Reducing Fraud in Expense Management through Automated Approvals

Strengthen expense governance with multi-level approvals, AI-driven flags, and Creodata automation to detect and prevent reimbursement fraud.

Introduction

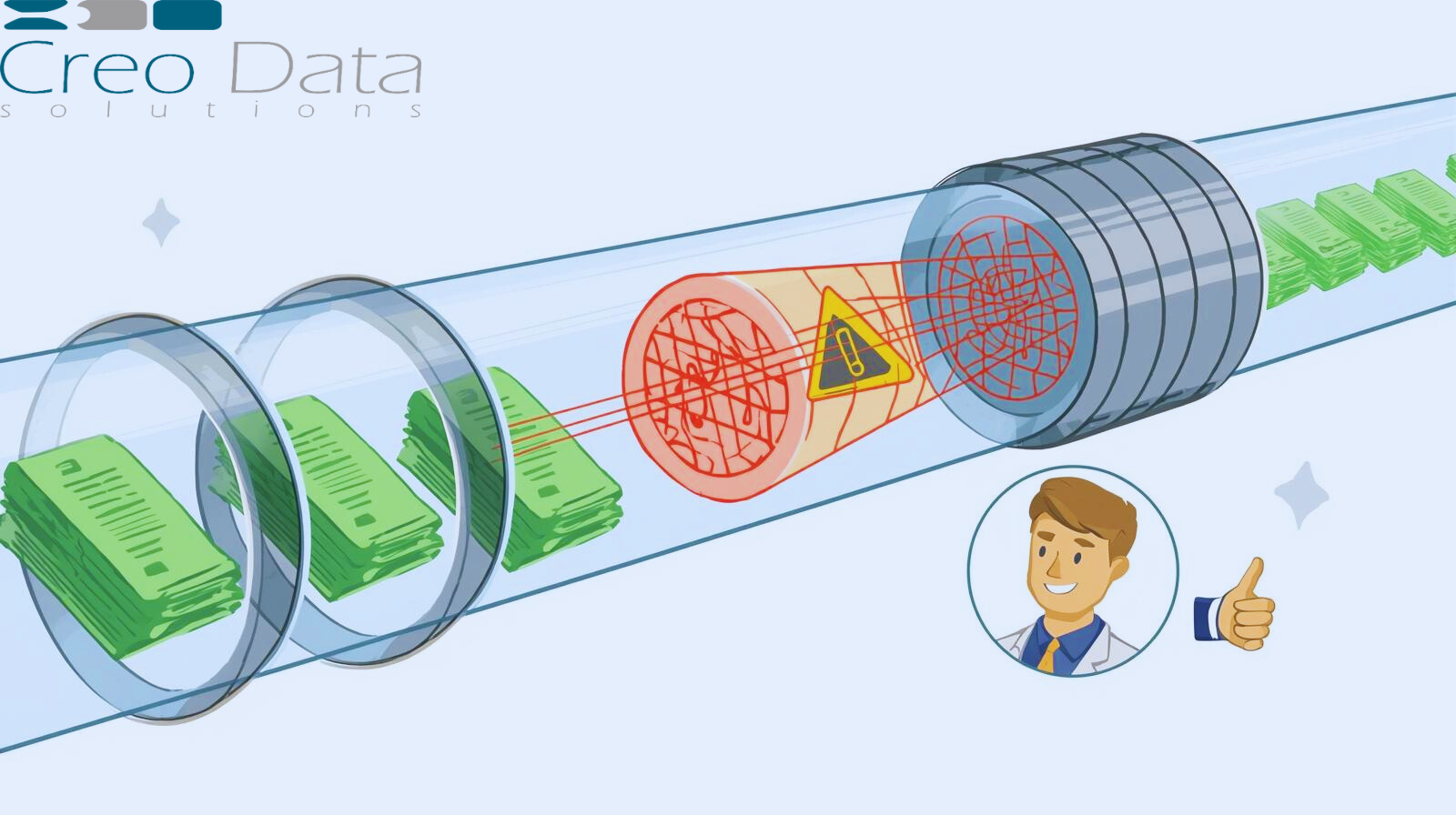

Expense fraud—whether deliberate falsification or inadvertent errors—poses significant financial and reputational risks for organizations. As businesses scale, manual processing of expense claims becomes untenable due to mounting inefficiencies, slow approvals, oversight gaps, and heightened exposure to policy violations.

Enter automated, configurable multi-level routing with automatic flags—a robust approach to expense fraud detection, especially within Risk & Compliance frameworks. This article delves into how such systems, particularly Creodata's AI-Powered Expense Management Automation, strengthen financial controls, streamline workflows, and reduce fraud risks.

About Creodata's Expense Management Automation

Creodata offers an AI-powered expense management solution—fully integrated with Azure Document Intelligence and Microsoft Dynamics 365 Business Central. Key highlights include:

- 95% data extraction accuracy using intelligent document processing

- 80% faster processing for expense submissions

- Microsoft-verified quality, with 4.8/5 ratings on Azure Marketplace

This solution simplifies expense capture, validation, and posting—laying the foundation for rich automation around approval workflows and fraud detection.

Target Audience

1. Finance and Compliance Officers

- Responsible for enforcing spending policies and risk controls

- Need systems that flag suspicious claims automatically and enforce complex routing based on thresholds and hierarchies

2. Internal Audit & Risk Teams

- Require visibility into potential fraud patterns, duplicate claims, or policy violations—ideally highlighted proactively

3. Finance Operations & Accounting

- Seek efficiency in approval workflows, accurate data capture, and integration with accounting ledgers like Dynamics 365

4. Line Managers & Department Heads

- Play governance roles in approving expenses—automated routing and flagging make their oversight seamless and auditable

5. IT & Technology Leaders

- Value secure, scalable automation built on Azure, reducing manual toil and ensuring data integrity

6. Executive Leadership (CFO, COO)

- Want to reduce financial leakage, maintain regulatory compliance, and optimize expense-related spend

Advantages of Automated, Configurable Routing with Flags

1. Minimized Manual Intervention

Creodata's automation slashes manual review by capturing and validating expense entries swiftly, freeing finance teams for strategic tasks. This reduction in manual labor drastically lowers the chance of human error or oversight that could lead to fraud.

2. Configurable Multi-Level Approval Workflows

Organizations can build tailored approval flows based on department, expense amount, or policy tiers—ensuring only the right approvers review claims. This rigid yet flexible design significantly reduces the risk of unauthorized or colluded approvals.

3. Automatic Fraud Flags

AI engines detect anomalies—such as duplicates, outlier amounts, or suspicious patterns—and flag them instantly. Other industry sources show that AI-powered systems are effective in spotting duplicate submissions, outlier values, and suspicious documentation.

4. Policy Enforcement at Scale

With automated approval logic, the system enforces spending rules consistently—minimizing loopholes employees might exploit. Industry best practices emphasize that customizable approval workflows help ensure compliance and prevent fraud.

5. Faster Processing & Improved User Experience

Automated validation and routing save time for employees and finance teams alike. Quicker reimbursements drive higher user satisfaction and reduce "workarounds" that often enable fraudulent behaviors.

6. Audit-Ready Trails

Every action—from submission to flagging to approval—is traceable. This auditability is critical for risk teams and supports compliance with regulatory or internal reviews.

7. Integration with Core Systems

As a Dynamics 365 Business Central-integrated solution, Creodata ensures seamless financial posting. This reduces reconciliation errors and ensures that flagged items are visible within core finance systems.

Detailed Workflow: From Submission to Approval

1. Submission & Intelligent Capture

Employees submit receipts via mobile or desktop. Azure Document Intelligence extracts key metadata with 95%+ accuracy, associating claims with relevant expense types.

2. Automated Validation

The system validates entries—checking formats, policy compliance, and potential red flags (e.g., excessive amounts, missing data).

3. Fraud Detection & Flagging

AI scans for duplication, anomalies, or inconsistent receipts. If found, flags are applied automatically, prompting enhanced scrutiny.

4. Multi-Tier Routing

Expense claims follow configured paths: low-value claims may approve quickly; mid-tier claims route to managers; high-value or flagged ones escalate to finance or compliance.

5. Delegation & Dynamic Handling

Approval responsibilities can be delegated—helpful during leave or absence—while maintaining accountability.

6. Approval or Escalation

Approvers review flagged or regular claims, taking either approval or escalation actions. Flags ensure transparency and due diligence.

7. Posting to Accounting System

Once approved, expenses post automatically to Dynamics 365 Business Central for reimbursement and record-keeping.

8. Reporting & Audit

Finance and audit teams access dashboards detailing flagged claims, approval statuses, and historical trends—providing insights to tighten policy and monitor fraud attempts.

Why It Matters: Context from Industry Trends

- Manual processes are vulnerable: Expense fraud can involve small amounts—yet collectively they erode margins significantly. Without strong controls like automated checks, these often slip through

- AI adds precision: Tools that detect anomalies, duplicates, and outliers empower finance teams to spot suspicious claims swiftly and consistently

- Configurable workflows drive compliance: The ability to tailor routing based on organizational structure ensures that rules are followed regardless of context or size

Conclusion

In the realm of Expense Fraud Detection—within Risk & Compliance—the adoption of configurable, multi-level routing with automatic flags is a critical, proactive defense mechanism.

Creodata's Expense Management Automation, underpinned by Azure AI and integrated with Microsoft Dynamics 365 Business Central, demonstrates how organizations can:

- Accelerate expense processing with high accuracy

- Enforce policy compliance consistently

- Detect anomalies and potential fraud automatically

- Maintain clean audit trails

- And reduce leakages while increasing trust and accountability

This intelligent combination of automation, fraud detection, and flexible workflow offers tangible benefits to finance teams, managers, compliance officers, and executives—culminating in more secure, efficient, and cost-effective expense management.

For more information, visit Creodata.com