Secure Role-Based Access in Loan Management: Ensuring Only Authorized Users Can Perform Actions at Each Workflow Stage

Implement role-based access control to ensure only authorized users can perform specific actions at each workflow stage, protecting sensitive data and ensuring compliance in loan management systems.

Introduction

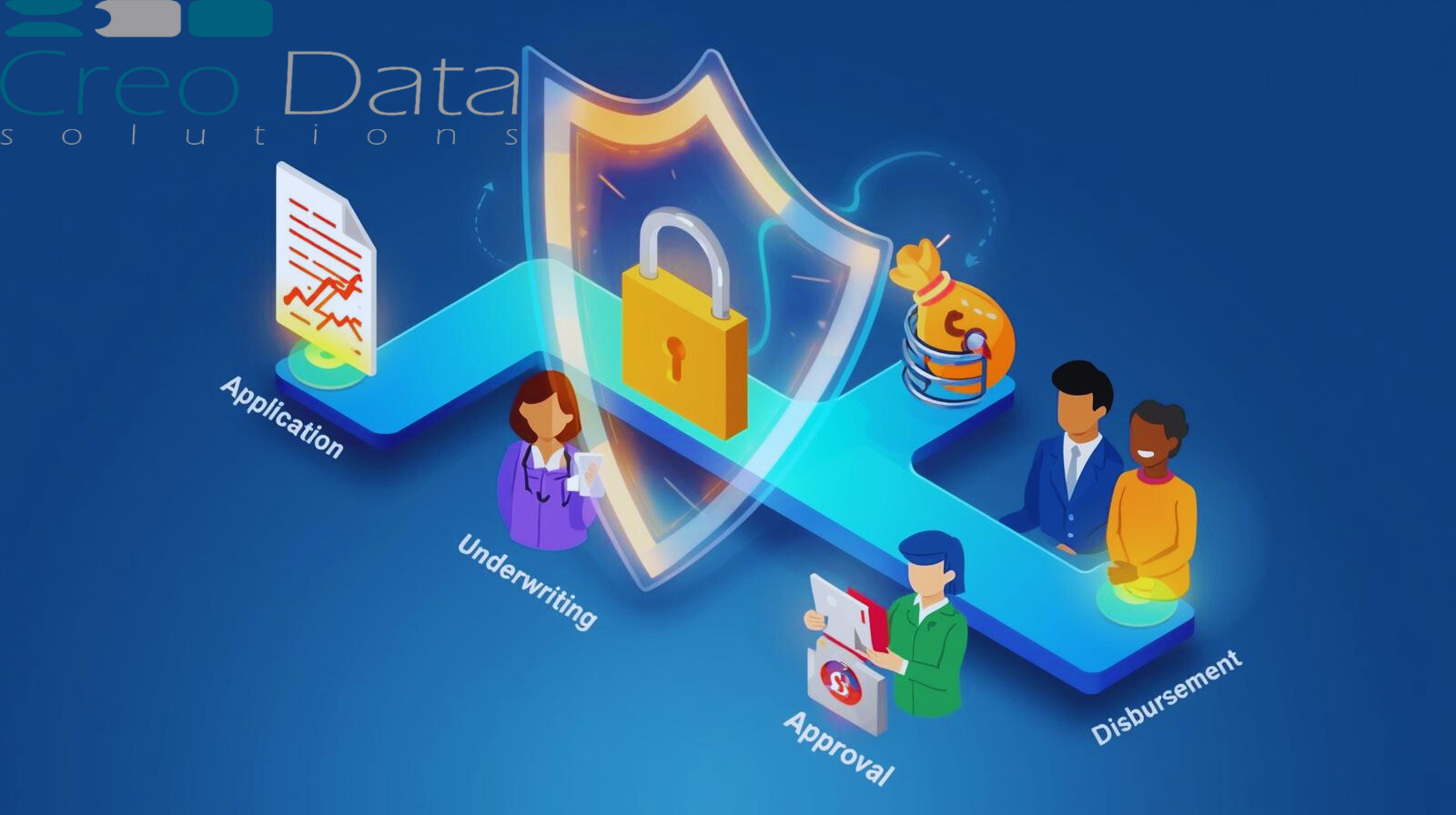

Loan management involves multiple steps, stakeholders, and sensitive data. From initial application, processing, underwriting, approval, disbursement, through to repayment and delinquency management, many actors are involved: loan officers, underwriters, risk & compliance teams, servicing agents, auditors, and more. Each of these must perform certain tasks, see certain data, and make decisions at specific points. If permissions are too broad or loosely managed, there is risk of fraud, error, policy violations, and non-compliance with regulations.

A very effective method to reduce these risks is using role-based permissions in workflow automation. Under the use case "Secure Role-Based Access", the idea is that at each workflow stage, only users with the correct role/authority can take specific actions (e.g. view documents, approve loans, alter terms). This ensures:

- Sensitive data is protected

- Responsibilities are clearly segmented (separation of duties)

- Auditing is possible

- Mistakes or misuse are minimized

Creodata's Loan Management system already supports such features. Their website lists Role-Based Access Control ("Fine-grained permissions to protect sensitive customer and financial data") as a security feature.

How Creodata's Loan Management Solution Implements Secure Role-Based Access

Based on the information from Creodata's "Comprehensive Loan Management for Financial Institutions" page, here are relevant details showing how its platform supports secure role-based access:

-

Role-Based Access Control (RBAC): Creodata's Loan Management system has "fine-grained permissions to protect sensitive customer and financial data." This implies that user roles are defined with precision, and system ensures only those roles that are authorized can access certain data or perform certain actions.

-

Enterprise-Grade Security Stack: Creodata's solution is hosted on Microsoft Azure, with data encryption (in transit and at rest), and built with compliance frameworks in mind. These provide foundational enablers for secure RBAC.

-

Customizable Workflows & Approval Hierarchies: The loan processing workflows (loan origination, multi-level approvals etc.) are configurable to align with institution-specific policy. The system can ensure that only the designated roles in those hierarchies get to approve or reject.

-

Audit Logging: Full traceability for actions and transactions is provided. This is essential to monitor who accessed what, when, etc.

Target Audience

Who benefits most from implementing secure role-based access (via automated workflows / RBAC) in a loan management system like Creodata's?

1. Banks, Microfinance Institutions, Credit Unions

Any financial institution that issues loans needs strong security, transparency, and controls. These entities deal with regulated data and large volumes of sensitive customer information.

2. FinTech Lenders and Digital Loan Platforms

Especially those operating online, with remote users, applicant portals, etc. They need to ensure that only authorized internal users (or external partners) can access or modify data at different stages.

3. Regulated Financial Services Enterprises

Institutions subject to stringent regulatory oversight, compliance requirements (AML, KYC, data protection), audit requirements, etc. Role-based permissions are often mandatory or heavily encouraged.

4. Organizations with Multiple Branches or Regions

If the institution operates in several branches, or different geographical jurisdictions, role-based permissions help restrict access to branch-specific data, region-specific workflows, etc.

5. Large or Growing Loan Portfolios

Where many employees participate in the loan lifecycle, it's impractical to manage user permissions individually. Scaling securely requires roles.

6. IT Security, Risk & Compliance Teams

These stakeholders are directly concerned with ensuring that systems are secure, access is as per policy, audit trails exist, permissions are tight, etc. They will be the ones benefiting from RBAC features.

7. Senior Management / Executive Leadership

C-suite (CIO, CRO, COO, CFO) care about reducing risk exposure, protecting reputation, ensuring operational integrity, and meeting regulatory obligations. Secure role-based access feeds into those objectives.

8. Auditors and Regulators

External auditors, internal audit teams, and regulatory bodies often require proof of who has access to what and when. Systems with clear role-based permissions + audit logs simplify those processes.

Real-World Example / Scenario

To illustrate how secure role-based permissions in loan management help, imagine the following scenario in a mid-sized bank (say 200 staff, multiple branches):

-

Stage 1: Loan Application — Loan Officer collects application documents and uploads them. They can see partial customer data but not risk scores.

-

Stage 2: Credit Evaluation — A Credit Analyst role is responsible for evaluating credit risk and running risk scoring. They are not permitted to approve or reject loans; that permission is reserved for a Loan Approval Manager.

-

Stage 3: Compliance Check / KYC — A Compliance Officer inspects documents, ensures regulatory requirements. They have permissions to flag issues or hold the loan in the workflow but cannot move forward with disbursement.

-

Stage 4: Approval — A Manager or Director role has authority to approve loans, depending on thresholds. For loans above certain amounts, senior executive approval may be required.

-

Stage 5: Disbursement — Once approved, only the Disbursement Officer or Finance role can initiate fund disbursement.

-

Stage 6: Servicing / Collections — Servicing agents can view payment schedules and interact with borrowers, but cannot change loan terms (that is restricted to more senior roles).

Every action (including e.g. altering repayment schedule, modifying interest rate, overriding approval) is checked against the logged-in user's role. If someone doesn't have permission, action is blocked. All actions are logged, so if a problem arises (say a borrower disputes a rate change), you can trace exactly who made the change, when, and under what role.

How Secure Role-Based Access Helps Creodata's Clients

Given Creodata's Loan Management feature set (customizable workflows, enterprise-grade security, role-based access control, audit logging, compliance, etc.), clients using Creodata can expect:

- Reduced risk of internal misuse or unauthorized changes in loan data.

- Clear visibility and control over who does what, improving trust with regulators and customers.

- Better operational efficiency by reducing manual checks / waiting for permissions or corrections.

- Easier compliance with laws and regulations, given audit trails and controlled access.

- Scaling of loan operations without insecurity: as more staff, branches, or products are added, secure permissions ensure stability.

Conclusion

Secure role-based access is a cornerstone of workflow automation in loan management. By ensuring that only authorized users, with appropriate roles, can perform the correct actions at each stage of the loan lifecycle, institutions can protect sensitive data, enforce policies, maintain compliance, reduce errors and mitigate risk.

Creodata's Loan Management System offers robust role-based access (fine-grained permissions), custom workflows, strong security architecture, and audit logging — all of which enable this secure access control. Institutions that need security, compliance, scalability, and operational integrity will find such capabilities essential.

For more information, visit Creodata.com