Audit-Ready Document Management System

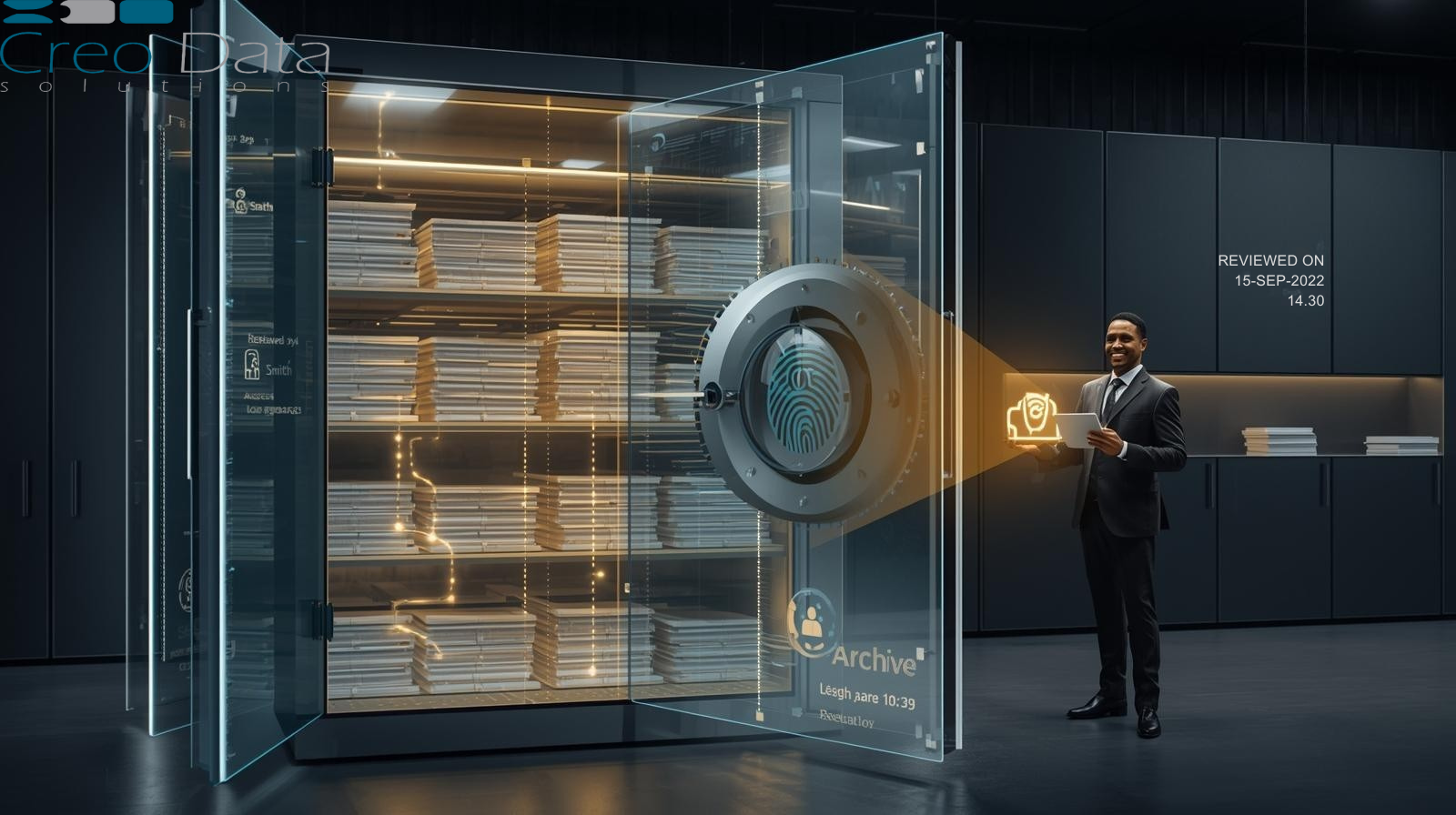

Build a compliant, traceable document management system with audit trails, versioning, and governance for regulated finance.

Introduction: Why Audit-Ready Documentation Matters

In regulated finance—where banks and lending institutions must adhere to standards like Basel III, IFRS 9, local central bank mandates, and others—document management isn't just operational; it's mandatory. Auditors demand full transparency: When was a document created, who last edited it, what changed, and in which version? And they expect this on demand.

Failing to meet those expectations can result in regulatory fines, reputational damage, or worse. But with an audit-ready document management system (DMS), organizations safeguard compliance, streamline governance, and build trust.

Core Features of an Audit-Ready Document Management System

Timestamping & Version Control

Every document is automatically marked with when it was created or modified—and by whom. Each version is preserved, so you can trace history precisely if regulators ask.

Audit Trails

Detailed logs capture user activity—access, edits, approvals—creating a chronological record essential for internal and external audit scrutiny.

Secure Categorization & Metadata

Documents are organized by type, project, or regulation, with metadata tags for easy retrieval. This structured approach ensures searches during audits are fast, accurate, and defensible.

Access Controls & Permissions

Role-based permissions ensure only authorized individuals can view, edit, or approve documents, greatly reducing risk.

Retention Policies & Disposal Automation

Systems can be configured to automatically archive, retain, or delete documents per regulatory retention schedules—removing human error from the equation.

Centralized Repository & Efficient Retrieval

All documents are housed in a unified, secure platform with powerful search capabilities—so auditors can easily retrieve the needed records without needing an SOS.

Why These Features Matter in Regulated Finance

- Traceability and Transparency: Each document's journey—who touched it and when—is recorded. Auditors value this clarity when verifying loan decisioning, policy changes, or customer documentation.

- Operational Efficiency: No more manual filing, chasing older versions, or dealing with inconsistent naming conventions—everything is automated, searchable, and organized.

- Risk Mitigation: Control access, prevent unauthorized edits, and protect against non-compliance or data breaches.

- Strategic Readiness: Whether it's scheduled audits or spontaneous regulatory checks, you're always ready.

Creodata's Loan Management System: Integrated Audit-Ready Capabilities

According to Creodata's product info on their Loan Management System:

- The system is a cloud-based lending platform built on Azure, tailored for small banks, SACCOs, and microfinance institutions. It streamlines the entire loan lifecycle while promoting regulatory compliance and operational efficiency.

- Key compliance-ready capabilities include:

- Audit trails and robust data governance tools

- Secure, bank-grade architecture, plus high uptime

- Customizable workflows, lending products, and loan processes suitable for diverse regulated organizations

Target Audience for an Audit-Ready DMS

Beyond auditors and compliance officers, other stakeholders benefit:

- Risk Managers – who need visibility into document provenance to assess governance controls

- Loan Officers & Back-Office Staff – who rely on accurate, current documentation to make lending decisions without compliance pitfalls

- IT and Security Teams – who oversee system integrity, access logs, and protection measures

- Senior Executives (e.g., CTO, CFO) – who demand operational dashboards and reports auditing readiness

- External Auditors / Regulators – who require clear, easy-to-access documentation and history

- Legal Counsel – ensuring doc authenticity for dispute resolution or contract verification

Advantages of an Audit-Ready System

| Advantage | What It Means for Regulated Finance |

|---|---|

| Full Traceability | Every change is recorded—complete audit trail in place. |

| Audit-Ready at All Times | No last-minute scramble to prepare for audits. |

| Data Governance Excellence | Built-in reporting, version control, and classification. |

| Operational Efficiency | Faster document retrieval and clear approvals. |

| Security & Integrity | Access controls, immutable versions, encrypted storage. |

| Reduced Risk | Limits user error and unauthorized access. |

| Scaling & Customization | Adapts to institution size and regulatory changes; Creodata offers configuration to match workflows. |

| Cost Savings | Less manual labor, fewer audit penalties, more automation. |

| Competitive Advantage | Institutions appear more trustworthy and efficient to regulators and partners. |

Best Practices for Deployment in Regulated Finance

- Audit Your Document Lifecycle – Start by mapping how documents are created, reviewed, approved, and stored

- Define Metadata Standards – Use structured naming, tags, and categories tailored to compliance needs

- Implement Role-Based Access – Limit editing/viewing rights to reduce exposure

- Automate Versioning & Archiving – Ensure every edit is logged, prior versions preserved, and retention rules enforced automatically

- Train Staff – Ensure users understand the system, retention policies, and compliance responsibilities

- Regular Audits & Testing – Periodically test system logs and functionality to ensure readiness

- Monitor Regulatory Changes – Update workflows and document structures as regulations evolve

How It Works in Practice

Scenario: A local microfinance institution adopts Creodata's Loan Management System integrated with audit-ready document management.

- Loan Application: A customer submits digitally scanned ID and financial statements

- Automatic Logging: The system timestamps uploads, tags them as Application Documents, and sets version 1

- Workflow Steps: Reviewer opens the doc, adds comments—system logs that action with timestamp and user ID

- Documents Evolve: If applicant updates or resubmits a file, a new version is created and prior one archived, without deleting history

- Compliance Review: Compliance officer runs a report to verify all loan files include KYC documents and have proper version status

- Audit Time: External auditor requests a sample of loan application files. The system allows immediate retrieval of full document history with logs and user activity records

Conclusion

An Audit-Ready Document Management System is more than a software—it's your institutional safeguard. By embedding timestamps, version control, structured categorization, and permissions from day one, your organization becomes agile, compliant, and resilient.

Creodata's Loan Management System, with its audit trail and governance features, offers a strong foundation for regulated financial institutions seeking operational excellence and compliance confidence.

A well-implemented DMS doesn't just satisfy compliance—it becomes a strategic advantage that streamlines operations, minimizes risk, and builds confidence with regulators, stakeholders, and customers alike.

For more information visit: https://www.creodata.com/products/loan-management/