Streamlining Lending Operations: The Strategic Power of the Branch Manager Role in Loan Origination

See how a dedicated Branch Manager role and assignment module in a Loan Management System streamlines lending operations, improves accountability, and accelerates loan origination.

Introduction

In the fast-paced world of banking and financial services, the loan origination process is the central nervous system. Its efficiency, accuracy, and speed directly impact customer satisfaction, risk management, and ultimately, the institution's bottom line. However, this process is often plagued by bottlenecks, lack of accountability, and visibility gaps, especially when managing the crucial handoff between customer-facing Relationship Managers (RMs) and their supervisory Branch Managers (BMs).

Modern Loan Management Systems (LMS) are transforming this chaotic workflow into a streamlined, digital powerhouse. A pivotal feature within these advanced systems is the dedicated BM Role module, specifically designed for BM Assignment. This is not merely a digital task list; it is a strategic command center that empowers Branch Managers to assign, monitor, and control the entire loan application lifecycle with unprecedented precision.

This article explores the BM Assignment use case in depth, examining how it works, its transformative advantages, and the financial institutions that stand to benefit most from its implementation.

Key Advantages of the BM Assignment Feature

Implementing a structured BM Assignment workflow delivers profound advantages across operational, risk, and strategic dimensions.

Enhanced Operational Efficiency & Speed

The most immediate impact is a dramatic reduction in loan processing time. By eliminating manual handoffs and centralizing information, the system minimizes administrative delays. RMs know exactly what's on their plate, and BMs have a clear view of the workflow. This streamlined process directly translates to a faster Time-to-Yes (and Time-to-Yours) for the customer, a critical competitive differentiator in today's market.

Unparalleled Accountability & Transparency

Every action is logged within the system. The BM knows who is responsible for an application at any given moment. This creates a culture of accountability where RMs are empowered to manage their assigned tasks efficiently. There is no ambiguity or "he said, she said" regarding responsibility, which fosters a more disciplined and professional work environment.

Optimized Resource Allocation & Workload Management

The BM gains data-driven insights into team capacity. By visualizing each RM's workload, the manager can distribute applications evenly, preventing overburdening top performers and under-utilizing others. This leads to better workforce planning, higher job satisfaction, and reduced risk of errors due to fatigue or rushing.

Improved Risk Management & Compliance

A consistent and auditable process is a cornerstone of good governance and regulatory compliance. The BM Assignment feature ensures that every application follows a predefined path. The system maintains a complete audit trail, recording who assigned what, to whom, and when, along with every status change. This is invaluable for internal audits and regulatory reporting, demonstrating a robust and controlled lending environment.

Data-Driven Decision Making

The oversight dashboard transforms a BM from a reactive problem-solver into a proactive strategist. By analyzing trends—such as which loan types take longer to process, which RMs excel in certain segments, or the common reasons for delays—the BM can make informed decisions to optimize processes, design targeted training programs, and improve the overall health of the branch's loan portfolio.

Superior Customer Experience

While this is an internal workflow tool, the beneficiary is ultimately the customer. A faster, more predictable, and error-free application process significantly enhances customer satisfaction. When an RM is fully informed and accountable, they can provide more accurate updates to the customer, building trust and reinforcing the institution's brand reputation for reliability.

The CreoData Advantage in Loan Management Workflow

When examining a platform like CreoData's Loan Management Solution, the principles of the BM Role and Assignment are integrated into a comprehensive, enterprise-grade system. As detailed on their website, their product is built to handle the entire loan lifecycle.

Configurable Workflows

The assignment rules and process stages are not rigid. Institutions can tailor them to their specific organizational structure and credit policies, ensuring the system adapts to their unique needs.

Seamless Integration

The LMS can integrate with Core Banking Systems (CBS), credit bureaus, and document verification APIs. This means when a BM assigns an application, the RM has immediate access to a 360-degree customer view without switching between platforms.

Advanced Analytics and Reporting

Beyond basic oversight, CreoData's platform offers deep-dive analytical reports on branch and RM performance, pipeline health, and turnaround times, giving BMs and senior management powerful strategic insights.

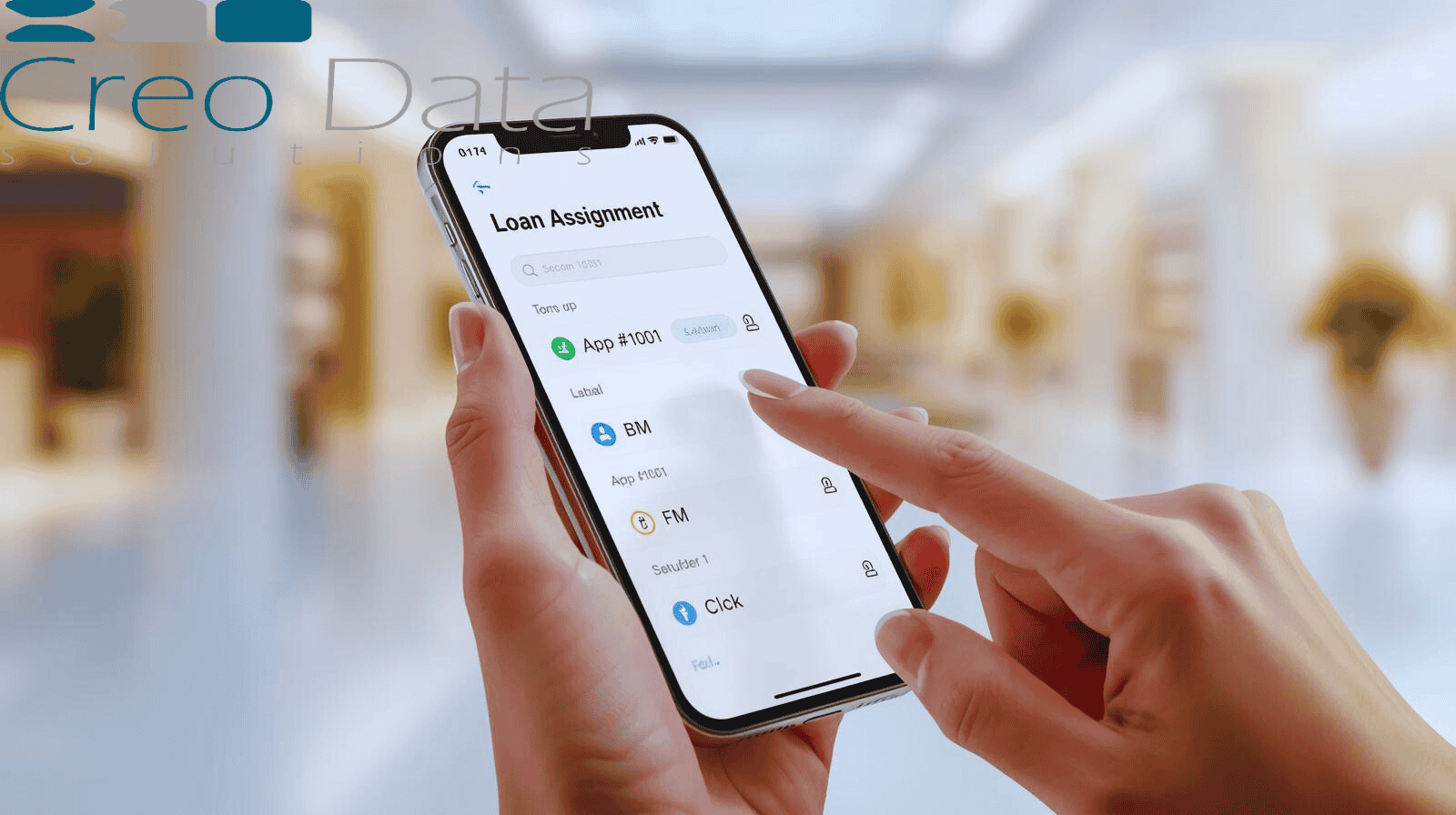

Mobile Accessibility

The ability for BMs and RMs to monitor and manage assignments on-the-go ensures that the workflow remains agile and responsive, even outside the physical branch.

By choosing a holistic solution like CreoData's, financial institutions are not just buying a task assignment tool; they are investing in a connected ecosystem that optimizes the entire lending value chain, with the BM Role acting as its intelligent control node.

Target Audience: Who Needs the BM Assignment Feature?

This feature is strategically critical for a wide range of financial institutions where a branch-based or team-based lending model is prevalent.

Commercial Banks (Retail & SME Lending)

This is the primary audience. Large banks with extensive branch networks require a standardized way for Branch Managers to distribute thousands of applications among hundreds of RMs. The scale makes manual management impossible, and the stakes make mismanagement costly.

Cooperative Banks and Credit Unions

These member-focused institutions thrive on personal relationships and efficient service. The BM Assignment feature allows them to maintain their personalized touch while adopting the operational efficiency of larger banks, ensuring that member loan applications are handled promptly and by the right loan officer.

Non-Banking Financial Companies (NBFCs)

NBFCs often operate in niche markets with aggressive growth targets. Their success hinges on a fast and flexible lending process. Empowering their branch or team managers with a tool to dynamically assign and track applications allows them to outpace traditional banks in speed and agility.

Microfinance Institutions (MFIs)

MFIs manage a high volume of small-ticket loans, often in remote locations. Field officers (their version of RMs) are constantly on the move. A digital system where area managers can assign groups of applicants to field officers and track collection progress is transformative for operational control and scalability.

FinTech Lenders

Even digitally-native FinTechs have teams of underwriters and analysts. The "BM" in their context might be a "Team Lead" or "Underwriting Manager." The need to assign incoming loan applications to the right analyst based on complexity, amount, or expertise is identical. This feature brings structure and scalability to their back-end operations.

Conclusion: From Managerial Chore to Strategic Command

The BM Assignment feature is a quintessential example of how technology can elevate a routine managerial task into a strategic function. It moves the Branch Manager from being a traffic cop drowning in paperwork to a conductor orchestrating a symphony of efficient, compliant, and customer-centric lending operations.

In an industry where margins are tight and competition is fierce, the ability to process loans faster, with lower risk and higher accountability, is no longer a luxury—it is a necessity. By implementing a robust Loan Management System with a dedicated BM Role module, financial institutions are not just streamlining a workflow; they are building a foundation for sustainable growth, resilience, and exceptional customer service.

The system empowers the very people—the Branch Managers and their teams—who are on the front lines, driving the business forward. Through enhanced visibility, accountability, and strategic control, Branch Managers transform from administrative coordinators into strategic leaders who optimize lending operations and deliver exceptional customer outcomes.

For more information, visit Creodata.com