Emergency Expense Reporting in Crisis Response

Mobile expense capture for responders: faster reimbursements, better visibility, and audit-ready records.

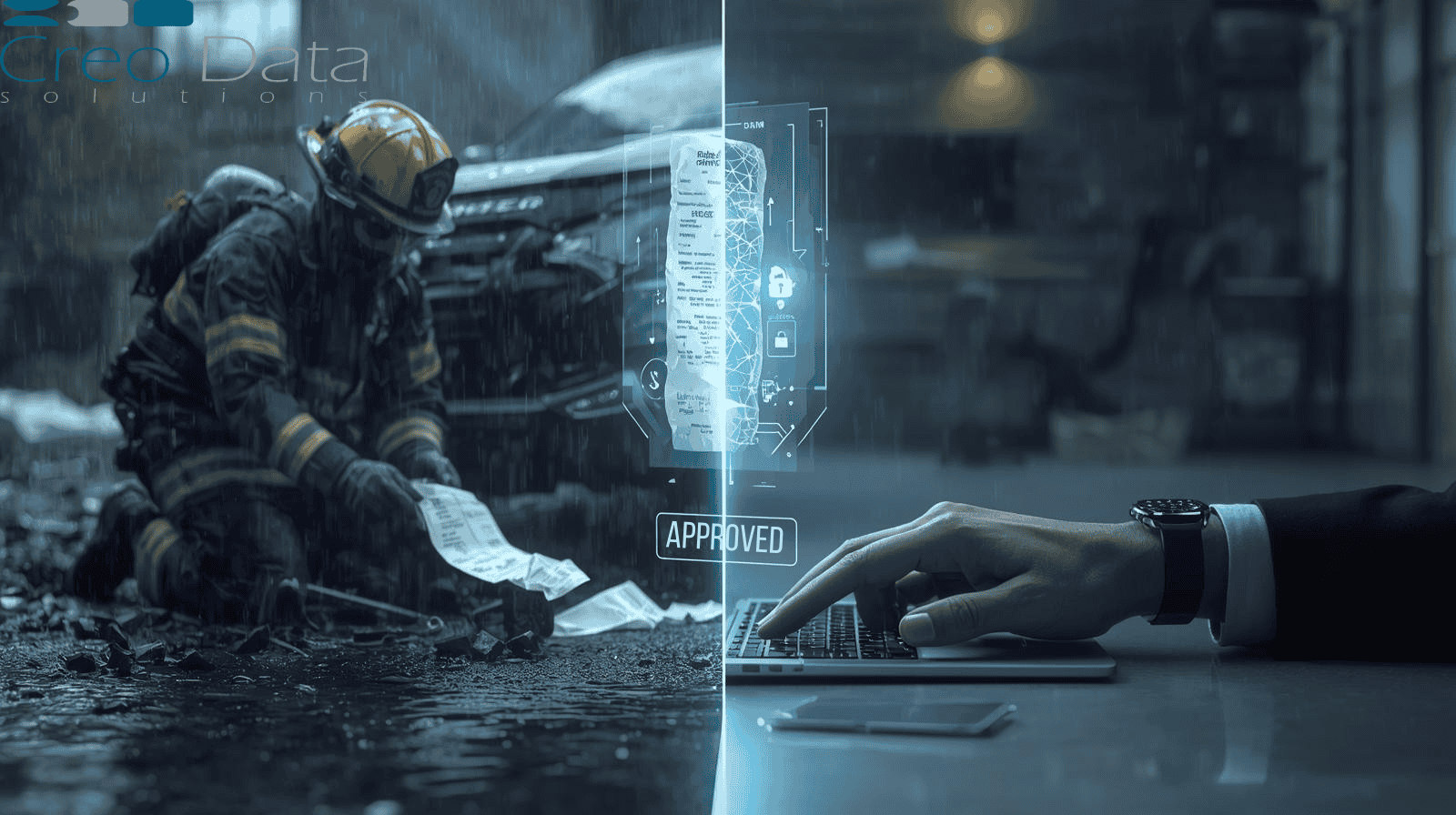

Introduction: The Challenge of Expenses in Disaster Zones

In catastrophic events—earthquakes, floods, conflicts—emergency responders frequently operate in chaotic, rapidly changing environments. Whether they're humanitarian aid workers, medics, or rescue personnel, these teams must often buy supplies, travel between downed infrastructure, or procure logistical support on the ground.

Tracking and managing expenses in these challenging environments is both crucial and complicated:

- Receipts get lost in the chaos

- Paper logging systems are too slow

- Finance teams back home wait days for expense data, delaying reimbursements and resupply

This is where Emergency Expense Reporting via mobile apps comes into play: responders document their spending in real time, even in remote or unstable areas—keeping operations efficient and accountable.

Why Real-Time Mobile Expense Reporting Matters

1. Speed and Efficiency

- Capture instantly: Snap a photo of a receipt or filled form using your phone

- Submit immediately: No need to manually enter expenses or wait to return to base

2. Accountability & Transparency

- All expenses can be tracked—with timestamps and geolocation if needed

- Helps avoid fraudulent reporting and ensures auditing compliance

3. Operational Continuity

- Finance and logistics teams get immediate visibility—allowing faster decisions on resupply, reimbursements, or budget allocation

4. Reduced Administrative Burden

- Saves hours compared to manually collecting, scanning, and entering paper receipts later

- Frees responders to focus on life-saving work, not paperwork

How It Works: Step-by-Step Mobile Workflow

Here's a streamlined workflow for how a typical emergency responder uses the mobile-based expense reporting:

-

Expense Occurs in Field

- Example: Buying fuel or snacks for relief teams

-

Capture Receipt

- Open the mobile app, snap a photo of the receipt or other proof-of-payment

-

Fill Out Details

- Enter category (e.g., "Fuel"), amount, date/time; fields can be preconfigured to suit common expense types

-

Upload in Real Time

- Data syncs to the central system immediately (or when connectivity is available)

-

Approval Workflow Starts

- Back-office reviewers or finance teams get notified and can approve, reject, or escalate as needed

-

Reimbursement or Resupply Triggered

- Once approved, reimbursements are initiated or new supplies dispatched—ensuring responders stay equipped

Creodata's Role: AI-Powered Expense Management

According to Creodata, their AI-Powered Expense Management Automation solution streamlines capturing, validating, and posting expense data. Key highlights include:

- 95% data extraction accuracy

- 80% faster processing

- Integrated mobile app for employees to submit expenses quickly

In the emergency response context, this tech enables:

- Accurate auto-extraction of amounts, dates, categories via AI—no typing errors

- Seamless integration with back-end systems like accounting or ERP (e.g., Dynamics 365 Business Central), which can adapt to humanitarian finance systems

Target Audience

1. Emergency Response Agencies

Military, NGOs, UN peacekeepers, and medical organizations that need streamlined field finance operations.

2. Field Responders

On-the-ground humanitarian staff, logistics officers, medical teams, and volunteer coordinators who need fast, easy expense reporting.

3. Back-Office Finance and Logistics Teams

Support teams responsible for tracking spending, approving claims, and ensuring funds flow to the right places quickly.

4. Donors and Oversight Bodies

Entities that demand transparency, audit trails, and financial accountability in crisis funding.

Benefits of Mobile Expense Reporting in Crisis

| Stakeholder | Benefit |

|---|---|

| Responders | Less admin, faster reimbursements, more focus on mission-critical tasks |

| Finance Teams | Immediate visibility, fewer errors, smooth integration |

| Organizations | Better compliance, improved trust, cost control |

| Donors | Clear audit records, real-time spending insights |

Security and Compliance Considerations

Even in chaotic environments, data protection matters—especially when dealing with personal and financial information.

Key safeguards include:

- Encrypted data capture and storage — protecting documents in transit and at rest

- User authentication — access control ensures only authorized personnel report or view expenses

- Audit logs & traceability — each receipt, approval, and action is logged for accountability

Real-Life Scenario

Example: Tropical Cyclone Relief Effort

A field medic travels between makeshift clinics, buying fuel, medical supplies, and food for teams. Using the mobile app, they:

- Snap each receipt, enter type/cost, and upload

- Back-office team immediately reviews it

- Supplies get replenished faster thanks to swift approvals

This boosts morale, keeps operations running, and preserves valuable time during critical missions.

Challenges and Solutions

1. Connectivity Issues

Solution: Offline mode with later sync when connectivity returns.

2. Power Constraints

Solution: App optimized for low battery usage; prioritized sync, minimal UI.

3. User Training

Solution: Simple onboarding, intuitive UI, minimal setup required.

4. Integration Complexity

Solution: Use platforms like Creodata with pre-built ERP/finance application connectors.

Why It Matters

As crisis response becomes increasingly data-driven, tools like Emergency Expense Reporting via Mobile App will redefine field operations:

- Speeds up response times

- Enhances financial transparency

- Empowers responders with financial autonomy

- Optimizes resource allocation during disasters

Combined with platforms like Creodata's AI-powered automation, organizations can transform expense processing from a delay-prone chore to a mission-acceleration tool.

For more information visit: https://www.creodata.com/products/expense-management/