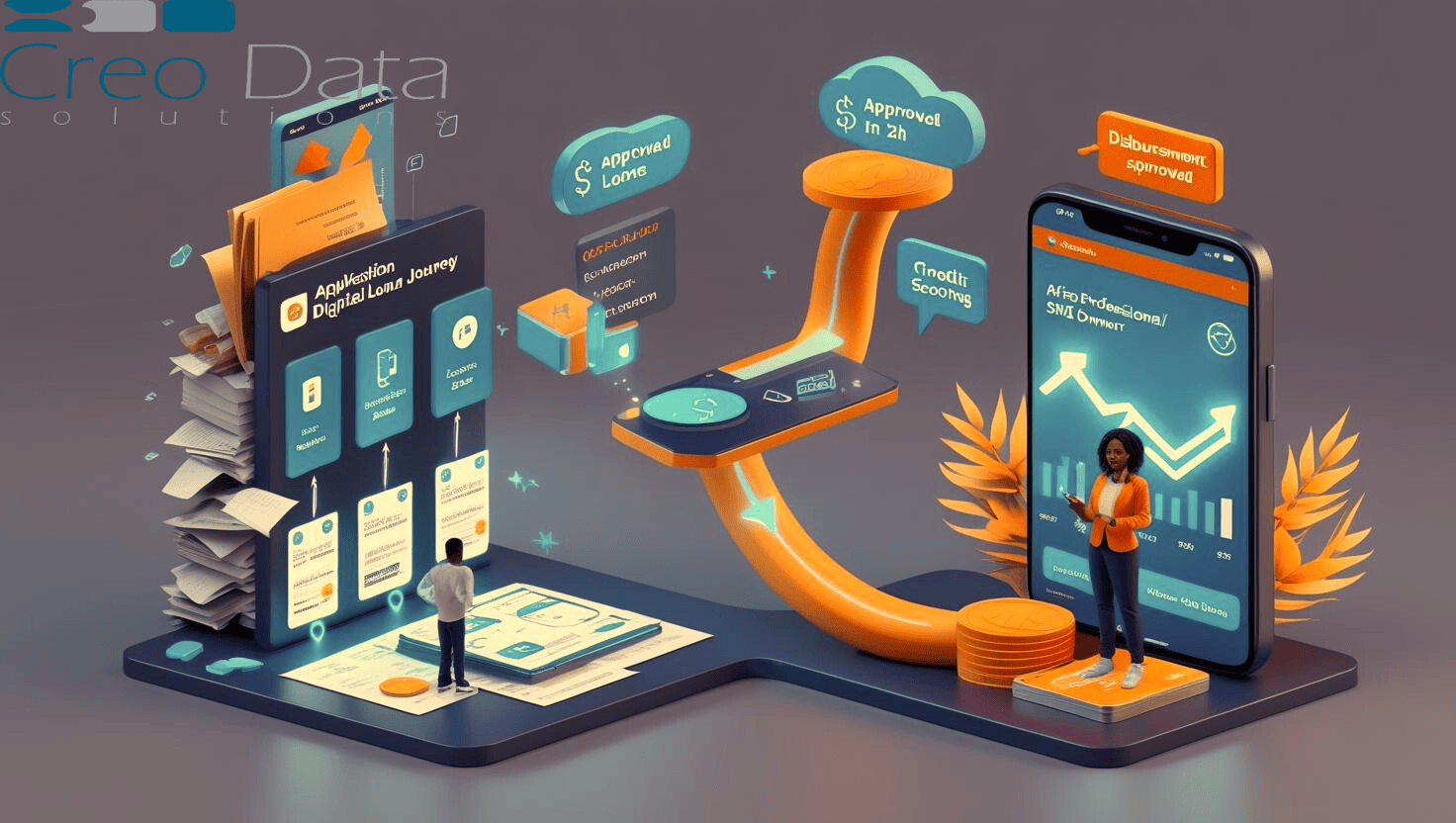

From Submission to Disbursement: Visualizing the Full Loan Origination Journey

Comprehensive end-to-end walkthrough of a modern Loan Origination System workflow for SME loans and salary advances, highlighting user checkpoints and decision gates.

In today’s digitally driven financial environment, traditional loan processing is being rapidly reimagined. Banks, microfinance institutions, and digital lenders are now embracing fully digitized Loan Origination Systems (LOS) to meet the growing demand for faster approvals, real-time visibility, regulatory compliance, and customer satisfaction. For leaders in finance—particularly those steering digital transformation—the need to understand the full loan origination journey from submission to disbursement is not just operational but strategic.

This article offers a comprehensive, end-to-end walkthrough of a modern LOS workflow as it applies to SME loans and salary advances, highlighting user checkpoints, adjustable form fields, and decision gates.

The Importance of Streamlining Loan Origination

Legacy loan systems are often burdened with inefficiencies: manual paperwork, inconsistent customer experiences, siloed data, and long approval cycles. These inefficiencies are no longer acceptable in an era of digital agility and embedded finance.

For banks and financial institutions seeking to stay competitive—especially those offering SME financing or salary-backed advances—an intelligent LOS streamlines every step: from application to underwriting, approvals, and disbursement. It ensures visibility, minimizes risks, automates compliance checks, and delivers a superior experience for both the customer and internal teams.

Step-by-Step LOS Journey: Submission to Disbursement

1. Loan Product Selection and Eligibility Precheck

The journey begins with the applicant—be it a salaried employee applying for a short-term advance, or an SME seeking working capital—accessing the loan application portal.

Key Components:

- Intuitive, mobile-optimized portal

- Product menu (Salary Advance, SME Loan, Asset Financing, etc.)

- Eligibility check using real-time parameters (e.g., employer verification, business turnover range)

Adjustable Fields:

- Field visibility can change based on product selection

- Salary advances might show employer name, net income, and next payday

- SME loans would request business registration, annual revenue, number of employees, etc.

User Checkpoint: Applicants get instant feedback on eligibility or disqualification criteria based on set rules (e.g., income bracket, location, or tenure).

2. Application Submission

Once eligibility is cleared, applicants fill out detailed forms and upload required documents.

Standard Fields Include:

- Personal/business details

- Loan amount and tenure

- Purpose of the loan

- Repayment account details

Dynamic Adjustment: Fields can be shown or hidden dynamically—e.g., if the applicant is a returning customer, the system can autofill known fields.

Document Uploads:

- SMEs upload tax returns, bank statements, business permits

- Employees upload payslips, employment letters

UX Enhancements:

- Document scanning with OCR

- Real-time input validation (e.g., ID number format, IBAN verification)

User Checkpoint: The system confirms receipt of the full application and provides a submission reference number with an estimated timeline.

3. KYC and Fraud Screening

Regulatory compliance requires every applicant to undergo Know Your Customer (KYC) and anti-fraud checks. These steps are fully automated in a modern LOS and occur immediately after submission.

Verification Processes:

- Identity verification via national ID or passport

- Cross-checks with credit bureaus

- Watchlist screening

- Facial recognition or selfie match (optional for salary advances)

Flagging and Escalation: If any inconsistencies are detected—such as mismatched names, duplicate applications, or suspicious transactions, the system flags them for manual review.

User Checkpoint: In case of delays or escalations, the user is notified proactively via SMS or email with instructions on next steps.

4. Credit Scoring and Risk Assessment

Based on the collected data, the LOS performs a creditworthiness evaluation using pre-set scoring models. While backend algorithms drive this, the system presents clear decision paths to internal teams and applicants.

Factors Considered:

- Credit history (via external bureaus)

- Debt-to-income ratio

- Employer stability or business health (for SMEs)

- Existing obligations (verified via account statements or internal records)

Scoring Output:

- Low, medium, or high-risk profile

- Automatic decision (approve/reject) or send for manual underwriting

User Checkpoint: Applicants receive updates on the status: “Application under review,” “Additional documents required,” or “pre-approved.”

5. Internal Review and Underwriting (If Required)

Complex or borderline cases—especially high-ticket SME loans—trigger manual review by credit officers or risk analysts.

Internal Dashboards Show:

- Full application history

- Risk flags

- Document summaries

- Internal comments from reviewers

Review Flexibility: Loan officers can request clarifications or schedule calls with the applicant. The system logs every interaction.

Team Coordination: Different departments (Legal, Compliance, Risk) collaborate seamlessly within the LOS, with timestamped notes and action logs.

6. Approval and Offer Presentation

Once underwriting is complete, the system automatically generates a loan offer tailored to the applicant's profile.

Offer Details:

- Loan amount and interest rate

- Repayment schedule

- Applicable fees

- Legal disclosures and terms

Digital Acceptance: Applicants can accept the offer digitally using an OTP, e-signature, or biometric authentication.

Adjustable Options: Applicants may be allowed to tweak tenure, view alternate repayment plans, or convert to a secured loan type (e.g., from salary advance to payroll-deductible facility).

7. Agreement and Compliance Checks

Once the offer is accepted, the LOS initiates final compliance validation before disbursement.

Steps Include:

- Cross-checking with lending limits or caps

- Approval from designated authorities (if required)

- Automated legal contract generation

- Contract archiving

User Checkpoint: Applicants receive a copy of the signed loan agreement and confirmation of approval.

8. Disbursement

This is the final leg of the journey—funds are disbursed to the applicant’s bank or mobile money account.

Instant Disbursement Logic:

- Salary advances may be disbursed in minutes

- SME loans might include partial disbursements, tied to milestone tracking

Audit and Tracking: The LOS logs disbursement date, amount, channel (bank, M-Pesa, etc.), and settlement ID for future references.

User Checkpoint: Applicants get SMS/email alerts confirming that funds have been sent, including loan repayment details.

9. Post-Disbursement Monitoring

Although disbursement concludes the origination journey, a robust LOS supports post-loan monitoring.

Post-Loan Capabilities:

- Repayment reminders

- Restructuring requests

- Early repayment incentives

- Feedback and customer satisfaction surveys

Why Adjustable Workflows Matter

No two borrowers are alike—and neither are lending products. Whether it’s a salaried teacher applying for a school fees advance or a small enterprise requesting bridge financing, adjustable form flows and flexible business rules ensure that every user journey is personalized.

Benefits of Adjustable Fields:

- Reduced friction and form fatigue

- Context-aware interfaces

- Compliance automation (e.g., local KYC variations)

- Higher conversion rates

LOS platforms like Creodata’s Loan Management System offer these capabilities out-of-the-box—ensuring that bank transformation teams can launch new products without rebuilding the system.

Value for C-Suite and Transformation Teams

For C-level decision-makers and banking transformation leads, a full understanding of the loan origination lifecycle allows for more informed planning, performance measurement, and resource allocation.

Strategic Benefits:

- Operational Transparency: Dashboards track every application, bottleneck, and user action.

- Regulatory Readiness: In-built compliance ensures audit trails and risk flagging.

- Speed to Market: New loan types can be launched swiftly with pre-configured field templates.

- Data Intelligence: Access to structured data for pricing, segmentation, and risk modeling.

- Cost Optimization: Reduced manual labor and branch dependence.

Conclusion: Visualizing the Path to Credit Empowerment

Loan origination is no longer a back-office operation; it is a front-line differentiator in the financial ecosystem. Platforms like Creodata’s LOS enable banks and digital lenders to visualize and optimize the full credit journey—from application to disbursement—with agility and compliance.

For C-Suite leaders and transformation teams, understanding the customer-facing flow, adjustable touchpoints, and real-time decisioning within a modern LOS is key to building scalable, inclusive, and future-proof lending operations.

By reimagining origination not just as a process, but as a journey, financial institutions can empower more customers, reduce risk, and unlock new value in the digital economy.

For more information, visit: https://www.creodata.com/products/loan-management/