Final Decision – MCC/Board Role in the Decision Workflow

Learn how MCC and Board-level final decision authority in loan management workflows ensures governance, accountability, and risk control for high-value credit decisions.

Introduction

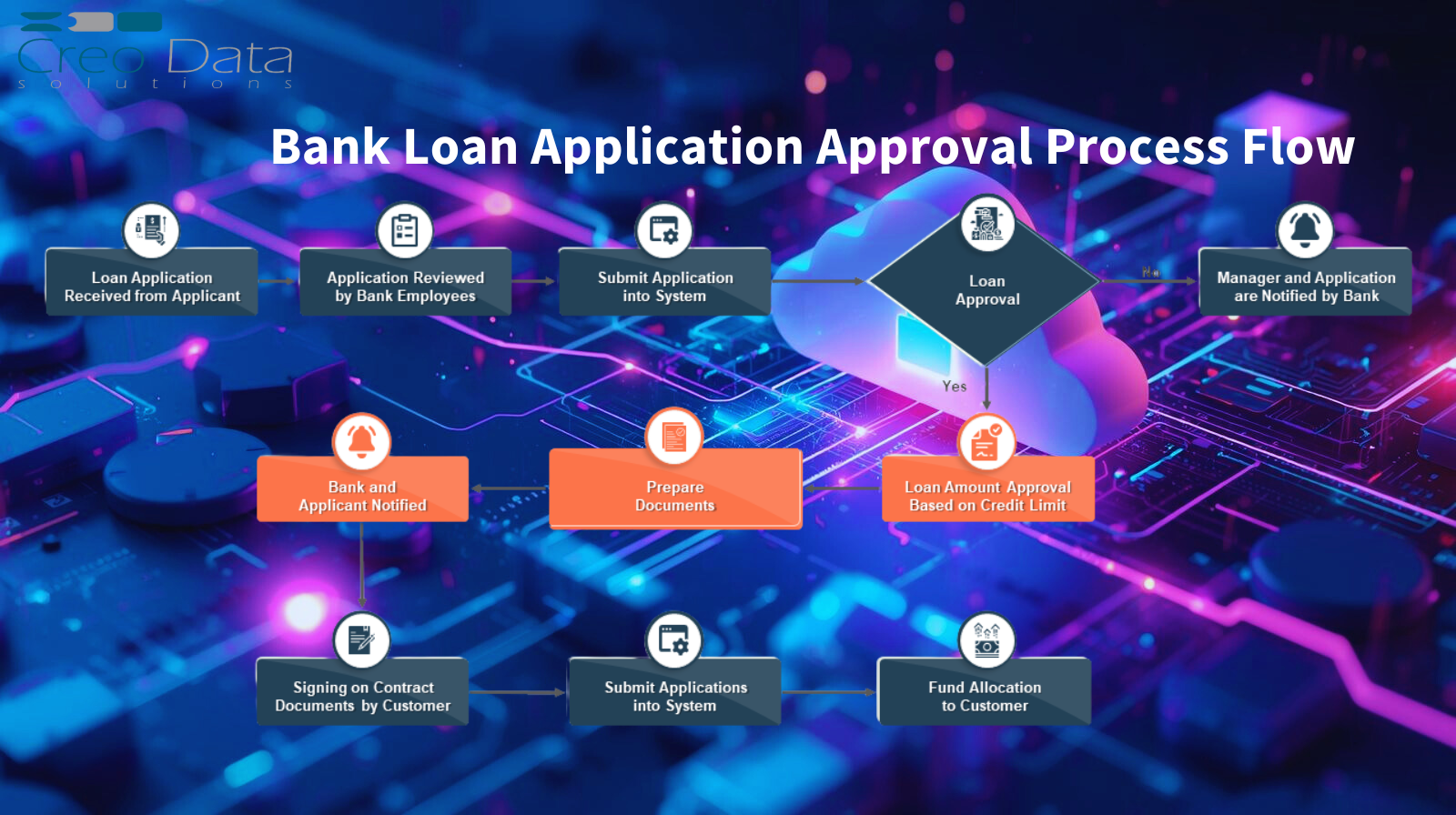

In modern lending institutions, the path from loan application to credit disbursement is rarely linear and mechanical. Rather, the decision-making process often involves multiple layers of review, checks, and balances. One essential layer in that architecture is the final decision authority—often implemented as a MCC (Management Credit Committee) or Board—which reviews proposals prepared by credit/officer teams and then issues the binding final credit decision. In a robust Decision Workflow system, this module (MCC / Board Role) acts as the apex checkpoint, overriding or affirming upstream approvals, mitigating concentration risk, ensuring governance, and embedding accountability.

Use Case: Final Decision (MCC / Board Reviews and Makes Final Credit Decision)

Let's walk through the use case "Final Decision" in more detail, showing a typical flow and considerations.

Actors / Roles Involved

- Credit Officer / Underwriter: Prepares the loan proposal package (credit analysis, risk scoring, financials, collaterals, exceptions, recommended terms)

- Credit Manager / Reviewer: Performs secondary checks, ensures compliance with policy, may adjust or question parts

- MCC / Board Members: Senior executives, risk committee members, board members with credit approval authority

- System / Workflow Engine: Automatically routes, aggregates inputs, enforces decision rules, and records outcomes

Typical Flow

1. Escalation Criteria Check

When a loan proposal is ready (after origination, underwriting, preliminary review), the system evaluates whether the proposal should go to MCC/Board. Criteria may include:

- Loan amount exceeds thresholds

- Risk score or deviation from standard policy is high

- Exceptions or override requests exist

- Aggregated exposure to a sector / client exceeds exposure limits

2. Packaging & Preparation

The system collates all relevant information: applicant profile, credit history, financial statements, risk metrics, proposed structure, exception summary, collateral details, recommended decision (approve/reject), sensitivity analyses, stress tests, comments from credit officers. This package becomes the "proposal dossier" in the MCC portal.

3. Notification & Distribution

MCC members are alerted (via email, in-app message) that a proposal is pending. They can access the dossier, review, and annotate.

4. Review & Discussion

In some setups, MCC members can hold discussion (in system-enabled comments or external meeting) and mark up the proposal. They may request changes or clarifications.

5. Decision / Voting

Each member may cast a vote (yes/no/conditional). The system may aggregate (e.g. majority rule), or require unanimous or quorum. The final decision is captured with reasons and conditions.

6. Conditional Modifications

The MCC may approve but with modified terms (e.g. lower loan amount, added covenant, stricter interest margin). These changes are recorded.

7. Finalization & Routing

- If approved: The workflow engine triggers subsequent steps (legal document preparation, disbursement, compliance checks, setting up repayment schedule, accounts, etc.).

- If rejected: The proposal is closed or returned with reasons; possibly alternative options (appeal to board, resubmit) are enabled.

- If remanded or conditional: The originator is notified to revise and resubmit.

8. Audit Trail & Logging

The system records every action, timestamp, user, comment, version of proposal, decision rationale.

9. Notifications / Dashboards

Credit operations, risk teams, compliance, disbursement teams are alerted of outcome. The decision is visible in portfolio dashboards and reports as part of the credit pipeline.

Incorporation in Creodata's Loan Management Solution

Creodata's Loan Management solution, per the official description, is a comprehensive, cloud-based platform that manages the full loan lifecycle (origination, approvals, disbursement, repayment, delinquency).

Key features listed include:

- End-to-End Loan Processing (manage application, approvals, disbursements, repayments)

- Customizable workflows and multi-level approval hierarchies

- Real-time reporting & dashboards

- Role-based access control, audit logging, compliance frameworks

Given these capabilities, Creodata's system is well suited to embed a Decision Workflow with MCC / Board Role. Below is how it could (or likely already) supports the use case of Final Decision:

1. Customizable Approval Hierarchies

Creodata allows configuring multi-level approval workflows (including escalation)—that becomes the backbone through which MCC/Board level nodes can be inserted.

2. Role-Based Access & Fine-Grained Permissions

The MCC / Board persons can be assigned a specific role with access only to critical review dashboards and override rights. Sensitive data may be masked or only visible to those roles.

3. Workflow Branching & Escalation Logic

Creodata allows "if-then" logic in workflow definitions (i.e. if loan > X, escalate to MCC)—so proposals can route dynamically.

4. Audit Trails & Compliance Support

All system activities are logged, which supports the accountability requirements of final decisions.

5. Dashboard / Reporting for Decision-Makers

Board / MCC members can view aggregated pipeline, pending decisions, historical decisions, and key metrics to inform approvals.

6. Integration with Downstream Modules

Once MCC decision is made, Creodata's disbursement, legal, repayment, and core integrations modules can kick in.

7. Notifications / SLA Enforcement

Email / in-app prompts can remind MCC members of pending proposals, and auto escalate if overdue.

Thus, Creodata's platform offers the infrastructure to support a robust Final Decision (MCC / Board Role) feature within its decision workflow engine. If not currently shipped as a distinct module, it is a natural extension for lenders requiring strong governance.

Advantages of Having the Final Decision (MCC / Board) Module

Embedding a structured "Final Decision by MCC / Board" feature in the decision workflow brings multiple key advantages:

1. Enhanced Governance, Oversight & Accountability

- Ensures major credit risks are reviewed by senior management or board-level bodies

- Mitigates undue concentration or exposure that junior underwriters might overlook

- Accountability is clear: every decision is traceable to persons and rationale

2. Consistency & Policy Enforcement

- MCC/Board can enforce standard credit policy consistently across proposals

- Conditions, deviations and exceptions are centrally reviewed rather than ad hoc

- Ensures that exceptions don't proliferate unchecked

3. Risk Control & Portfolio Quality

- Escalation of high-risk or borderline proposals for scrutiny helps maintain credit quality

- Ensures that loans with aggressive assumptions are double-checked

- The oversight body can demand additional mitigants, covenants, collateral, or adjustments

4. Strategic Oversight & Portfolio Steering

- MCC/Board sees the macro picture—trends, emerging risks, sector concentrations

- They can adjust policy direction or intervene in specific sectors as needed

- Enables holistic decision-making (not just focusing on individual deals)

5. Protection & Audit Compliance

- Audit logs and formal review paths strengthen internal controls, regulatory compliance, and auditability

- In case of defaults or disputes, the decision trail provides evidence

- Helps with risk & compliance reviews and external regulator audits

6. Empowerment and Scalability

- Delegation: routine low-risk loans can be handled by credit officers; only escalations reach the board

- Scalable: as volumes grow, only a small fraction reach MCC, so the system remains efficient

- Standardization: decision templates, checklists and workflows reduce ad hoc errors

7. Transparency and Efficiency

- Decision-makers don't have to chase documents manually; everything is aggregated in one dossier

- Decisions are executed faster, with clarity on next steps

- Feedback loops: originators see comments, conditions, and learn from declined cases

In total, this feature balances control and agility—enabling institutions to scale credit operations without losing oversight or risk discipline.

Target Audience

Not all lending institutions need or will benefit equally from an MCC/Board final decision module. It is most relevant where:

1. Banks & Commercial / Retail Banks

- Larger banks with multiple branches, significant credit portfolios, and exposure risk

- They already maintain credit committees; integrating them into the digital workflow improves governance and efficiency

2. Microfinance Institutions / Tiered MFIs

- MFIs that scale beyond very small loans into mid-size portfolios

- When they begin to issue higher-value loans or portfolio risk becomes material, oversight bodies become necessary

3. SACCOs / Credit Unions / Cooperative Lenders

- SACCOs that grow in size, multiple branches, diversified loans, and need stronger risk controls

- They may have boards or oversight committees that should formally review large loans

4. Specialized Lenders / Niche Finance (Asset Finance, SME Lending, Leasing)

- Institutions doing asset-based lending or SME financing, where credit appraisal is more complex

- They often deal with exceptions, structuring, and risk exposures needing senior oversight

5. Holding Companies / Financial Groups

- Financial institutions that hold subsidiaries; central credit committees may need to audit or review proposals across the group

- They may want a group-level board review of significant credit exposures

6. Institutions in Regulated / Strict Compliance Environments

- Places where regulatory or audit requirements demand formal committee reviews of large credit exposures

- Institutions that want to document decision rationales, show traceability, and withstand scrutiny

7. Growing Institutions with Ambition to Scale

- Lenders in growth stage that foresee increasing volumes and risk complexity

- They want to embed governance disciplines before lapses occur

In short, any institution that wants to scale credit operations, maintain risk discipline, and enforce oversight would find significant value in the MCC / Board final decision feature.

Summary & Conclusion

The Decision Workflow category of a loan management system encompasses the structured pathways through which a credit application flows from initiation to disbursement. The MCC / Board Role feature is a critical module in that workflow, enabling senior-level oversight and binding final credit decisions.

The Final Decision use case—where MCC or the Board reviews proposals and issues the ultimate approval, rejection, or conditional modifications—is a pivotal control point in lending. Embedding this use case in software ensures consistency, accountability, auditability, and risk control, while allowing the institution to scale.

Creodata's Loan Management platform, with its support for end-to-end loan operations, customizable workflows, multi-level approvals, role-based access, and audit logging, is well positioned to integrate or already accommodate such a module. By incorporating an MCC/Board decision layer, Creodata users can elevate governance and oversight without sacrificing efficiency.

For more information, visit Creodata.com