Simplifying Employee Expense Reporting Through AI OCR Technology

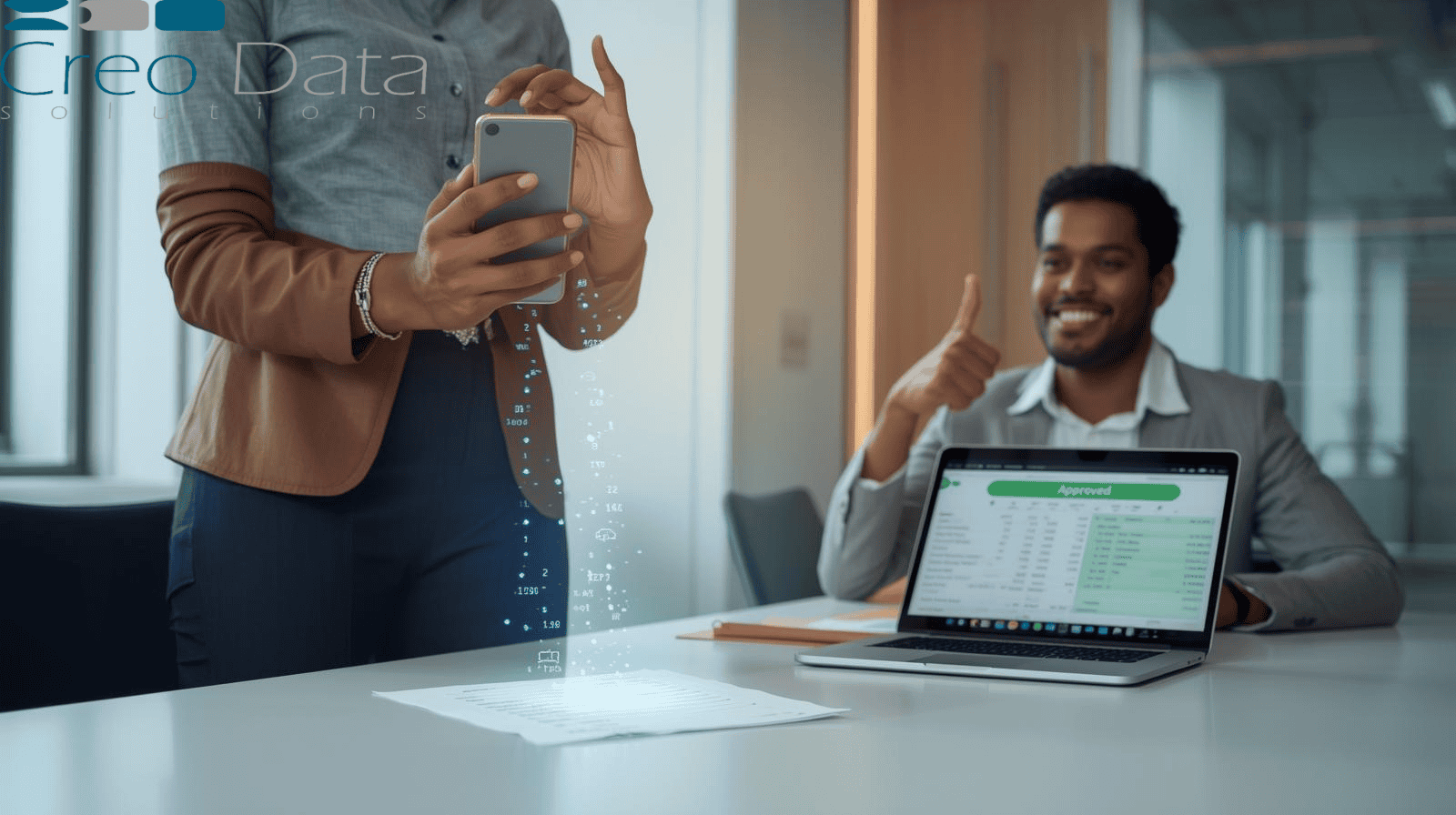

Make expense reporting faster and more accurate with AI-powered OCR and automated workflows.

Introduction

Expense reporting is a routine yet often frustrating task for many employees—collecting receipts, manually entering data, waiting for approvals. For HR Managers, overseeing these reports, ensuring policy compliance, and managing reimbursements can be equally tedious. But what if you could eliminate the drudgery entirely?

Enter AI-powered OCR (Optical Character Recognition) technology—a sophisticated system that scans receipts or invoices and intelligently extracts critical data like amount, date, and vendor. This innovation transforms expense reporting into a fast, accurate, and user-friendly process.

Target Audience

1. Employees

From sales reps to remote teams, any employee who incurs expenses—travel, meals, supplies—benefits by submitting clean, accurate reports with minimal effort.

2. HR Managers & Finance Teams

Those responsible for approving, auditing, and reconciling expense reports. They need transparency, compliance control, and efficient workflows.

How AI + OCR Transforms Expense Reporting

1. Smart Receipt Capture

Employees simply snap a photo of a receipt using a mobile app. OCR technology automatically reads it and fills in fields like amount, merchant, and date. Platforms today achieve impressive accuracy—even with varied receipt formats and languages.

2. Automated Data Entry & Categorization

Gone are manual inputs. AI systems extract key info and classify expenses (e.g., travel, meals, office supplies) using machine learning. The system learns and improves over time.

3. Policy Compliance & Fraud Detection

AI applies spending rules in real-time—flagging disallowed items, duplicates, or over-limit claims. This reduces fraud and keeps processes transparent.

4. Smart Approval Routing

AI-powered systems can route reports to appropriate approvers based on expense type, amount, or department. This eliminates manual hand-offs and speeds approvals.

5. Real-Time Analytics & Budgeting Insights

Managers gain instant visibility into spending patterns—identifying trends, anomalies, and budget progress—all from clean, AI-extracted data.

6. Faster Reimbursement & Seamless Integration

Expense tools integrated with accounting systems automate reconciliation and reimbursements, accelerating the process from report submission to payment.

Advantages by Audience

For Employees:

- Time savings – no more typing every detail

- Fewer mistakes – data is captured accurately

- Faster reimbursements – smoother approval workflows

- User-friendly experience – legal receipts submitted in seconds

For HR Managers & Finance Teams:

- Reduced workload – less manual review required

- Improved compliance – built-in policy checks

- Fraud mitigation – instant flagging of suspicious patterns

- Better insights – accessible dashboards and reporting

Creodata's Expense Management Solution

Creodata Solutions Expense Management product is designed to bring the power of AI-driven automation and OCR directly into your organization's workflows:

- AI-powered data extraction from receipts, automating the capture of key metadata

- Automated approval workflows, likely configurable and scalable

- Azure-based cloud platform – secure, compliant, and enterprise-grade

- Seamless integration with broader systems, from HR to accounting and ERP

This combination positions Creodata as a robust platform that simplifies expense reporting end-to-end.

Real-World Impacts at a Glance

| Persona | Benefits from AI-OCR Expense Reporting |

|---|---|

| Employee | Snap a receipt → OCR extracts info → Auto-populates report → Submit |

| HR Manager | Receives clean submission → AI verifies policy → Routed for approval |

| Finance Team | Matched expenses seamlessly feed into accounting systems |

| Organization | Improved compliance, faster reimbursements, actionable spend insights |

The Broader Landscape of OCR-Driven Expense Management

OCR isn't new—yet modern implementations smarter than ever. As part of Smart Data Capture, OCR is combined with object detection, real-time insights, and automation.

Leading case studies also highlight deeper AI integration:

- A corporate system using OCR + Intelligent Document Processing (IDP) + Generative AI reduced processing time by over 80%, with error reduction and higher satisfaction

These demonstrate that AI-OCR is the foundation for expanding automation—from structured expense capture to intelligent exception handling.

Implementing OCR-Powered Expense Reporting

1. Choose a Solution

Select a platform like Creodata's Expense Management with integrated OCR, ideally Azure-secure and policy-aware.

2. Configure Expense Policies

Set rules for spending limits, allowable categories, and approval hierarchies.

3. Train Users

Show employees how to snap receipts, validate auto-extracted data, and submit reports.

4. Monitor & Improve

Track flagged items, measure processing times, and refine system rules for better accuracy.

5. Scale & Integrate

Ensure the platform integrates with your accounting/ERP systems for end-to-end automation and auditability.

Conclusion

AI-powered OCR technology is transforming employee expense reporting—making it faster, more accurate, and policy-compliant with minimal manual intervention. Employees gain a user-friendly, efficient expense submission process. HR Managers and finance teams benefit from streamlined approvals, reduced fraud risk, and improved visibility into spending.

Creodata's Expense Management solution, built on AI and Azure, offers a secure, scalable platform that brings these benefits to your organization. By embracing AI-OCR, companies can not only modernize their workflows but also empower employees and decision-makers with data-driven clarity and speed.

For more information visit: https://www.creodata.com/products/expense-management/