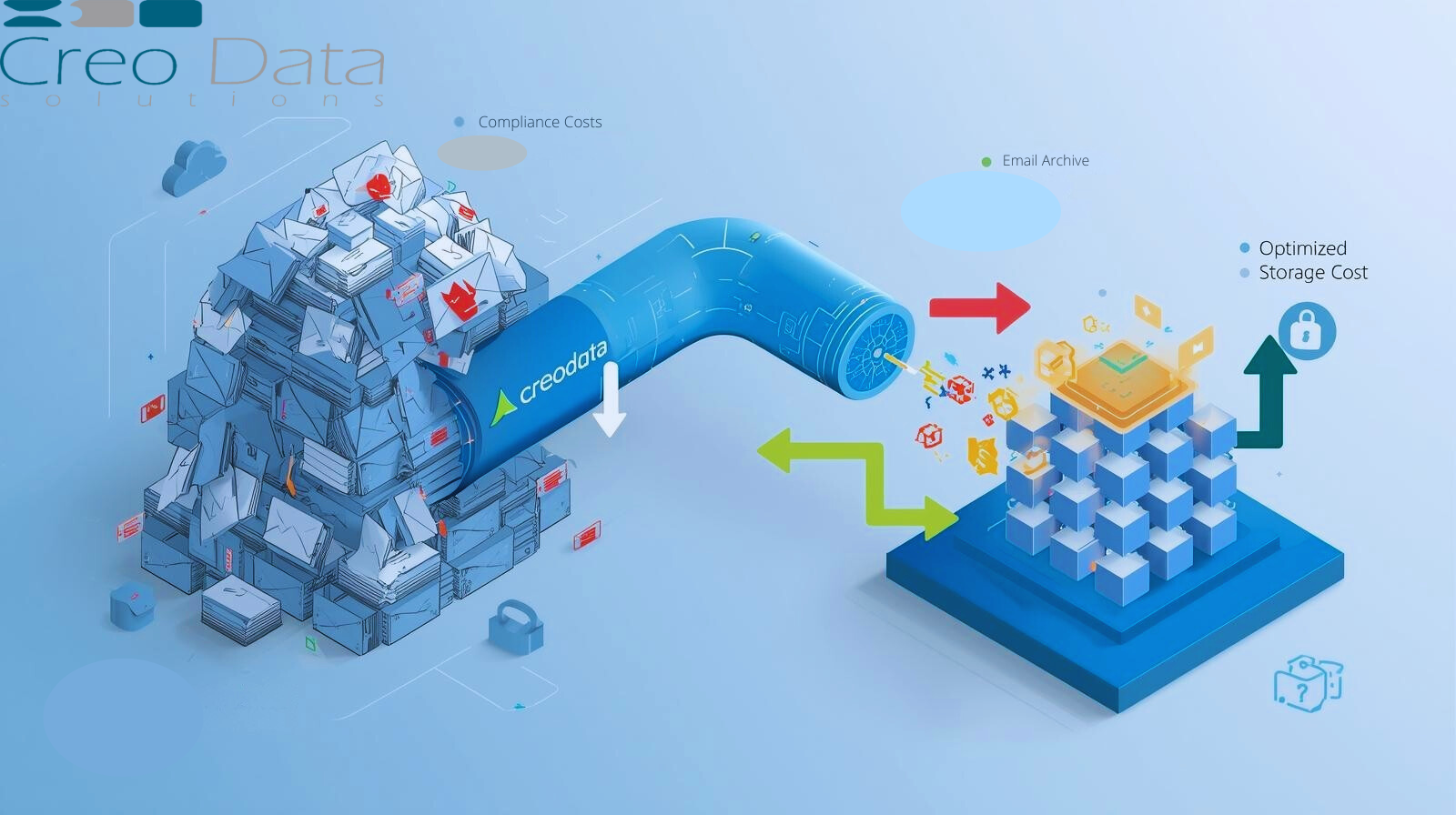

Security & Compliance: Encryption & Sovereignty in Secure Storage

Security & Compliance: Encryption & Sovereignty in Secure StorageJanuary 14, 2026

encryptiondata sovereigntysecure storageExplore how encryption and data sovereignty in Creodata's mail journaling solution protect sensitive data inside tenant environments while meeting global regulatory requirements.

Seamless Coverage: Hybrid/Cloud Support for Microsoft 365 Integration

Seamless Coverage: Hybrid/Cloud Support for Microsoft 365 IntegrationJanuary 14, 2026

mail journalinghybrid cloudmicrosoft 365How Creodata's hybrid/cloud journaling support delivers seamless coverage across on-premises Exchange and Microsoft 365 environments for compliance-ready email governance.

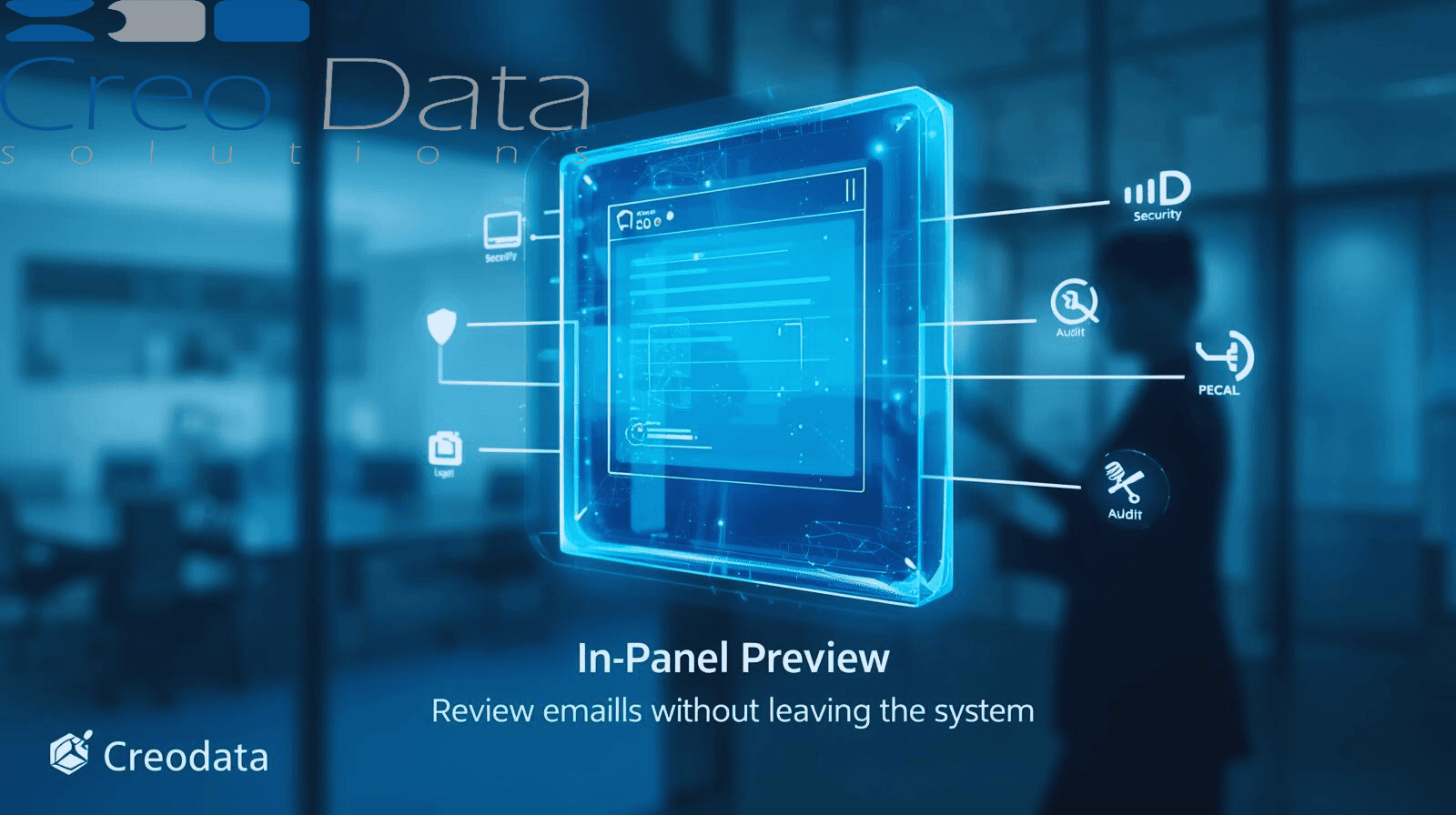

In-Panel Preview: Enabling Simple Legal Review in Journaling Systems

In-Panel Preview: Enabling Simple Legal Review in Journaling SystemsJanuary 14, 2026

in-panel-previewmail-journalinglegal-reviewDiscover how in-panel preview capabilities streamline legal review workflows by enabling users to view email content and metadata directly within the journaling system UI without external exports.

Native Format Export: Journal Viewer UI

Native Format Export: Journal Viewer UIJanuary 14, 2026

native-format-exportmail-journalingediscoveryLearn how native format export (.eml) capabilities in journal viewer UIs enable legally defensible email exports with complete metadata fidelity for eDiscovery and compliance workflows.

Receipt Matching Boost: Elevating Receipt-to-Transaction Linking with Attachment Association

Receipt Matching Boost: Elevating Receipt-to-Transaction Linking with Attachment AssociationJanuary 14, 2026

expense managementreceipt matchingcorporate cardsHow AI-powered receipt-to-transaction matching in Creodata's Expense Management solution boosts accuracy, compliance, and audit readiness by attaching proof to every card transaction.

Simplify Audit Trail: Ensuring Traceability in External Audits & Compliance

Simplify Audit Trail: Ensuring Traceability in External Audits & ComplianceJanuary 13, 2026

audit-trailtraceabilitycomplianceLearn how to simplify audit trails by ensuring traceability between card transactions and expense claims, reducing audit risk and improving compliance for external audits.

Enterprise Archiving with Scalable Architecture: Supporting Millions of Emails Reliably

Enterprise Archiving with Scalable Architecture: Supporting Millions of Emails ReliablyJanuary 13, 2026

email-archivingscalable-architecturecomplianceDiscover how scalable architecture enables enterprise email archiving solutions to handle millions of emails reliably, ensuring compliance, security, and business continuity.

Escalation Workflow: High-Value Review in Corporate Loan Governance

Escalation Workflow: High-Value Review in Corporate Loan GovernanceJanuary 13, 2026

escalation-workflowloan-managementgovernanceDiscover how escalation workflows for high-value loan proposals ensure proper governance, oversight, and accountability in corporate lending through automated senior-level review processes.

Catch Discrepancies Early: Exception Handling in Expense Management

Catch Discrepancies Early: Exception Handling in Expense ManagementJanuary 13, 2026

exception-handlingdiscrepancy-detectionexpense-managementDiscover how early exception detection in expense management helps catch discrepancies, prevent fraud, and reduce audit risk through automated mismatch detection and policy enforcement.

Final Decision – MCC/Board Role in the Decision Workflow

Final Decision – MCC/Board Role in the Decision WorkflowJanuary 13, 2026

loan-managementdecision-workflowmccLearn how MCC and Board-level final decision authority in loan management workflows ensures governance, accountability, and risk control for high-value credit decisions.

Proactive Compliance: Real-Time Alerts for Monitoring Journaling & Quota Issues

Proactive Compliance: Real-Time Alerts for Monitoring Journaling & Quota IssuesJanuary 13, 2026

real-time-alertscompliancemonitoringLearn how real-time alerts enable proactive compliance monitoring for email journaling systems, detecting failures and quota issues before they impact compliance or data integrity.

BCC Approval Workflows: A Smarter Way to Review, Discuss, and Approve Proposals

BCC Approval Workflows: A Smarter Way to Review, Discuss, and Approve ProposalsJanuary 12, 2026

Loan ManagementApproval WorkflowsBCCEnhance loan approval workflows with BCC roles for oversight and governance. Enable risk teams and auditors to review proposals without bottlenecking the primary approval chain.

Match & Verify Cards: Ensuring Accuracy in Daily Reconciliation

Match & Verify Cards: Ensuring Accuracy in Daily ReconciliationJanuary 12, 2026

Expense ManagementCard MatchingReconciliationAutomate the matching of corporate card transactions with expense entries to ensure accuracy in daily reconciliation. Reduce errors, improve audit trails, and scale reconciliation effortlessly.

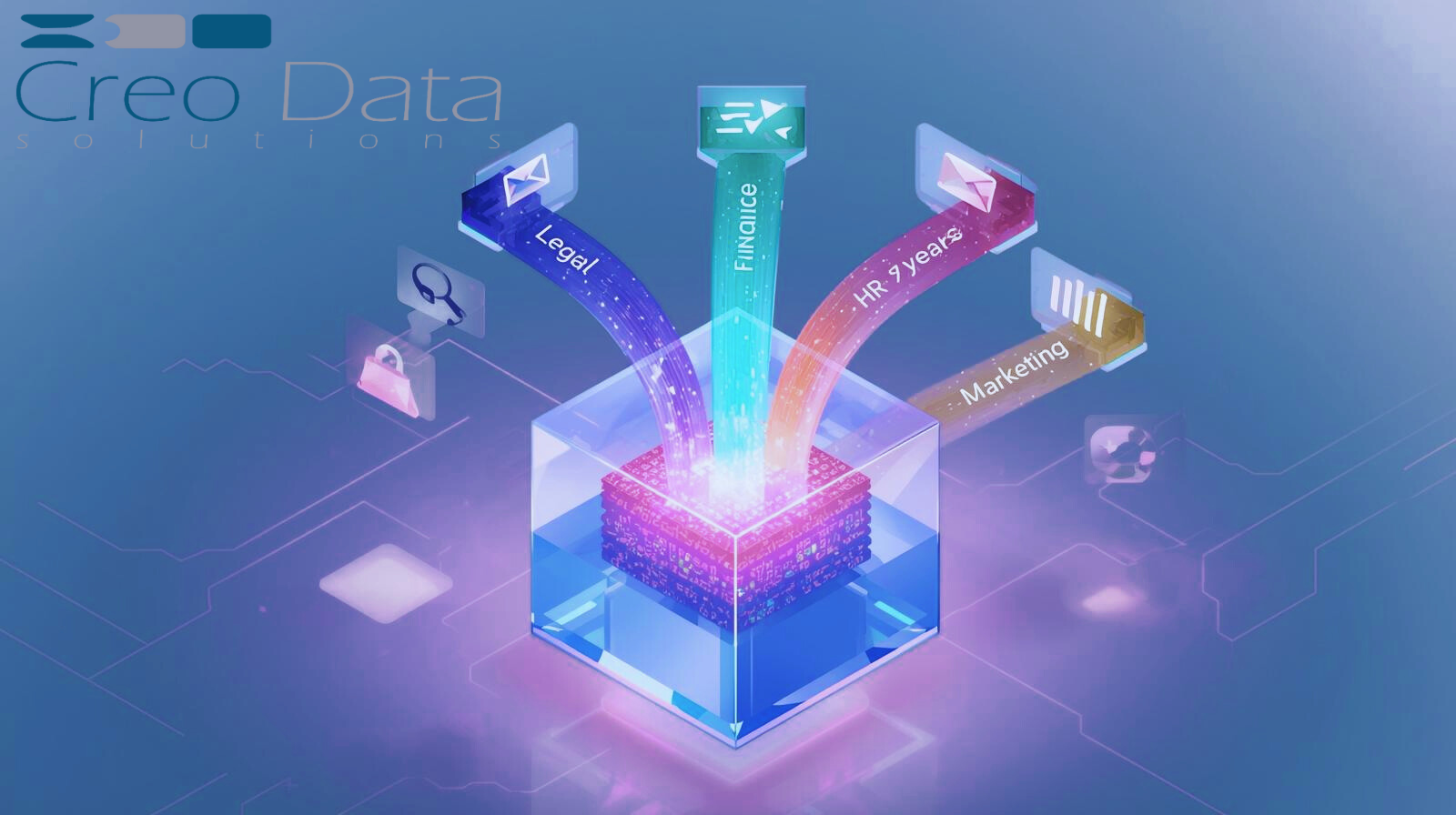

Tailored Archiving: Department-Based Retention Rules in Flexible Retention Policies

Tailored Archiving: Department-Based Retention Rules in Flexible Retention PoliciesJanuary 12, 2026

Retention PoliciesEmail ComplianceData GovernanceApply different retention durations, archival dispositions, and deletion rules per department. Achieve compliance and operational efficiency with department-based retention policies.

RM Proposal: Structured Proposal Creation for Committee Review

RM Proposal: Structured Proposal Creation for Committee ReviewJanuary 12, 2026

Loan ManagementProposal CreationCredit ManagementStreamline credit proposal creation for Relationship Managers. Create structured, standardized proposals with templates, auto-population, and integrated workflows for committee review.

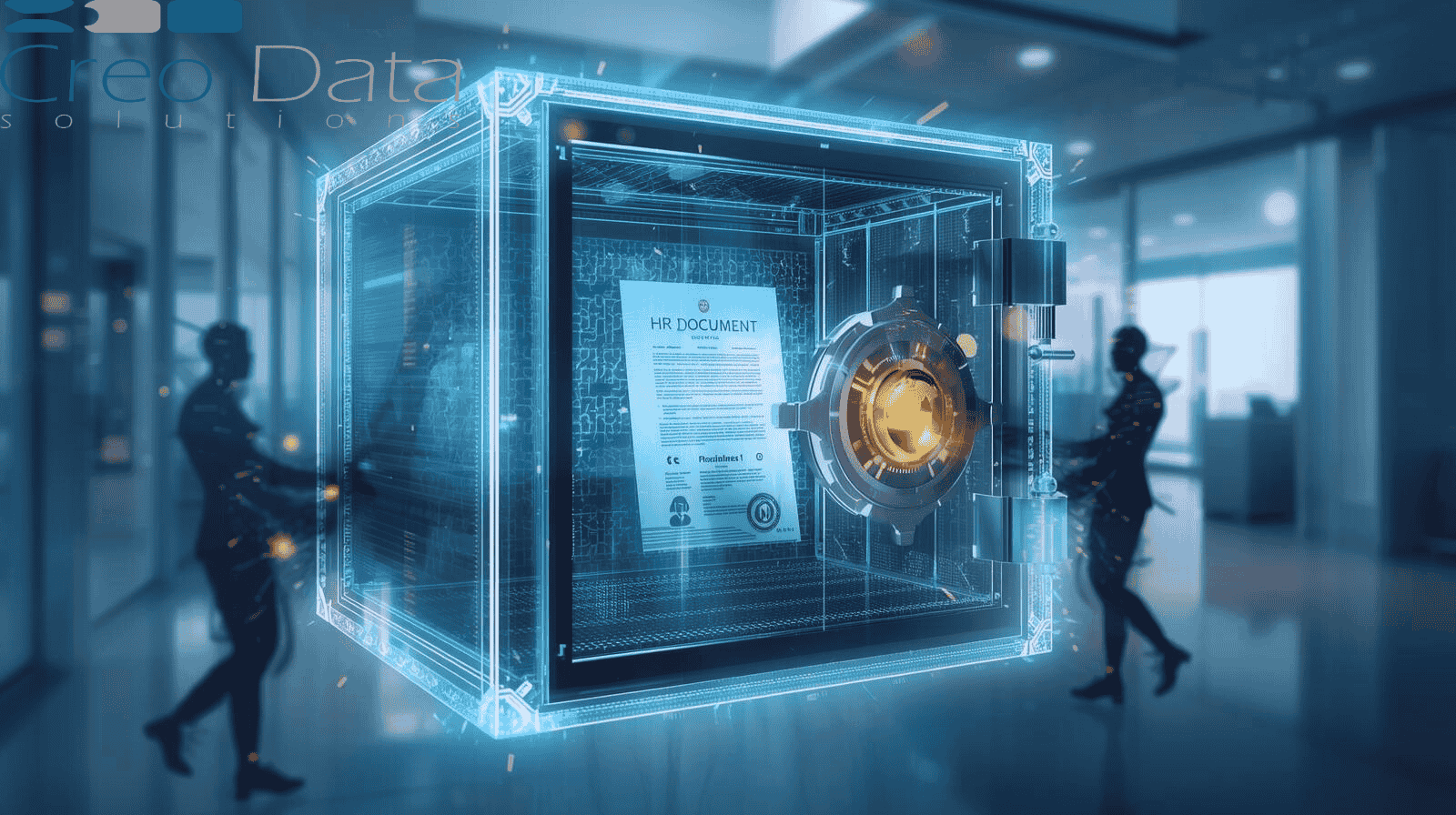

Secure Digital Vaults for Customer Documents

Secure Digital Vaults for Customer DocumentsJanuary 12, 2026

Loan ManagementDocument ManagementSecurityCentralized, encrypted platform for borrowers and relationship managers to upload, store, view, and manage loan documents securely in a cloud-based repository.

Integration with SharePoint: Archive in SharePoint

Integration with SharePoint: Archive in SharePointJanuary 12, 2026

SharePointEmail ArchivingUnified StorageUnified Storage — Manage Emails and Docs Together. Learn how to archive and manage emails and documents side by side in SharePoint for unified search, retention, and governance.

Speed Up Reconciliation

Speed Up ReconciliationJanuary 12, 2026

Expense ManagementReconciliationAutomationAutomate card matching to speed up expense reconciliation during month-end and quarter-end close periods. Reduce manual work by 95% and process expenses 80% faster with AI-powered automation.

Securing Corporate Communications from Manipulation: A Tamper-Proof Design for Audit & Compliance

Securing Corporate Communications from Manipulation: A Tamper-Proof Design for Audit & ComplianceJanuary 12, 2026

Mail JournalingTamper-ProofAudit & ComplianceTamper-proof design ensures corporate communications remain unaltered and verifiable for audit and compliance, incorporating immutable storage and cryptographic integrity checks.

Streamlining Lending Operations: The Strategic Power of the Branch Manager Role in Loan Origination

Streamlining Lending Operations: The Strategic Power of the Branch Manager Role in Loan OriginationJanuary 5, 2026

loan-managementbranch-managerloan-originationSee how a dedicated Branch Manager role and assignment module in a Loan Management System streamlines lending operations, improves accountability, and accelerates loan origination.

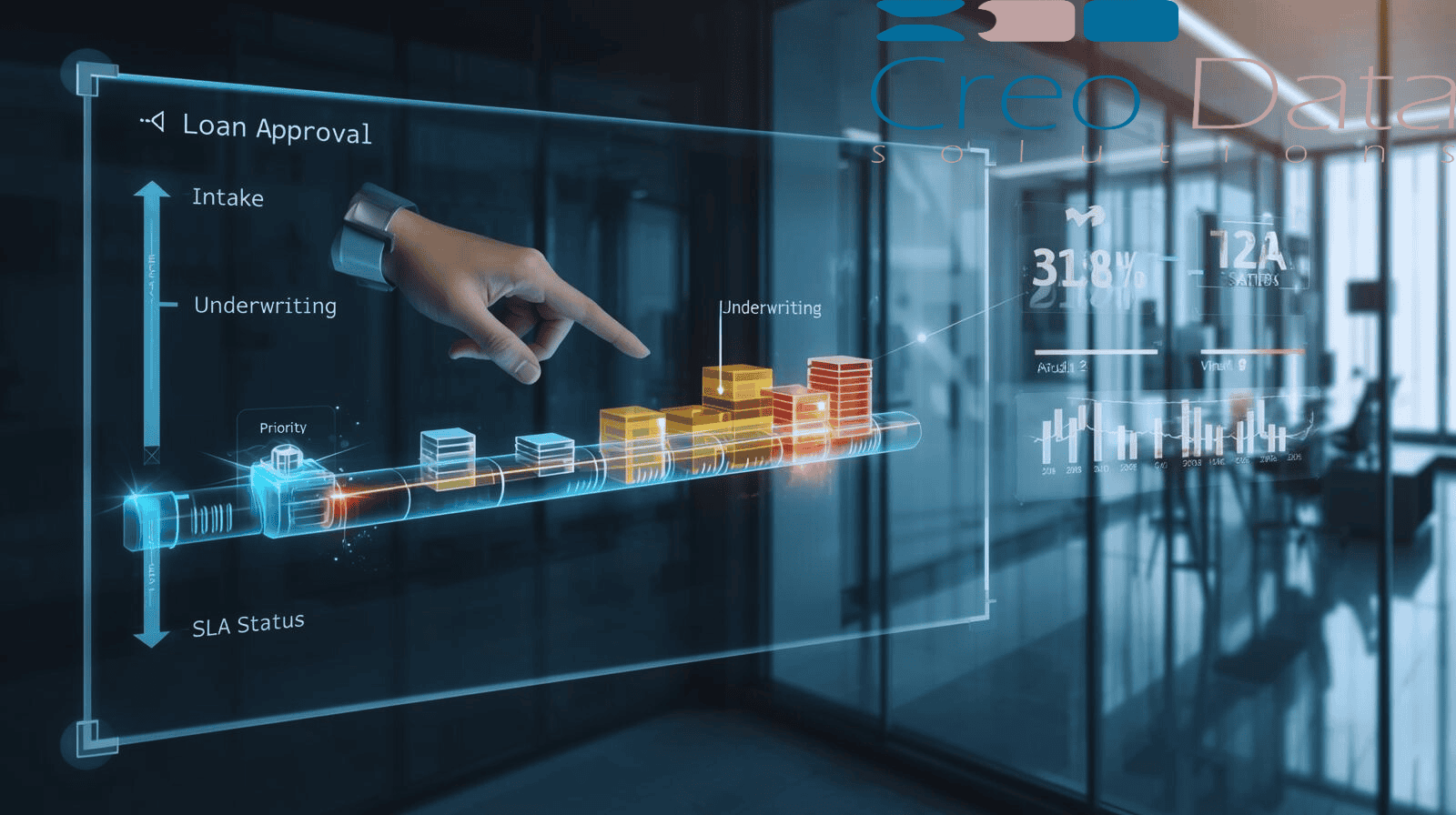

BM Tracking: Enhancing Loan Workflow Visibility and Control

BM Tracking: Enhancing Loan Workflow Visibility and ControlJanuary 5, 2026

loan-managementbm-trackingworkflow-visibilityLearn how Branch Manager tracking in a Loan Management System improves loan workflow visibility, SLA compliance, and operational control across branches.

Event Reconstruction: Building a Chronological Email History with Timeline Filters

Event Reconstruction: Building a Chronological Email History with Timeline FiltersJanuary 5, 2026

mail-journalingevent-reconstructiontimeline-filteringSee how timeline-based email filtering and journaling help investigators reconstruct a defensible, chronological history of communications for audits, forensics, and insider-threat investigations.

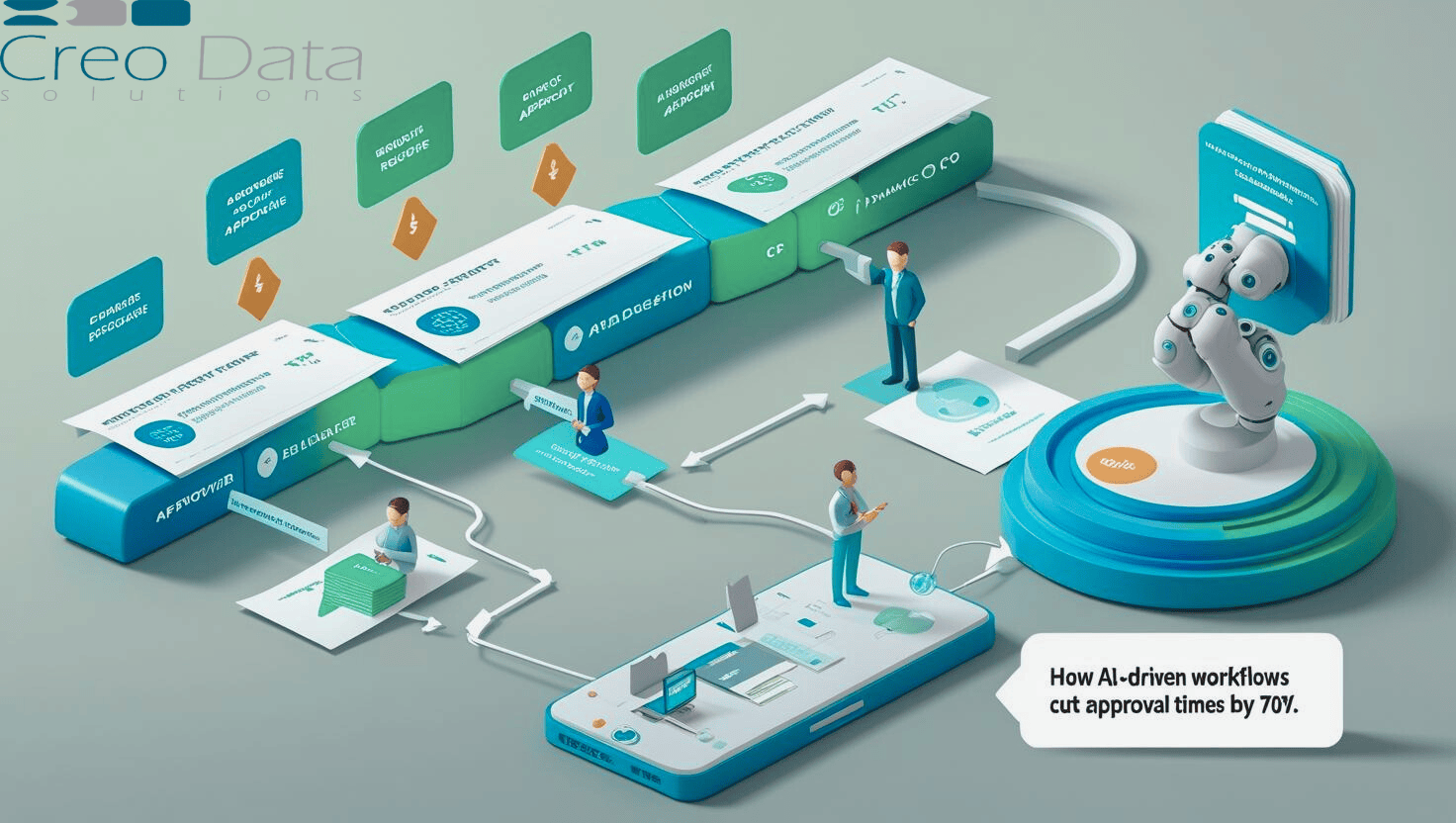

Streamlining Expense Approvals with Custom Workflows

Streamlining Expense Approvals with Custom WorkflowsJanuary 5, 2026

expense-managementworkflow-automationapproval-workflowsLearn how configurable, multi-level workflows with delegation and automatic flags streamline employee expense reimbursements, reduce bottlenecks, and enhance oversight.

How Finance Teams Gain Control with Custom Approval Routing

How Finance Teams Gain Control with Custom Approval RoutingJanuary 5, 2026

expense-managementapproval-routingfinance-controlDiscover how custom approval routing with configurable workflows, delegation, and automatic flags empowers finance teams to maintain control and oversight without becoming bottlenecks.

Multi-Level Approvals for Large Corporate Purchases

Multi-Level Approvals for Large Corporate PurchasesJanuary 5, 2026

expense-managementmulti-level-approvalsprocurementLearn how configurable multi-level approval workflows with delegation and automatic flags help organizations manage high-value procurement with proper governance, compliance, and oversight.

CSO Verification: How Loan Operations Rely on Strong Onboarding & Access Controls

CSO Verification: How Loan Operations Rely on Strong Onboarding & Access ControlsDecember 15, 2025

loan-managementcso-verificationrbacDiscover how CSO Verification with Role-Based Access Control ensures data integrity, reduces fraud, and streamlines loan application intake in modern lending operations.

Transforming Employee Experience with Faster Expense Reimbursements

Transforming Employee Experience with Faster Expense ReimbursementsDecember 15, 2025

expense-managementemployee-experienceworkflow-automationDiscover how faster expense reimbursements with smart workflow automation can transform employee satisfaction, reduce processing time, and improve operational efficiency.

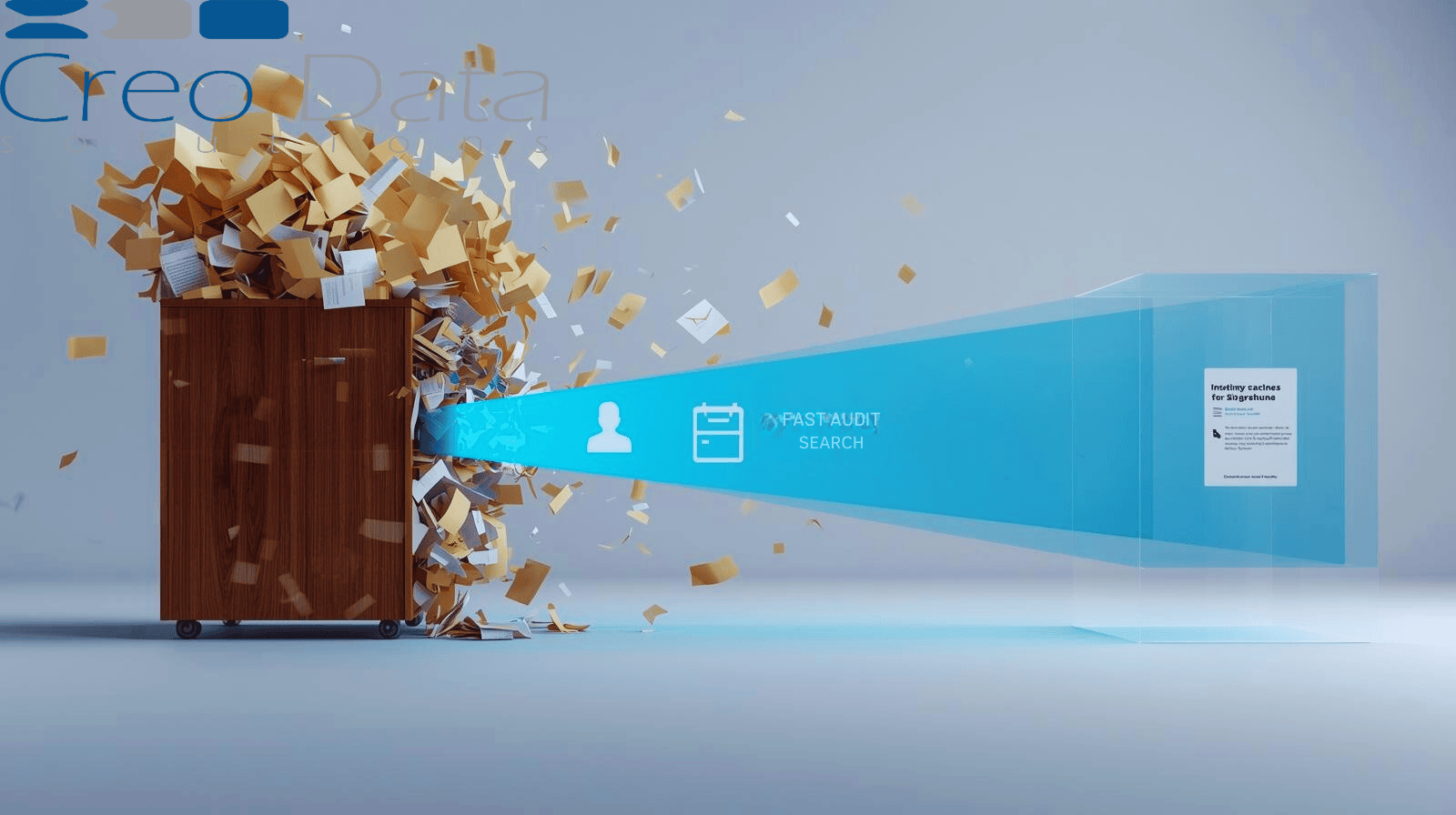

Fast Audit Search: Quickly Locating Emails for Compliance Checks

Fast Audit Search: Quickly Locating Emails for Compliance ChecksDecember 15, 2025

mail-journalingaudit-searchcomplianceDiscover how fast audit search capabilities enable organizations to quickly locate and retrieve email evidence for compliance checks, audits, and investigations using mailbox, date, and sender filters.

Cloud-Native Integration: Scaling Storage & Compute for Enterprise Agility

Cloud-Native Integration: Scaling Storage & Compute for Enterprise AgilityDecember 11, 2025

mail-journalingcloud-nativescalabilityDiscover how cloud-native integration empowers enterprises to scale storage and compute seamlessly, enabling operational agility, compliance, and long-term resilience for mail journaling solutions.

How Customers Are Mapped to Roles in the System

How Customers Are Mapped to Roles in the SystemDecember 11, 2025

loan-managementrbacazure-adLearn how Creodata's Loan Management System uses Azure AD and RBAC to securely map customers to roles, ensuring proper access control, scalability, and compliance in financial institutions.

Reducing Manual Errors in Expense Approvals with Automation

Reducing Manual Errors in Expense Approvals with AutomationDecember 11, 2025

expense-managementautomationerror-reductionDiscover how automation with configurable workflows, multi-level routing, and automatic flags reduces manual errors in expense approvals, improving accuracy and compliance.

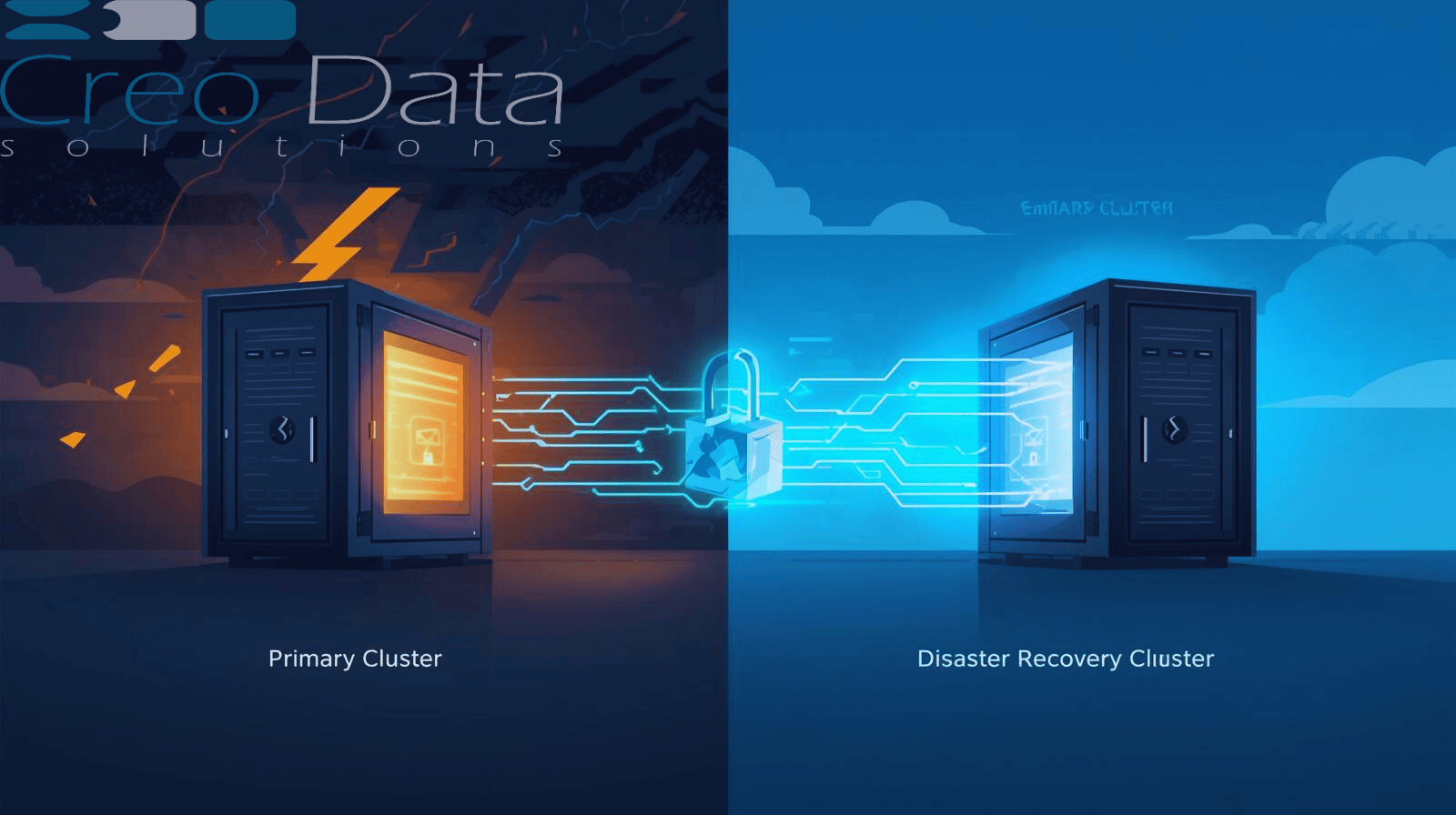

Building a Disaster-Resilient Future: How MinIO Powers Unbreakable Mail Journaling

Building a Disaster-Resilient Future: How MinIO Powers Unbreakable Mail JournalingDecember 11, 2025

mail-journalingdisaster-recoveryminioLearn how integrating MinIO S3-compatible storage with Creodata Mail Journaling creates a disaster recovery-ready solution with near-zero data loss and rapid failover capabilities.

Ensuring Policy Compliance with Configurable Approval Chains: The Key to Unbreakable Expense Policy Adherence

Ensuring Policy Compliance with Configurable Approval Chains: The Key to Unbreakable Expense Policy AdherenceDecember 11, 2025

expense-managementpolicy-complianceapproval-workflowsLearn how configurable approval chains with multi-level routing and automatic flags transform expense policies into active enforcement, ensuring unbreakable compliance and financial control.

Transparent Status Monitoring: Keep Management and Clients Informed at Every Stage

Transparent Status Monitoring: Keep Management and Clients Informed at Every StageDecember 11, 2025

loan-managementstatus-monitoringworkflow-visibilityDiscover how transparent status monitoring in loan management systems provides real-time visibility into application progress, reducing anxiety, building trust, and improving operational efficiency.

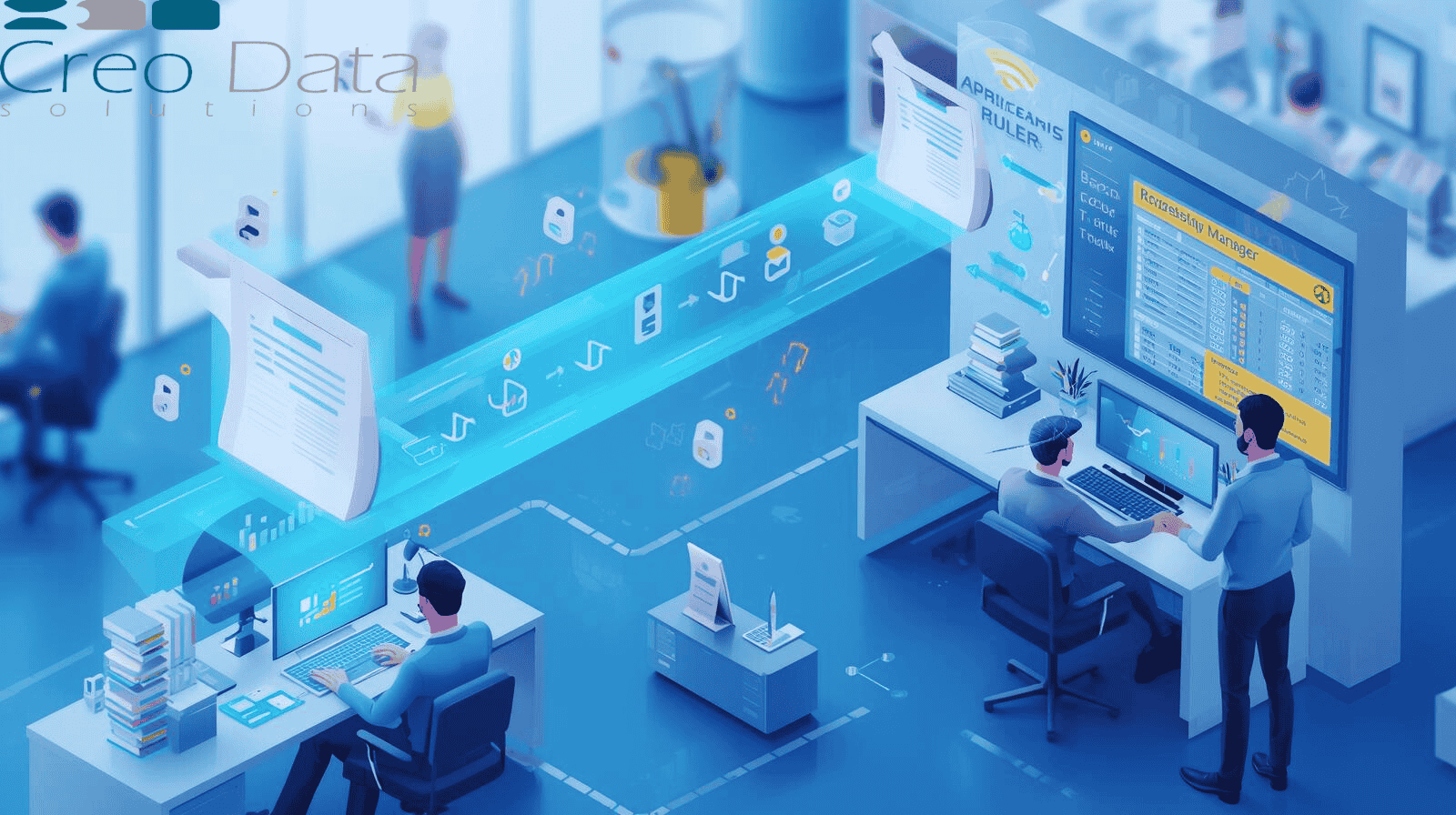

Dynamic Task Routing: Routing Applications Dynamically to the Right Personnel to Avoid Bottlenecks

Dynamic Task Routing: Routing Applications Dynamically to the Right Personnel to Avoid BottlenecksNovember 26, 2025

loan-managementworkflow-automationtask-routingLearn how dynamic task routing automates workflow assignments in loan management systems, reducing bottlenecks, improving turnaround times, and ensuring tasks reach the right personnel automatically.

Advanced Analytics on Emails: Using Metadata for Trend Analysis, Monitoring, and Detecting Suspicious Activity

Advanced Analytics on Emails: Using Metadata for Trend Analysis, Monitoring, and Detecting Suspicious ActivityNovember 26, 2025

mail-journalingemail-analyticsmetadata-analysisLearn how email metadata analytics enables organizations to detect suspicious activity, monitor trends, and maintain compliance using Creodata's Mail Journaling solution for Microsoft 365.

How Automated Flags Prevent Overspending in Expense Reports

How Automated Flags Prevent Overspending in Expense ReportsNovember 21, 2025

expense-managementautomated-flagsbudget-controlLearn how automated flags, configurable rules, and multi-level approval routing help organizations prevent overspending, enforce budgets proactively, and streamline expense management workflows.

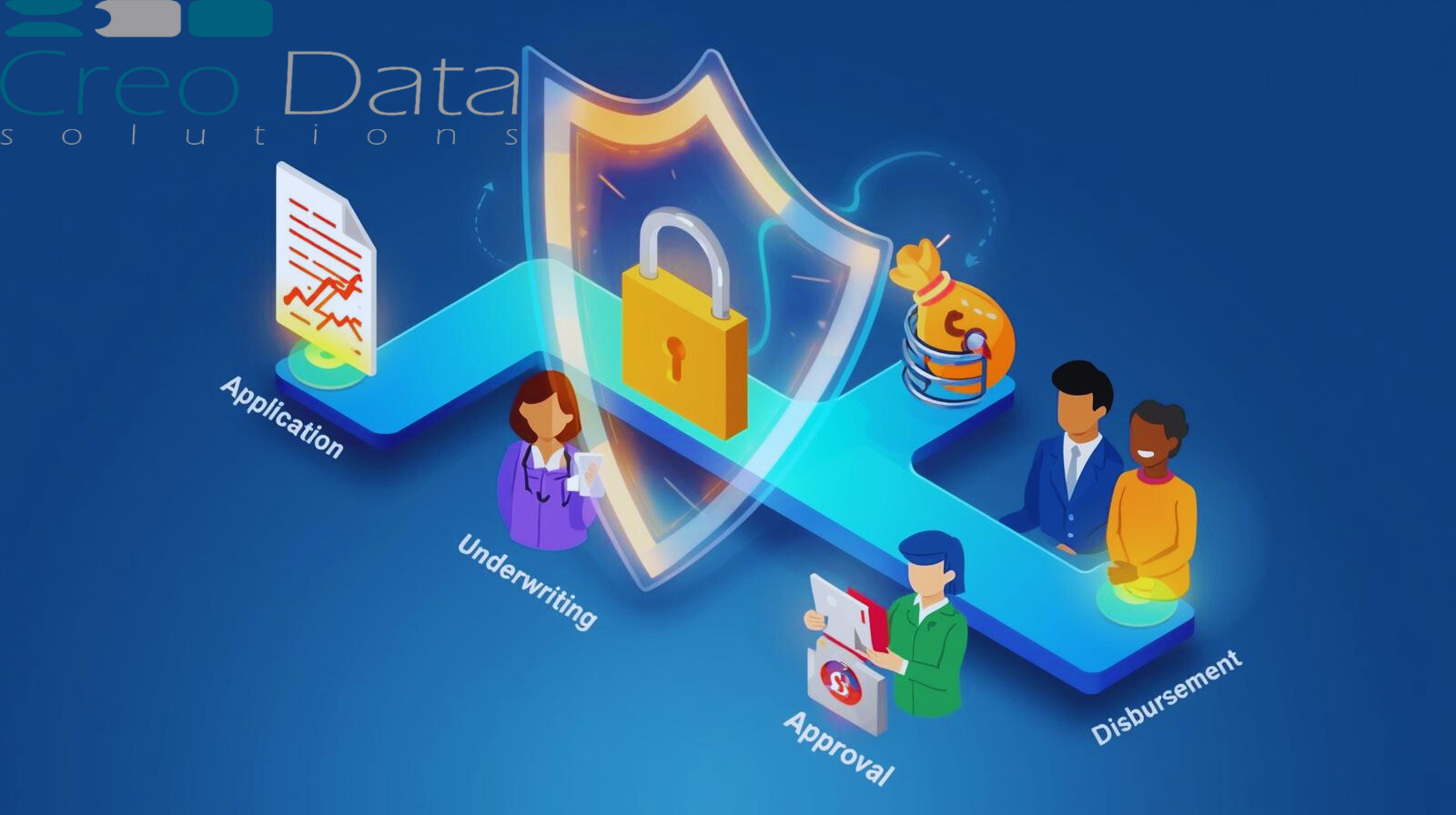

Secure Role-Based Access in Loan Management: Ensuring Only Authorized Users Can Perform Actions at Each Workflow Stage

Secure Role-Based Access in Loan Management: Ensuring Only Authorized Users Can Perform Actions at Each Workflow StageNovember 21, 2025

rbacrole-based-accessloan-managementImplement role-based access control to ensure only authorized users can perform specific actions at each workflow stage, protecting sensitive data and ensuring compliance in loan management systems.

Compression with Configurable Options: Optimize Storage Costs

Compression with Configurable Options: Optimize Storage CostsNovember 20, 2025

compressionstorage-optimizationemail-archivingTailor compression strategies to balance storage savings and retrieval speed, optimizing storage costs while maintaining acceptable performance for archived emails and compliance data.

Custom Workflows for Real-Time Expense Visibility

Custom Workflows for Real-Time Expense VisibilityNovember 19, 2025

expense-managementcustom-workflowsworkflow-automationAchieve centralized monitoring and transparency with configurable multi-level routing, delegation, and automatic flags for real-time expense visibility and better decision-making.

Workflow Automation & State Machines: Real-Time Tracking in Credit Applications

Workflow Automation & State Machines: Real-Time Tracking in Credit ApplicationsNovember 19, 2025

workflow-automationstate-machinesreal-time-trackingEnable real-time tracking of credit applications with workflow state machines, providing transparency, traceability, and faster turnaround times while ensuring regulatory compliance.

Faster Backups with Gzip / Brotli Compression in Email Archiving

Faster Backups with Gzip / Brotli Compression in Email ArchivingNovember 13, 2025

email-archivingcompressionbackupReduce storage costs and accelerate backups with Gzip and Brotli compression in email archiving, improving backup speeds, reducing bandwidth usage, and enhancing compliance capabilities.

Eliminating Approval Bottlenecks in Travel & Entertainment Expenses

Eliminating Approval Bottlenecks in Travel & Entertainment ExpensesNovember 13, 2025

expense-managementapproval-workflowsworkflow-automationStreamline T&E expense approvals with configurable multi-level routing, delegation, and automatic flags to eliminate bottlenecks, reduce delays, and improve employee satisfaction.

Workflow Automation: Legal Review – Contract & Collateral Documentation

Workflow Automation: Legal Review – Contract & Collateral DocumentationNovember 13, 2025

legal-reviewcontract-documentationcollateral-verificationAutomate and standardize legal review of contracts and collateral documentation before loan disbursement, reducing risk and accelerating the lending lifecycle while ensuring compliance.

Risk Assessment for Large Loans

Risk Assessment for Large LoansNovember 13, 2025

risk-assessmentlarge-loansrisk-managementImplement automated risk review workflows for loans exceeding 100 million, ensuring thorough risk assessment across multiple vectors before approval and maintaining regulatory compliance.

Smooth Loan Disbursement

Smooth Loan DisbursementNovember 13, 2025

loan-disbursementworkflow-automationloan-managementStreamline the final disbursement stage with workflow automation, reducing turnaround time for clients, minimizing operational risk, and improving throughput in the credit department.

Improving Audit Readiness with Workflow-Based Expense Approvals

Improving Audit Readiness with Workflow-Based Expense ApprovalsNovember 12, 2025

audit-readinessworkflow-automationexpense-approvalEnhance audit readiness with configurable workflow-based expense approvals featuring multi-level routing, delegation, and automatic policy flags for compliance.

Governance & Compliance in Workflow Automation

Governance & Compliance in Workflow AutomationNovember 12, 2025

board-approvalgovernancecomplianceEnsure board-level oversight for high-value loans with automated workflow escalation, enhancing governance, compliance, and risk management for financial institutions.

Proposal Preparation Efficiency in Credit Proposal Workflow Automation

Proposal Preparation Efficiency in Credit Proposal Workflow AutomationNovember 12, 2025

workflow-automationcredit-proposalsloan-managementTransform credit proposal generation with workflow automation, ensuring accuracy, compliance, and speed for small banks, SACCOs, and microfinance institutions.

Delegated Expense Approval: Empowering Managers to Act Faster

Delegated Expense Approval: Empowering Managers to Act FasterNovember 12, 2025

delegated-approvalexpense-managementworkflow-automationStreamline expense approvals by empowering department managers with delegated authority, configurable workflows, and automatic policy flags for faster processing.

Long-Term Email Preservation with High-Performance S3-Compatible Storage (MinIO)

Long-Term Email Preservation with High-Performance S3-Compatible Storage (MinIO)November 12, 2025

email-preservationminios3-storageEnsure immutable, scalable, and compliant long-term email preservation with MinIO S3-compatible storage, meeting regulatory requirements and legal discovery needs.

Enterprise-Ready Email Archiving: The Role of Scalable, High-Performance Storage

Enterprise-Ready Email Archiving: The Role of Scalable, High-Performance StorageNovember 12, 2025

enterprise-archivingscalable-storageemail-journalingScale email archiving to enterprise levels with high-performance storage, ensuring compliance, fast retrieval, and seamless growth for large organizations.

Internal Decision Accuracy via MCC Review in Workflow Automation

Internal Decision Accuracy via MCC Review in Workflow AutomationNovember 12, 2025

mcc-reviewcredit-committeeworkflow-automationEnhance credit decision accuracy with multi-level credit committee (MCC) review workflows, ensuring governance, consistency, and regulatory compliance.

How Multi-Level Routing Speeds Up Corporate Card Expense Approvals

How Multi-Level Routing Speeds Up Corporate Card Expense ApprovalsNovember 12, 2025

multi-level-routingcorporate-cardsexpense-approvalAccelerate corporate card expense approvals with multi-level routing, configurable delegation, and automatic flags for faster processing and stronger compliance.

Adaptive Archiving: Configurable Compression for Optimal Email Storage

Adaptive Archiving: Configurable Compression for Optimal Email StorageNovember 10, 2025

adaptive-archivingcompressionconfigurableUse adaptive compression policies to balance storage savings and retrieval fidelity across your email archive.

How AI OCR Extraction Saves Time and Cuts Costs in Expense Management

How AI OCR Extraction Saves Time and Cuts Costs in Expense ManagementNovember 10, 2025

ai-ocrexpense-automationreceipt-captureAutomate receipt capture with AI OCR to eliminate manual entry, cut processing costs, and increase audit-ready accuracy in Creodata's expense platform.

Collaborative Credit Evaluation

Collaborative Credit EvaluationNovember 10, 2025

credit-committeeloan-evaluationworkflowCoordinate branch and board credit committees with Creodata workflows that deliver shared dashboards, audit trails, and faster collaborative decisions.

Reducing Compliance Costs Through Gzip/Brotli Compression in Email Archiving

Reducing Compliance Costs Through Gzip/Brotli Compression in Email ArchivingNovember 10, 2025

email-archivingcompressioncomplianceCut compliance costs by applying Gzip and Brotli compression to email archives without sacrificing audit readiness or searchability.

Executive Oversight in Workflow Automation: Corporate Head Review for High-Value Loan Applications

Executive Oversight in Workflow Automation: Corporate Head Review for High-Value Loan ApplicationsNovember 10, 2025

executive-oversightrisk-managementloan-automationEmbed corporate head review into Creodata loan workflows to protect high-value approvals with executive insight, audit trails, and risk controls.

Reducing Fraud in Expense Management through Automated Approvals

Reducing Fraud in Expense Management through Automated ApprovalsNovember 10, 2025

expense-fraudrisk-complianceautomationStrengthen expense governance with multi-level approvals, AI-driven flags, and Creodata automation to detect and prevent reimbursement fraud.

Efficient Initial Review: Workflow Automation Feature in Loan Management

Efficient Initial Review: Workflow Automation Feature in Loan ManagementNovember 10, 2025

workflow-automationloan-managementrm-reviewAutomate RM proposal preparation with Creodata loan workflows that prefill data, orchestrate approvals, and speed initial review cycles.

Real-Time Compliance Checks — High-Performance Storage

Real-Time Compliance Checks — High-Performance StorageNovember 10, 2025

compliancereal-timeemail-archivingCapture and search Microsoft 365 email archives instantly for audit-ready, real-time compliance checks on Azure.

- Reducing Manual Data Entry Errors in Accounts Payable Using AI OCR

November 7, 2025

accounts-payableai-ocrautomationEliminate manual data entry errors in accounts payable with AI-powered OCR that achieves 95%+ accuracy and accelerates invoice processing by 80%.

Automating Audit Trails and Compliance Reporting with AI OCR

Automating Audit Trails and Compliance Reporting with AI OCRNovember 7, 2025

audit-trailscomplianceai-ocrAutomate audit trails and compliance reporting with AI OCR to deliver transparent, accurate, and fully traceable expense workflows for auditors and compliance officers.

Fast Email Search and Filtering

Fast Email Search and FilteringNovember 7, 2025

email-searchmetadatacomplianceLeverage high-performance storage with metadata indexing for lightning-fast email search, filtering, and compliance-ready retrieval.

Handling Growing Email Volumes with High-Performance, Scalable Storage

Handling Growing Email Volumes with High-Performance, Scalable StorageNovember 7, 2025

scalabilityemail-archivingperformanceScale horizontally to handle explosive email growth without sacrificing capture speed, retrieval performance, or compliance readiness.

Mobile Expense Reporting Made Easy with AI OCR Extraction

Mobile Expense Reporting Made Easy with AI OCR ExtractionNovember 7, 2025

mobile-expenseai-ocrremote-workersEmpower remote workers and sales teams with mobile expense reporting powered by AI OCR for instant receipt capture and automated data extraction.

Mobile-Friendly Uploads for Field Operations

Mobile-Friendly Uploads for Field OperationsNovember 7, 2025

mobile-uploadsfield-operationsoffline-syncEnable field agents to capture and upload loan documents from remote areas with mobile-optimized uploads that work offline and sync when connected.

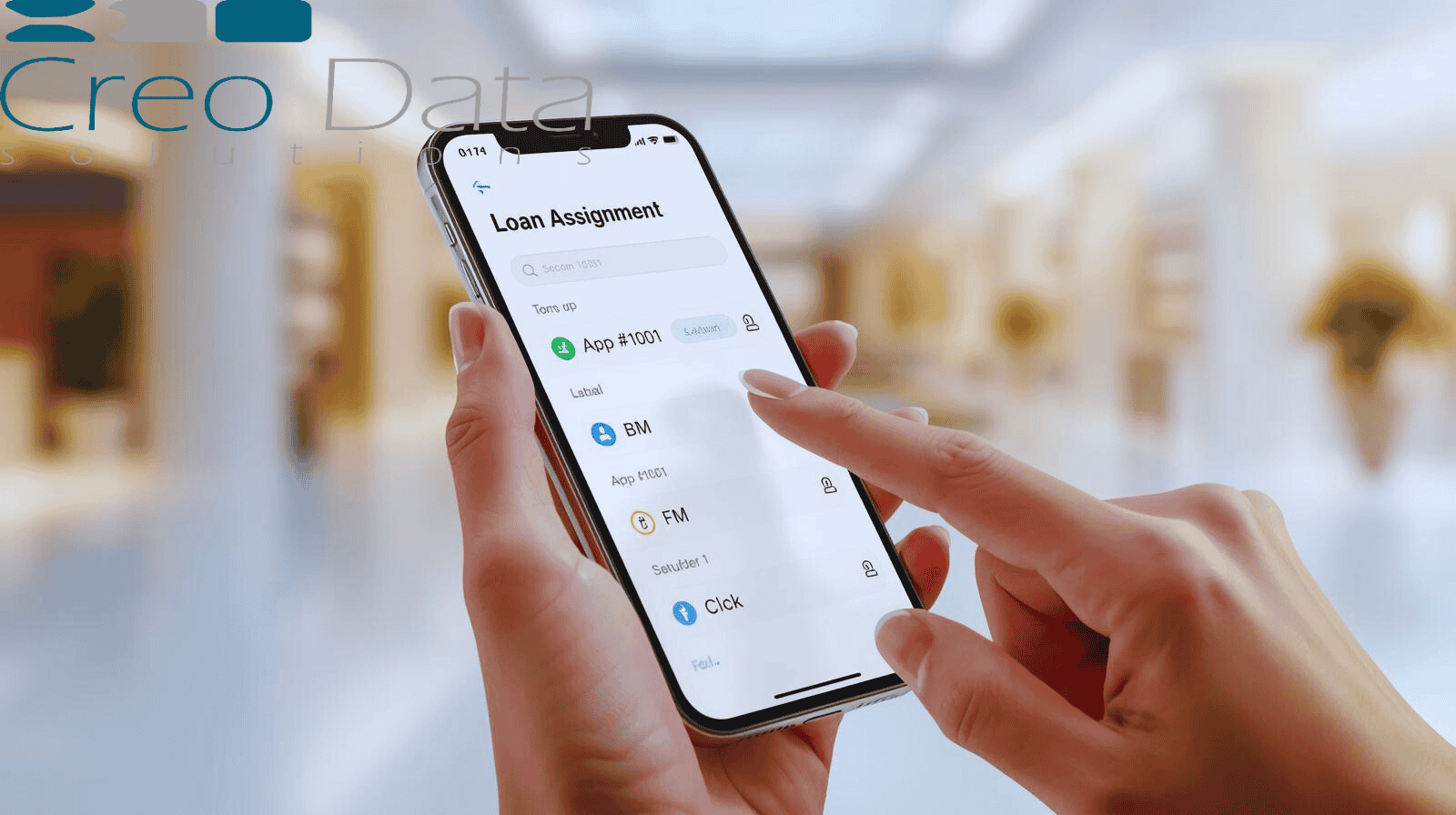

Role-Based Assignment: Transforming Loan Processing Through Intelligent Automation

Role-Based Assignment: Transforming Loan Processing Through Intelligent AutomationNovember 7, 2025

role-based-assignmentworkflow-automationloan-processingAutomatically route loan applications to the right relationship managers based on configurable rules for faster processing and balanced workloads.

Secure Original Email Retention

Secure Original Email RetentionNovember 7, 2025

email-retentioncompliancesecurityStore original .eml files securely with immutable, high-performance storage for compliance, legal discovery, and audit-ready retention.

Streamlined Application Intake: Revolutionizing Credit Application Management with Workflow Automation

Streamlined Application Intake: Revolutionizing Credit Application Management with Workflow AutomationNovember 7, 2025

workflow-automationapplication-intakeloan-processingAutomate credit application capture and routing to eliminate delays, reduce errors, and accelerate loan processing from submission to approval.

Integrating AI OCR Extraction with ERP Systems for Seamless Workflow

Integrating AI OCR Extraction with ERP Systems for Seamless WorkflowNovember 6, 2025

ai-ocrerp-integrationexpense-managementStreamline expense workflows by integrating AI OCR extraction with ERP systems like Dynamics 365 for automated data processing and seamless accounting integration.

The Role of AI-OCR in Ensuring Policy Compliance in Expense Claims

The Role of AI-OCR in Ensuring Policy Compliance in Expense ClaimsNovember 6, 2025

ai-ocrcomplianceexpense-managementEnsure expense policy compliance with AI-powered OCR that automatically flags violations, detects fraud, and maintains comprehensive audit trails.

- Audit-Ready Document Management System

November 6, 2025

auditcompliancedocument-managementBuild a compliant, traceable document management system with audit trails, versioning, and governance for regulated finance.

Bulk Uploads for Group Loan Schemes

Bulk Uploads for Group Loan SchemesNovember 6, 2025

bulk-uploadsgroup-lendingmicrofinanceSpeed up group lending by uploading and validating multiple applicants' documents in one streamlined action.

Drag-and-Drop Uploads for Non-Tech-Savvy Users

Drag-and-Drop Uploads for Non-Tech-Savvy UsersNovember 6, 2025

usabilityuploadsinclusionA simple drag-and-drop upload experience that improves inclusion and speeds lending workflows in rural/cooperative contexts.

Flexible Compression Strategies

Flexible Compression StrategiesNovember 6, 2025

compressionstorageoptimizationConfigure per-message or batch compression strategies to balance processing speed and storage efficiency in email archiving.

- Forensic Analysis in Cybersecurity Incident Response

November 6, 2025

forensicsecuritycomplianceEnsure archived emails remain legally valid and unchanged during breach investigations with tamper-proof email archiving.

- Real-Time Financial Insights Powered by AI OCR Expense Extraction

November 6, 2025

ai-ocrexpense-managementfinancial-insightsGain real-time visibility into spending patterns with AI-powered OCR expense extraction that automates data capture and provides instant financial insights.

Boosting Accuracy: Achieving >95% Expense Data Extraction with AI OCR

Boosting Accuracy: Achieving >95% Expense Data Extraction with AI OCRNovember 5, 2025

ai-ocraccuracyafricaHow African finance teams achieve >95% data extraction accuracy with AI OCR and Creodata's solution.

How AI OCR Extraction Is Revolutionizing Expense Management

How AI OCR Extraction Is Revolutionizing Expense ManagementNovember 5, 2025

ai-ocrexpense-managementautomationAI-powered OCR delivers >95% accuracy, faster processing, and built-in compliance for expense management.

Simplifying Employee Expense Reporting Through AI OCR Technology

Simplifying Employee Expense Reporting Through AI OCR TechnologyNovember 5, 2025

ai-ocrexpense-reportingautomationMake expense reporting faster and more accurate with AI-powered OCR and automated workflows.

Auto-Validation of Uploaded Documents

Auto-Validation of Uploaded DocumentsNovember 5, 2025

documentsvalidationautomationAutomate file type, size, and format checks at upload to speed reviews and strengthen compliance.

Email Notifications for Missing or Expired Documents in Financial Services

Email Notifications for Missing or Expired Documents in Financial ServicesNovember 5, 2025

notificationsdocumentscomplianceAutomated alerts for missing or expiring documents keep lending compliant and on schedule.

Event-Triggered Document Verification Workflows

Event-Triggered Document Verification WorkflowsNovember 5, 2025

workflowskycverificationKick off KYC and risk checks the moment documents are uploaded with trigger-based workflows.

Protecting HR and Payroll Communications: Encrypted Blob Storage

Protecting HR and Payroll Communications: Encrypted Blob StorageNovember 5, 2025

encrypted-storageHRpayrollHow encrypted blob storage safeguards sensitive HR and payroll documents at rest and in transit.

Investigating Insider Threats in Multinational Banks

Investigating Insider Threats in Multinational BanksNovember 5, 2025

insider-threatsimmutable-loggingcomplianceHow immutable email logging strengthens insider threat investigations across multinational banking operations.

Securing Investment Advisor Correspondence with AES-256 Encryption at Rest

Securing Investment Advisor Correspondence with AES-256 Encryption at RestNovember 5, 2025

encryptionAES-256securityProtect sensitive investment advisor communications with AES-256 encryption at rest to ensure regulatory compliance and client confidentiality.

Email Archiving for M&A Due Diligence: A Pillar of Audit & Compliance

Email Archiving for M&A Due Diligence: A Pillar of Audit & ComplianceNovember 5, 2025

M&Aemail-archivingcomplianceWhy long-term email archiving underpins audit and compliance during M&A due diligence.

Government Email Retention Mandates: Long‑Term Retention for Public Sector Compliance

Government Email Retention Mandates: Long‑Term Retention for Public Sector ComplianceOctober 31, 2025

governmentretentioncomplianceHow public sector organizations meet 7+ year email retention mandates using compliant journaling and immutable storage.

Seamless Document Collection for Loan Applications

Seamless Document Collection for Loan ApplicationsOctober 24, 2025

document collectionKYCloan processingCollect every required document upfront to slash turnaround time and improve borrower experience.

Tamper‑Proof Communications

Tamper‑Proof CommunicationsOctober 24, 2025

immutabilitylegal holdcomplianceTamper‑proof email archiving for audits and investigations using journaling, immutable storage, and verifiable export.

Cross-Department Capture for Shared Costs

Cross-Department Capture for Shared CostsOctober 24, 2025

expensemulti-channelgovernmentUnify receipt intake across departments to speed reimbursements and simplify audits.

Emergency Expense Reporting in Crisis Response

Emergency Expense Reporting in Crisis ResponseOctober 24, 2025

emergencymobileexpenseMobile expense capture for responders: faster reimbursements, better visibility, and audit-ready records.

Audit & Compliance: Immutable Logging for Email Activity Audits in Legal Departments

Audit & Compliance: Immutable Logging for Email Activity Audits in Legal DepartmentsOctober 24, 2025

immutabilityauditlegalHow immutable logging and Creodata Mail Journaling enable defensible email activity audits for legal departments.

Faster Loan Approvals with Real-Time Document Uploads

Faster Loan Approvals with Real-Time Document UploadsOctober 23, 2025

loan approvalsdocument uploadOCRReal-time uploads, OCR, and automated checks cut approval times from days to hours.

Azure AD for Loan Security: Hardening Access Across the Lending Journey

Azure AD for Loan Security: Hardening Access Across the Lending JourneyOctober 23, 2025

Azure ADsecurityRBACHow Azure AD, Conditional Access, and least‑privilege RBAC protect loan origination and servicing systems.

High‑Volume Expense Uploads: Bulk Processing Without Bottlenecks

High‑Volume Expense Uploads: Bulk Processing Without BottlenecksOctober 23, 2025

expensesbulk uploadautomationProcess thousands of receipts and invoices via bulk uploads with validation, dedupe, and audit readiness.

Offline Capture & Sync: Expense Reporting That Works Anywhere

Offline Capture & Sync: Expense Reporting That Works AnywhereOctober 23, 2025

offlinemobilesyncCapture receipts without connectivity and sync automatically when back online—perfect for field teams.

Encrypted Blob Storage: Protecting Healthcare Emails in Cloud Environments

Encrypted Blob Storage: Protecting Healthcare Emails in Cloud EnvironmentsOctober 23, 2025

encryptionhealthcarePHIHow encrypted Azure Blob Storage protects PHI in healthcare email archives and supports HIPAA‑aligned compliance.

AES‑256 Email Security

AES‑256 Email SecurityOctober 23, 2025

encryptionAES‑256securityProtect sensitive emails with AES‑256 encryption at rest, key rotation, and secure key custody using Azure Key Vault.

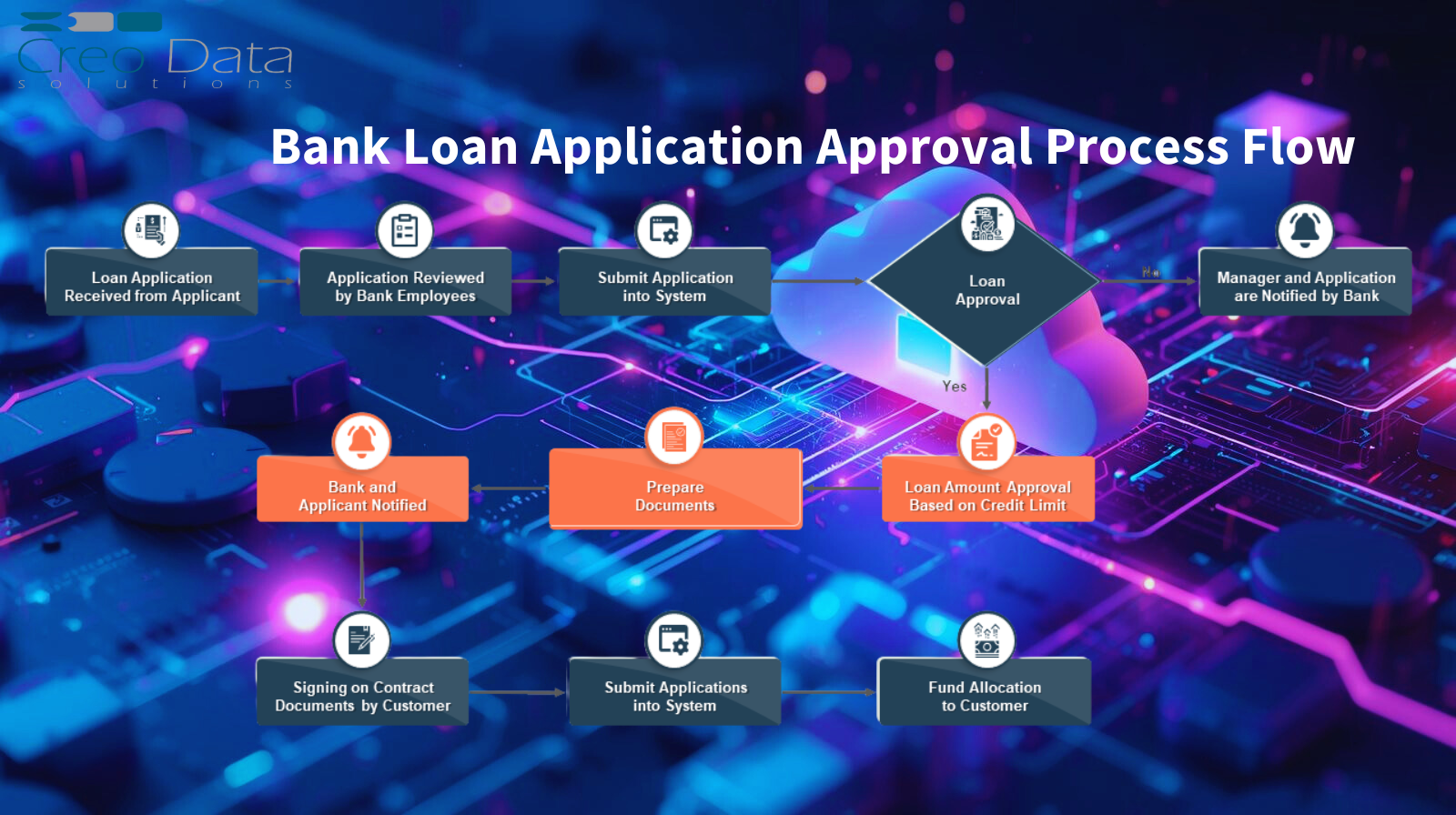

From Submission to Disbursement: Visualizing the Full Loan Origination Journey

From Submission to Disbursement: Visualizing the Full Loan Origination JourneyOctober 22, 2025

loan-managementloan-originationworkflowComprehensive end-to-end walkthrough of a modern Loan Origination System workflow for SME loans and salary advances, highlighting user checkpoints and decision gates.

How Loan Document Metadata Enables Audit Readiness

How Loan Document Metadata Enables Audit ReadinessOctober 22, 2025

loan managementmetadataaudit readinessDiscover how loan document metadata provides complete audit trails, governance, and compliance for lending institutions, enabling transparent and efficient audit-readiness through automated tracking and version control.

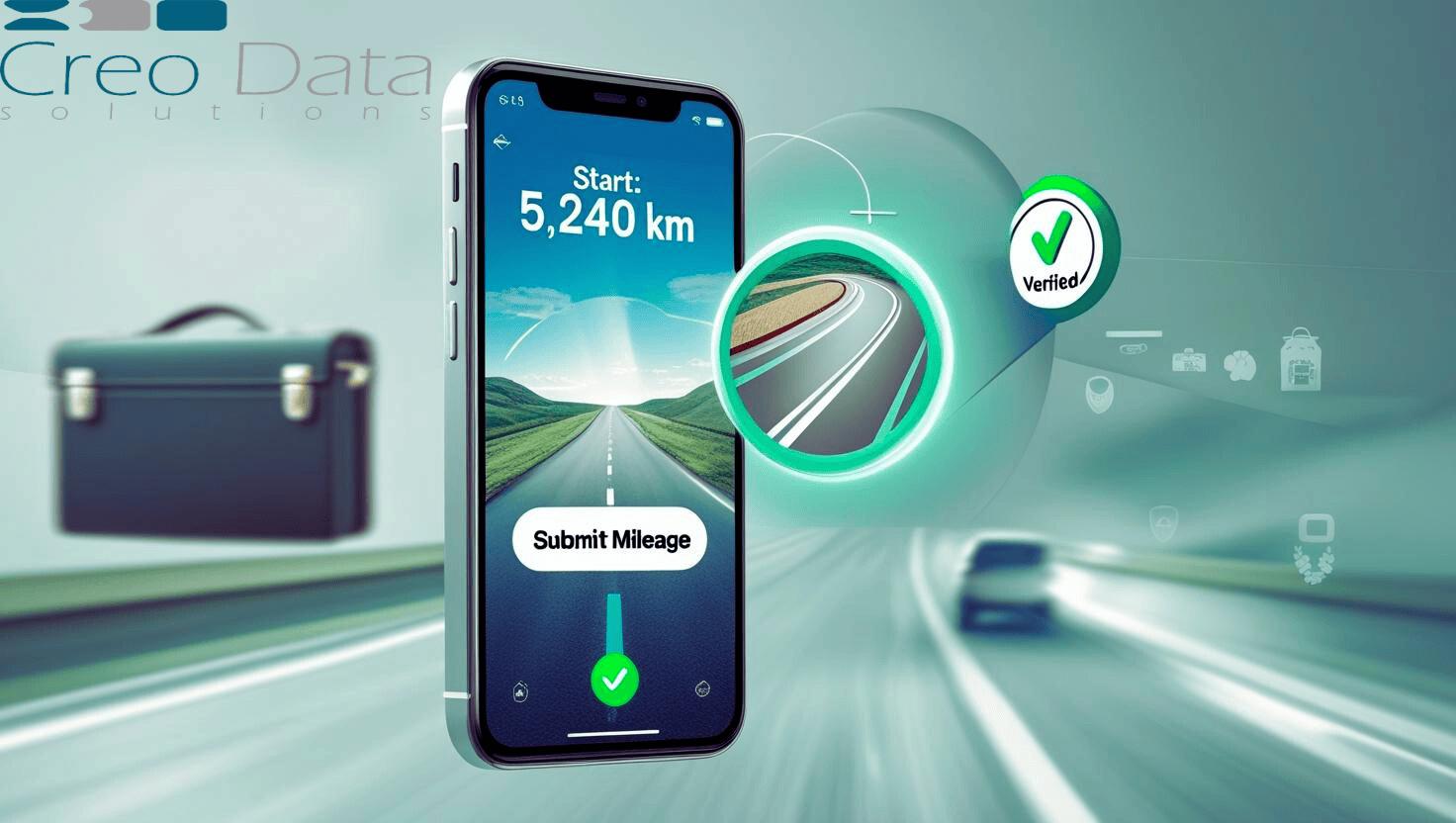

Mileage Claims with Photo Uploads: Streamlining Sales Travel Reimbursements via Mobile Apps

Mileage Claims with Photo Uploads: Streamlining Sales Travel Reimbursements via Mobile AppsOctober 22, 2025

mileage trackingmobile appssales teamsDiscover how photo-based mileage tracking via mobile apps revolutionizes travel expense management for field sales teams in retail and pharmaceutical industries, ensuring accuracy, compliance, and faster reimbursements.

Corporate Card Receipts via Email Auto-Forwarding: Streamlining Finance Operations in the Banking Sector

Corporate Card Receipts via Email Auto-Forwarding: Streamlining Finance Operations in the Banking SectorOctober 22, 2025

expense managementcorporate cardsautomationDiscover how email auto-forwarding for corporate card receipts revolutionizes expense management in banking and finance, automating receipt capture, transaction matching, and compliance.

Azure-Hosted Journaling for Multi-Branch Enterprises: Empowering IT Operations with Scalable and Efficient Deployment

Azure-Hosted Journaling for Multi-Branch Enterprises: Empowering IT Operations with Scalable and Efficient DeploymentOctober 22, 2025

azureemail journalingmulti-branchDiscover how Azure-hosted email journaling empowers multi-branch enterprises with unified compliance, centralized control, and scalable deployment for IT operations across global locations.

Managing Insider Threats with Secure Email Archives: How Journaling Enhances IT Operations Security & Compliance

Managing Insider Threats with Secure Email Archives: How Journaling Enhances IT Operations Security & ComplianceOctober 22, 2025

email securityinsider threatscomplianceDiscover how secure email journaling helps IT Operations teams detect and manage insider threats through comprehensive email archiving, advanced search capabilities, and compliance-ready evidence preservation.

Supporting Business and Individual Loans Under One Roof

Supporting Business and Individual Loans Under One RoofOctober 21, 2025

loan managementSME loansretail loansDiscover how a unified loan platform enables financial institutions to serve both SMEs and individual retail customers through one intelligent system with dynamic logic branching and product flexibility.

Multi-Channel Capture for International Business Travel

Multi-Channel Capture for International Business TravelOctober 21, 2025

multi-channeltravelexpenseLet travelers submit receipts via mobile, email, or web to speed reimbursements and improve compliance.

How IT Teams Use Journaling to Monitor Mail Flow

How IT Teams Use Journaling to Monitor Mail FlowOctober 21, 2025

mail journalingIT operationsemail monitoringDiscover how email journaling provides IT teams with real-time visibility, tamper-proof records, and powerful troubleshooting capabilities for monitoring and managing organizational email flow.

From Form to Function: Automated Loan Processing via Azure Cloud Infrastructure

From Form to Function: Automated Loan Processing via Azure Cloud InfrastructureOctober 21, 2025

loan managementAzurecloud automationExplore how Microsoft Azure's cloud platform enables financial institutions to automate loan workflows, reduce processing time, and enhance accuracy through AI-powered services and scalable architecture.

How to Capture Accurate Borrower Data for Loan Risk Analysis

How to Capture Accurate Borrower Data for Loan Risk AnalysisOctober 21, 2025

loan managementrisk analysisborrower dataDiscover best practices for capturing accurate borrower data to enhance loan risk analysis, reduce defaults, and ensure regulatory compliance in East African lending institutions.

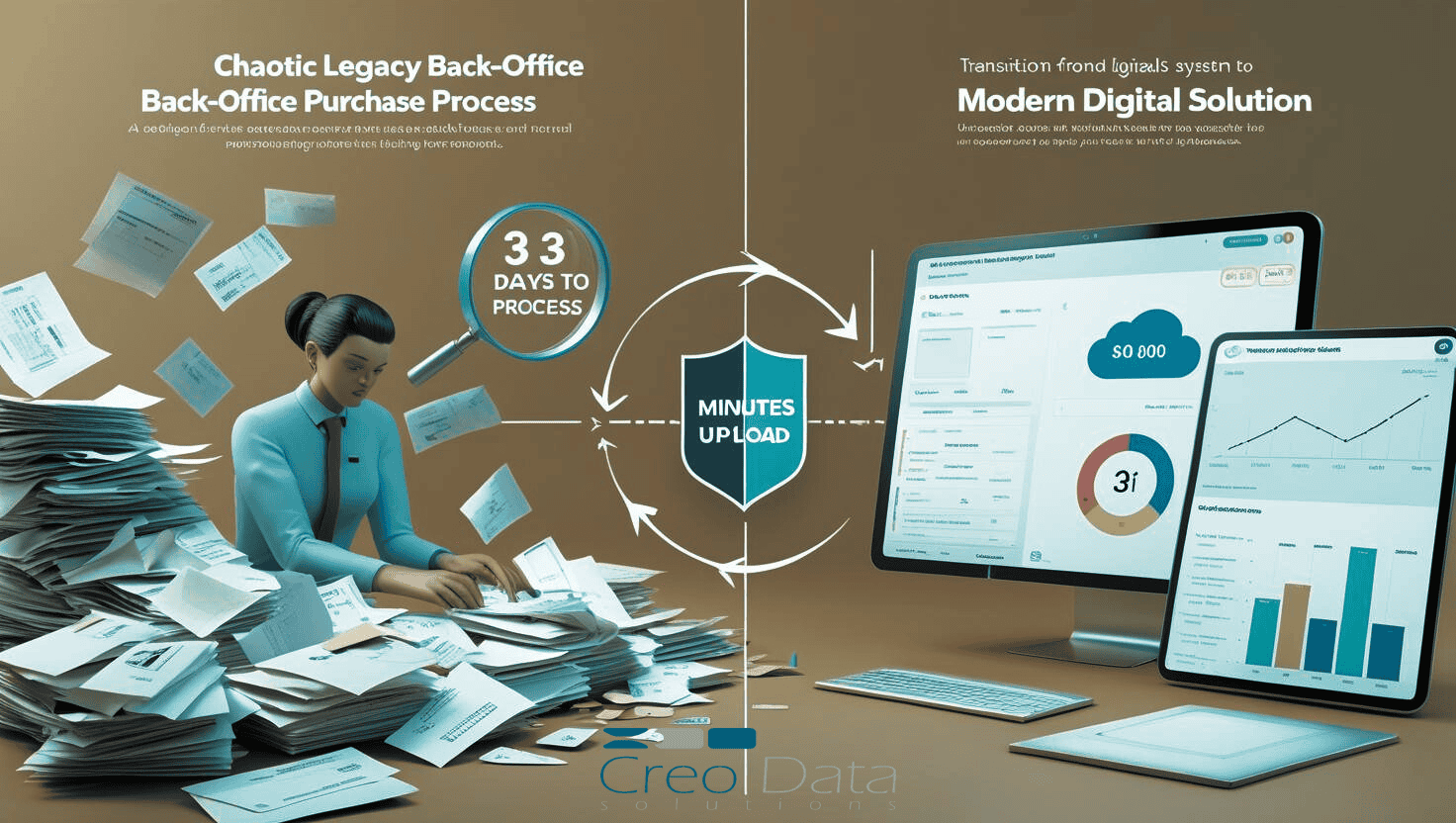

Web Uploads for Back-Office Purchases: Streamlining Financial Oversight

Web Uploads for Back-Office Purchases: Streamlining Financial OversightOctober 21, 2025

expense managementback-officeweb portalDiscover how web-based upload portals transform back-office purchase management with digitized receipt workflows, automated processing, and enhanced financial oversight for finance and admin teams.

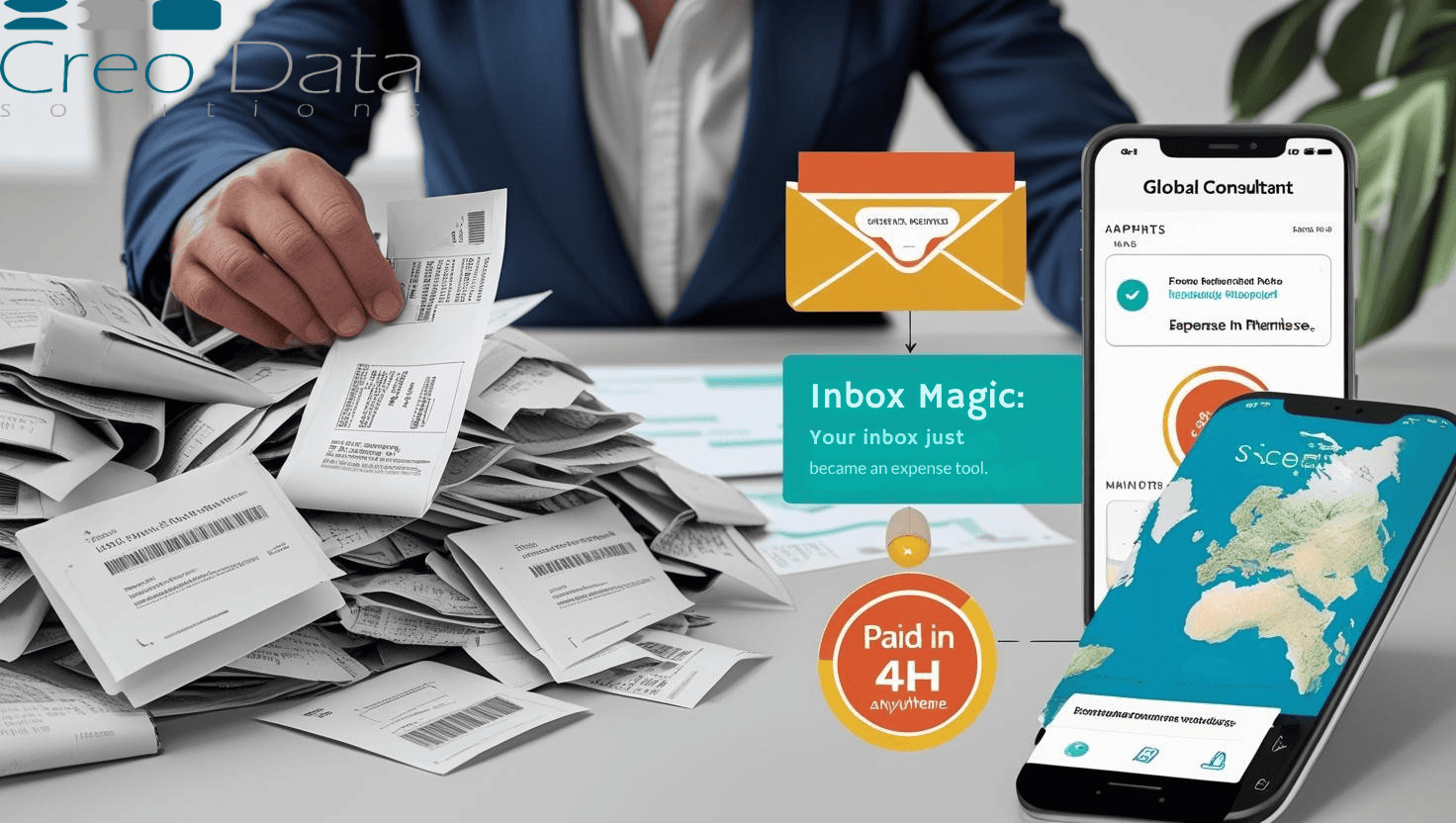

Email-Based Reimbursement for Remote Consultants: Simplifying Expense Reporting

Email-Based Reimbursement for Remote Consultants: Simplifying Expense ReportingOctober 21, 2025

expense managementremote consultantsemail automationDiscover how email-based expense reimbursement simplifies workflows for remote consultants and professional services firms with automated tracking, AI-powered extraction, and seamless approval processes.

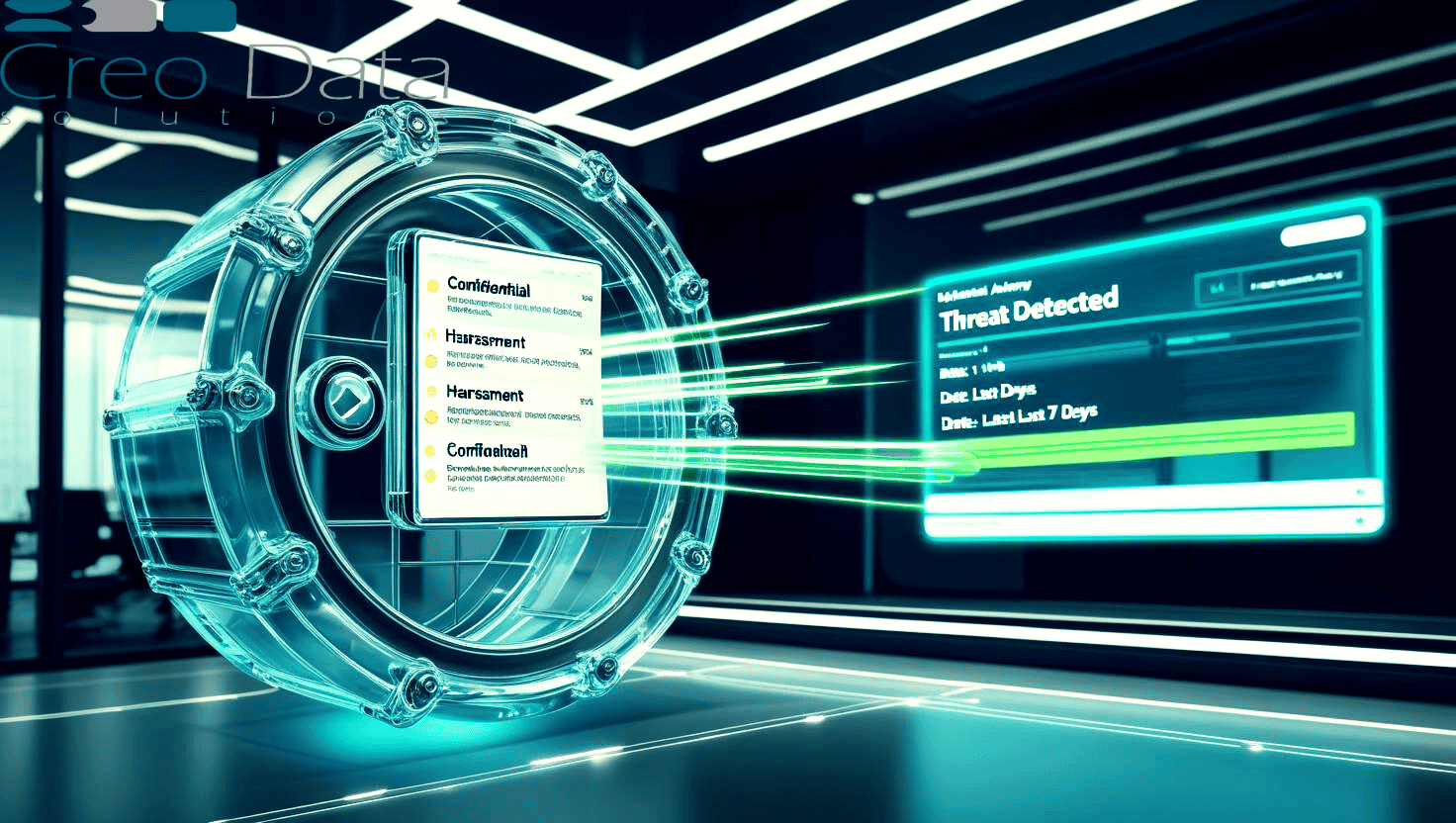

Real-Time Email Archiving for Internal Investigations

Real-Time Email Archiving for Internal InvestigationsOctober 21, 2025

mail journalingHR investigationscomplianceDiscover how real-time email journaling empowers HR and Legal teams to detect and address employee misconduct with immediate access to immutable email records for workplace investigations.

The Role of Journaling in Regulatory Investigations

The Role of Journaling in Regulatory InvestigationsOctober 17, 2025

mail journalingcomplianceaudit readinessHow real-time email journaling ensures audit readiness, regulatory compliance, and helps organizations respond efficiently to investigations and legal holds.

Custom Approval Workflows for Lending: From Intake to Disbursement

Custom Approval Workflows for Lending: From Intake to DisbursementOctober 17, 2025

workflowsapprovalslendingDesign flexible, auditable approval workflows across credit, risk, and compliance with SLA tracking.

Digitizing Loan Intake: The First Step to Smarter Lending

Digitizing Loan Intake: The First Step to Smarter LendingOctober 17, 2025

loan managementdigital transformationloan originationTransform traditional paper-based loan applications into a streamlined digital process, reducing processing time by up to 70% and improving borrower satisfaction.

Digital Co-Applicant and Guarantor Flows — No More Paper Forms

Digital Co-Applicant and Guarantor Flows — No More Paper FormsOctober 16, 2025

loan managementdigital onboardingco-applicantTransforming multi-party loan applications with digital loan origination — eliminating paper forms, reducing errors, and accelerating approvals for co-applicants and guarantors.

AI OCR Extraction: Auto Extracting Expense Data with Over 95% Accuracy

AI OCR Extraction: Auto Extracting Expense Data with Over 95% AccuracyOctober 16, 2025

AIOCRexpense managementDiscover how AI-powered OCR technology revolutionizes expense data extraction from receipts and invoices, delivering over 95% accuracy and reducing processing time by 80%.

Legal Hold vs. Email Deletion: Why Journaling Matters for Legal Litigation Readiness

Legal Hold vs. Email Deletion: Why Journaling Matters for Legal Litigation ReadinessOctober 16, 2025

mail journalinglegal holdcomplianceUnderstand the critical difference between legal hold and email deletion policies, and how journaling ensures compliance and prevents spoliation in legal disputes.

ISO27001 and Email Security: What You Need to Know

ISO27001 and Email Security: What You Need to KnowOctober 15, 2025

ISO27001email securitycomplianceDiscover how email journaling supports ISO27001 compliance by addressing key controls around access auditing, data retention, and secure storage for regulatory adherence.

On-The-Go Expense Reporting by Field Teams: A Deep Dive

On-The-Go Expense Reporting by Field Teams: A Deep DiveOctober 15, 2025

expense managementfield teamsmobile appTransform field team expense reporting with Creodata's mobile-first automation, AI-powered receipt capture, and seamless Dynamics 365 integration.

Data Leak Tracing: Advanced Search for Email Security Investigations

Data Leak Tracing: Advanced Search for Email Security InvestigationsOctober 6, 2025

data-leak-tracingmail-journalingsecurityExplore how data leak tracing capabilities enable organizations to search archived email bodies and attachments for sensitive keywords and patterns to detect, investigate, and remediate information leaks.