Auto-Import Magic: Card Feed Import in Expense Data Ingestion

Discover how automated card feed import in Creodata's Expense Management solution streamlines expense data ingestion, reconciliation, and financial control.

Introduction

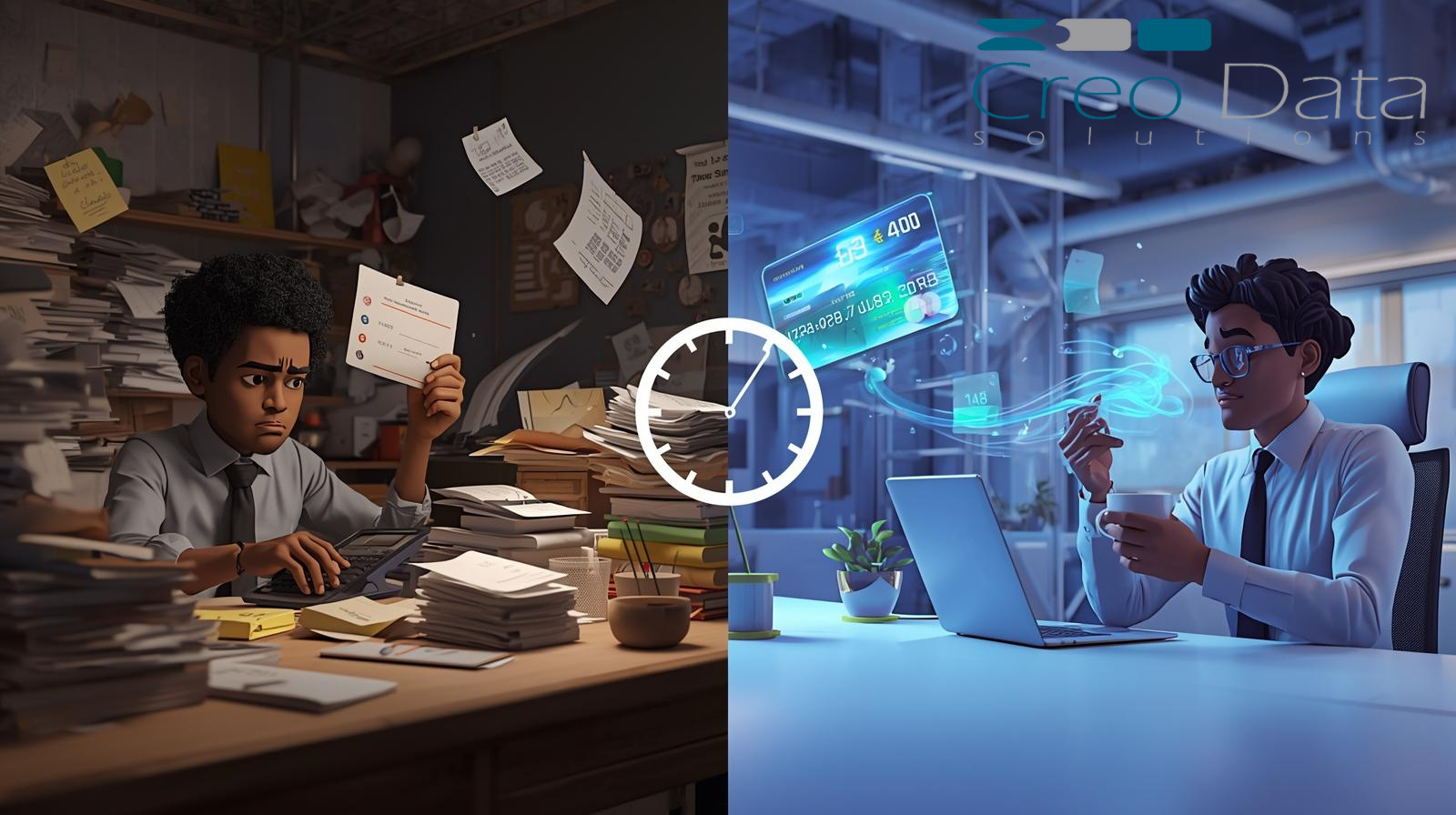

In the modern finance and accounting landscape, managing employee and corporate expenditures efficiently is a major challenge. Organizations often must ingest large volumes of transactional data—from receipts, invoices, and credit or debit card transactions—and then transform, validate, and link those transactions to the right expense records. One powerful capability that removes manual friction is auto-importing card feeds: automatically fetching credit card transaction data, ingesting it into the expense system, and intelligently matching those transactions against expense entries or prompting users to reconcile them.

The Use Case: Card Feed Import for Expense Automation

What Is Card Feed Import?

Card feed import is the process by which credit card (or corporate card) transaction data is automatically ingested into an expense management system. Rather than requiring users or finance staff to manually upload statements or key in card transactions, the system connects (via API, file feed, or bank export) to credit card or bank systems, fetches the transaction records (cardholder, merchant, date, amount, currency, etc.), and places them into a staging or reconciliation area in the expense workflow.

Once the feed is imported, each card transaction is processed: potentially matched to an existing submitted expense (if a user has already entered a claim and attached a receipt), or surfaced as a new "pending" expense to be completed by the user. The system may prompt for missing data (e.g. category, purpose, receipt) or automatically propose matches based on heuristics, rules, or machine learning.

Creodata's Expense Management & Card Feed Integration

Creodata's Expense Management Automation solution, listed on the Creodata website, is designed to streamline expense processing by intelligent automation and integration. While its core focus is capturing and validating receipts, it also supports corporate card reconciliation / card feed import as one of its features.

How Creodata Implements Auto-Import Magic

Based on product documentation, Creodata's approach includes:

-

Corporate Card Reconciliation: A built-in feature that supports importing credit card transaction feeds and matching them against submitted expense entries.

-

Native Integration: Because the solution is integrated with Microsoft Dynamics 365 Business Central, expense entries (post approval) can be automatically posted to correct general ledger accounts, with card transaction metadata included.

-

Configurable Matching Rules: The system allows configurable matching logic, thresholds, and fallback behavior (e.g. amount tolerance, merchant matching).

-

User Prompting & Exception Handling: For card transactions not automatically matched, users are prompted in the mobile or web portal to provide missing information or designate them as new expense claims.

-

Seamless Workflow: Once reconciled, the transaction flows into the normal approval workflow, benefiting from Creodata's configurable approval chains, policy enforcement, and posting automation.

Because Creodata's Expense Management solution is deployed via the Azure Marketplace and built on Azure infrastructure, it inherits scalability, security, and resilience. This makes it suitable for organizations with significant card transaction volumes.

Advantages of Auto-Import Card Feed Capability

Implementing auto-import magic for card feeds yields numerous advantages. Below are key benefits:

1. Reduced Manual Effort & Administrative Burden

Manually entering or uploading card statements is laborious and error-prone. Auto-import eliminates the need for manual data entry, freeing users and finance teams to focus on exceptions and higher-value tasks.

2. Faster Reconciliation & Turnaround

Because card transactions flow automatically into the system and often get auto-matched, the reconciliation cycle is accelerated. Finance teams can close expense periods faster, reimburse employees more quickly, and ensure more timely financial snapshots.

3. Improved Accuracy & Consistency

Automated parsing and matching minimize data entry errors. Standardized metadata (merchant normalization, category suggestions) bring consistency across users. Matching logic reduces mistakes in linking wrong transactions.

4. Better Visibility & Control

Finance leadership gains near real-time visibility into card spending. Unmatched or flagged transactions are surfaced promptly for review. Policy violations can be flagged early (e.g. merchant category restrictions).

5. Lower Risk of Lost Receipts & Unclaimed Transactions

Because card transactions land automatically in the system, users are less likely to forget to claim them. Reminders can prompt users to attach missing receipts or finalize unmatched entries.

6. Auditability & Traceability

Every stage—import, matching, override, user action—is logged, creating a full audit trail. This strengthens governance, compliance, and internal control.

7. Scale & Performance

With a properly designed ingestion pipeline, the system can handle high volumes of card transactions across many users, without degradation. This is key as organizations scale and card usage increases.

8. Seamless Integration to ERP/GL

By reconciling and posting card-based expenses directly into accounting systems (e.g. Microsoft Dynamics 365 Business Central via Creodata's integration), financial data flows smoothly, reducing reconciliation overhead between card statements and general ledger entries.

Target Audience for Auto-Import Card Feed in Expense Management

The auto-import card feed capability is valuable to several types of organizations, especially those with moderate to heavy card usage and expense complexity. The ideal target audiences include:

-

Mid-to-Large Enterprises: Organizations with dozens to thousands of corporate cards, high transaction volumes, and layered departmental spend.

-

Finance-Intensive Firms: Entities such as consulting firms, law firms, marketing agencies—where employee spend is frequent and varied.

-

Sales & Field Teams: Companies with large sales forces or field operations that regularly incur card expenses (e.g. travel, hospitality).

-

Dispersed / Remote Organizations: Where employees are geographically distributed, making manual processes slow and error-prone.

-

Organizations with Compliance or Audit Requirements: Industries requiring full traceability of expenditures (e.g. public sector, regulated sectors, nonprofits).

-

Companies Already Using Microsoft / Dynamics ERP Ecosystems: Because Creodata's solution integrates natively with Dynamics 365, organizations in that stack benefit from tighter end-to-end workflows.

-

High-Growth Businesses: Firms scaling quickly, whose card transaction volumes will grow and demand a scalable ingestion approach.

In short: any organization seeking to modernize, streamline, and automate their expense processing would benefit from auto-import of card feeds.

Conclusion

"Auto-Import Magic" of card feeds transforms the way organizations ingest, reconcile, and manage corporate card transactions in expense workflows. By automating the retrieval, parsing, matching, and linking of credit card transactions to expense entries, the system eliminates manual data entry, accelerates reconciliation turnaround, and increases accuracy, visibility, and control.

Creodata's Expense Management Automation solution, with built-in corporate card reconciliation and native integration to Dynamics 365 Business Central, exemplifies how this kind of auto-import capability can be delivered in a scalable, secure, and enterprise-ready fashion. Organizations that adopt such capabilities gain significant advantages in cost, operational efficiency, compliance, and user satisfaction.

For more information, visit Creodata.com