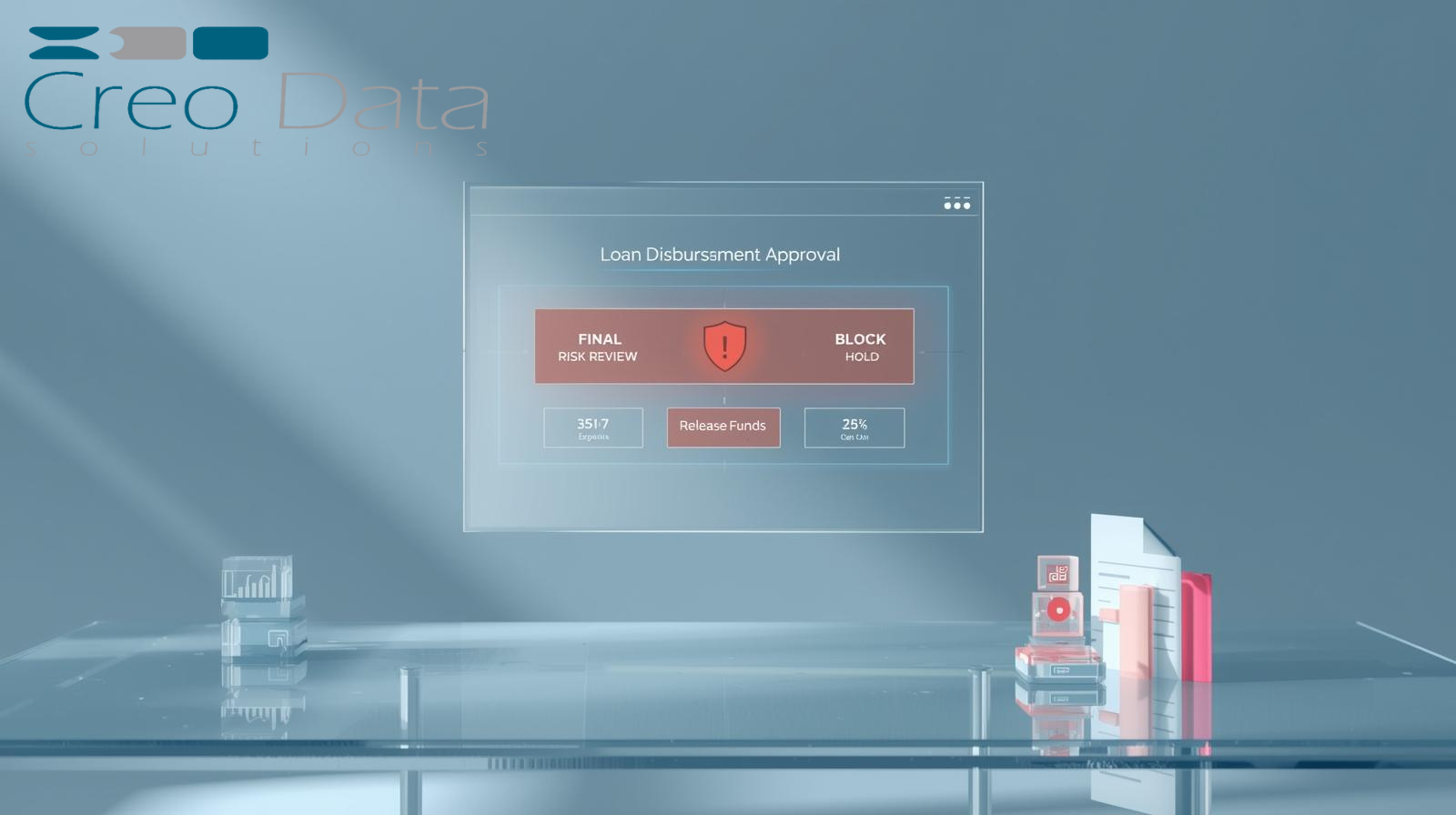

Review & Compliance – Feature: Risk Oversight

See how Creodata's Loan Management System embeds risk review checkpoints into the loan lifecycle so risk officers can block disbursements when red flags appear.

Use Case: Risk Review

Description

In the Risk Review use-case, risk officers within a lending institution are empowered to highlight critical issues and, when necessary, block disbursements until those issues are resolved. The objective is to embed strong oversight and control into the loan lifecycle — not only tracking when funds are released, but validating that all risk, compliance and documentation requirements are satisfied before disbursement occurs.

By integrating this capability into a loan management platform such as Creodata Solutions Ltd.'s Loan Management System (LMS) (as described on the Creodata website), institutions can ensure that their risk officers have full visibility at the moment of disbursement decision-making, and the systems and workflows in place to pause or block disbursement if a red-flag is raised.

Why It Matters: The Role of Risk Oversight in Lending

The use case of Risk Review is not just a procedural nicety — it is a critical control function in prudent lending operations.

- Regulatory guidance emphasizes that an effective credit-risk review system must identify weaknesses before they lead to loss, validate internal risk ratings, monitor portfolio trends, and report to senior management and the board.

- Credit risk remains the largest source of loss for many financial institutions; effective oversight, especially at origination and disbursement, is one of the first lines of defense.

- Without disbursement-block controls, loans can be released prematurely: missing documentation, unmitigated exceptions, inadequate collateral, or failing to surface early-warning signals. Once funds are out, recovering is far costlier.

- Integrating this risk-review checkpoint within the loan lifecycle ensures that the compliance and risk teams operate not in isolation, but in real time and within the operational workflow — thereby reducing manual post-facto checks and blind spots.

How Creodata's Loan Management System Supports Risk Review

The Creodata LMS, as described on the Creodata website, offers features and controls that align directly with the Risk Review use case.

Key Relevant Features

- End-to-end loan processing: From application, approval, disbursement to repayment and delinquency workflows all in one platform.

- Customizable workflows: Institutions can tailor loan products, interest/fee structures, and importantly, approval hierarchies and workflows. This means a risk officer stage can be embedded right before disbursement.

- Real-time reporting and dashboards: Insight into risk metrics, loan portfolio performance, delinquencies and approval exceptions. These dashboards give risk officers the context they need.

- Audit logs, role-based access & compliance frameworks: The system supports full audit trails, role-based access control (so risk officers have the right permissions), and is built with compliance (PCI-DSS, GDPR, ISO 27001) in mind.

- Scalability & deployment on Azure: The system is cloud-based with 99.9% uptime, enabling institutions small to large to implement with minimal infrastructure overhead.

How These Features Enable Risk Review

- The custom workflow means you can define a "risk review" step (or multiple steps) immediately before disbursement: only once risk officer sign-off occurs will the disbursement event trigger.

- Real-time dashboards mean risk officers don't wait for monthly reports—they get instant visibility of loan approvals, exceptions, portfolio trends and can trigger holds or blocks as soon as an issue arises.

- Audit trails ensure that the decision to block/hold is properly recorded and can be explained to regulators, auditors or senior management—meeting compliance expectations for transparency and independent review.

- Integration with KYC, payment gateways, core banking systems means the risk review isn't isolated: if KYC fails, or payment details suspicious, the system flags it and stops the disbursement workflow.

Advantages of Implementing Risk Review via Creodata LMS

Implementing the Risk Review use case via Creodata's platform offers multiple advantages for lending institutions:

1. Reduced Credit Losses and Stronger Portfolio Quality

By embedding risk review at point of disbursement, fewer bad loans slip through. Early intervention helps mitigate risk exposures. This directly improves asset quality and reduces provisioning.

2. Faster Approval-to-Disbursement Turnaround with Control

The system supports streamlined workflows ("get your lending operation transformed in four simple steps"). Because approvals and risk checks are embedded, you avoid separate manual risk-off processes that slow things down.

3. Better Visibility and Reporting for Risk Officers and Senior Management

Real-time dashboards and audit logs give risk officers the tools they need, and senior management the confidence that oversight is happening consistently.

4. Compliance Readiness and Auditability

The platform is built with compliance frameworks in mind. Audit trails and role-based access ensure both accountability and traceability—critical for regulators and auditors.

5. Scalability and Flexibility

Whether a small bank, SACCO or microfinance institution (as the Creodata website addresses), the platform can scale. You can configure workflows, approval thresholds, risk review steps depending on institution size and risk appetite.

6. Operational Efficiency and Cost Reduction

Embedding risk review within the loan lifecycle means fewer manual checks, fewer back-office corrections, fewer remediation tasks post-disbursement. Staff time is freed, and fewer errors means less cost.

7. Integration and Ecosystem Connectivity

With API & integrations (payment gateways, credit bureau, core banking) built in, risk review doesn't remain siloed—it's part of the broader lending ecosystem, enabling data-driven decisions and automation of pre-disbursement checks.

Target Audience

The Risk Review feature, supported by Creodata's LMS, is ideally suited for the following institutional audiences:

Community Banks and Small Banks

These institutions often face resource constraints but still face credit risk exposures. As per Creodata's website: "For Small Banks: Compete with larger institutions using enterprise-grade lending technology."

The risk review module gives them robust oversight without needing large internal risk infrastructure.

Savings & Credit Cooperative Organizations (SACCOs)

SACCOs typically manage member loans and have unique governance/approval workflows. Risk review allows SACCOs to embed a formal checkpoint for oversight before disbursement, ensuring policy compliance. Creodata mentions SACCOs: "Efficiently manage member loans with customizable products and workflows."

Microfinance Institutions (MFIs)

MFIs often deal with high volumes of smaller loans, sometimes in challenging environments. A risk review step helps control risk, even in a fast-moving origination environment. Creodata emphasizes: "For Microfinance: Scale operations while maintaining the personal touch your clients expect."

Larger Lending Institutions Looking to Modernize Risk Oversight

Enterprises that want to move away from legacy systems or siloed risk processes can adopt the Creodata LMS to embed risk oversight into core approval/disbursement workflows.

Risk & Compliance Departments

Within any lending institution, the risk/compliance function benefits directly. They are the users of the "block/disbursement hold" capability, dashboards, audit trails, remediation tracking and workflow notifications.

Conclusion

In today's challenging lending environment, institutions cannot afford to treat disbursement as the final step of a loan process without oversight. Embedding a robust Risk Review checkpoint — where risk officers highlight issues and retain the authority to hold or block disbursements — is a pivotal feature in risk oversight and compliance.

The Creodata Loan Management System offers a strong technology foundation for this use case: its end-to-end workflow, customizable approval paths, real-time reporting, audit logs, and cloud-based scalability make it well-suited to enable risk review without compromising speed or customer experience.

For more information, visit Creodata.com