Improve Policy Compliance: Enforcing Spend Policies with Compliance Checks

Discover how automated compliance checks in Creodata's Expense Management solution ensure only policy-compliant card transactions become valid expenses.

Ensuring Only Compliant Card Transactions Become Valid Expenses

In today's complex business environment, organizations issue corporate cards to employees to facilitate business purchases—travel, client entertainment, office supplies, software subscriptions, and more. While convenient, this freedom comes with risk: uncontrolled card usage can lead to overspending, policy violations, fraud, reputational damage, and unnecessary effort in expense reconciliation. The challenge is not just issuing cards; it's ensuring that only compliant card transactions become valid expenses. In short: improve policy compliance.

Focus Area: Compliance Checks for Card Transactions

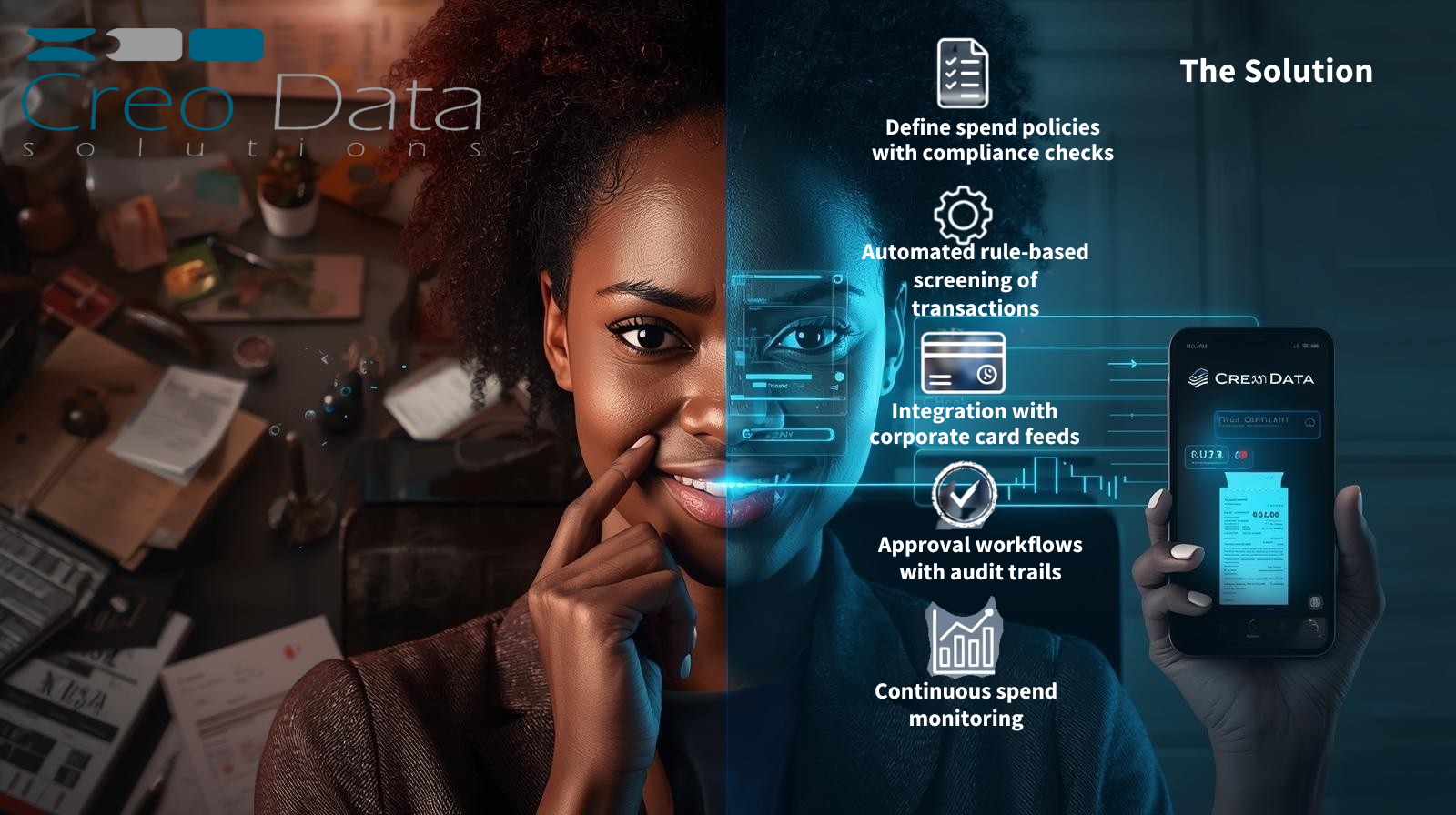

To achieve the objective, the organization must implement effective compliance checks around card transactions. These can be broken down into several dimensions:

1. Policy definition and alignment

First, the organization must clearly define the spend policy: allowable categories, roles with card access, spending limits (per transaction, per day, per period), required documentation (receipts, client entertainment justification), merchant restrictions, pre-approval workflows, etc. According to one guide:

"Clear guidelines for credit-card use protect your business against misuse and fraud. … By defining acceptable business expenses and establishing clear consequences for violations, you reduce the risk of expensive mistakes."

Without a clear policy, compliance checks cannot be reliably configured.

2. Automated rule-based screening

Once a spend policy exists, compliance checks must be embedded into the card/expense workflow. Rule engines can check:

- Is the merchant category permitted?

- Is the spend amount within the allowed limit?

- Does the cost centre/department match an approved role?

- Has the receipt or supporting documentation been uploaded?

- Is the submission within the required timeframe?

Systems that flag or block out-of-policy transactions in real time are much more effective than manual after-the-fact reviews.

3. Integration with card feeds and expense platform

For card transactions, compliance checks must link seamlessly to the expense management system and ideally to the card issuer or spend-management tool. This ensures that card swipes or transactions feed into the system quickly, enabling checks before reconciliation or reimbursement.

4. Approval workflows and exceptions management

When a transaction fails a policy check, a defined workflow should handle what happens: is it automatically declined? Flagged for review? Allowed with explanatory notes? An approval hierarchy may allow specialized purchases (e.g., senior exec travel) with different limits. This ensures flexibility while maintaining control.

5. Audit trail and reporting

Every transaction, its policy status, approval or rejection, must be logged. This enables post-period review, exception tracking, identification of policy gaps or repeated violators, and supports internal/external audit requirements. The culture of compliance is strengthened when employees know transactions are monitored.

6. Continuous monitoring and update

Policies and compliance checks must evolve: merchant types change, new categories appear, budgets shift, regulatory requirements evolve (e.g., tax, VAT). Frequent reviews and updates of both policy and the embedded compliance engine are essential.

Why Use a Solution Like Creodata's Expense Management Automation

The expense‐management solution from Creodata brings concrete advantages when one's focus is enforcing spend policies with compliance checks. Key features from their platform include:

-

AI-powered data extraction: The system claims > 95% accuracy in capturing vendor, date, amount, tax and line items from receipts/invoices. This minimizes manual data-entry errors, enabling faster compliance checks.

-

Seamless integration with ERP (Microsoft Dynamics 365 Business Central): This means once approved, expenses post automatically to the correct GL accounts and dimensions—reducing backlog and human error.

-

Configurable workflows & policy compliance checks: The platform allows you to define expense categories, routing rules, approval thresholds, and automatic flagging of policy violations (it explicitly calls out "Policy Compliance: Automatically flag expenses that violate company policies before they're approved").

-

Corporate-card reconciliation: The ability to match card transactions and receipts automatically supports spend-policy enforcement at one point of truth.

-

Reporting & analytics: Custom dashboards help finance and management monitor spending patterns, exceptions, and compliance metrics.

-

Enterprise-grade security: Built on Microsoft Azure, with encryption, identity management (Azure AD), compliance certifications (GDPR, ISO 27001, SOC 2) and full audit-trail logging—important for governance and audit readiness.

Advantages

1. Greater automation means fewer manual errors and delays

Manual expense processing is slow, labor-intensive and prone to mistakes. Creodata's automation frees finance teams to focus on exceptions rather than data-entry.

2. Early detection of policy violations

By embedding checks at submission/approval time, non-compliant expenses are flagged before reimbursement or posting, reducing risk and rework.

3. Real-time visibility and control

Management gets insight into spend patterns, exceptions and potential cost leakage, enabling proactive corrective action.

4. Integration simplifies the end-to-end process

From card transaction to posting in ERP, the streamlined workflow reduces reconciliation burdens and helps accurate financial reporting.

5. Audit-ready environment

Built-in logging and security means organizations are better prepared for internal/external audits or regulatory scrutiny.

6. Better employee experience

Mobile capture, faster reimbursements, less back-and-forth on receipts improves user satisfaction and compliance behavior.

Target Audience

The target audience for "Improve Policy Compliance" includes:

1. Finance Teams and Controllers

Professionals responsible for enforcing company spend policies, managing reimbursements, and maintaining accurate financial records.

2. Chief Financial Officers (CFOs)

Executives focused on reducing financial risk, improving governance, and ensuring policy-driven control over business spending.

3. Procurement and Compliance Managers

Individuals ensuring that all purchases and expenses align with corporate, legal, and tax requirements.

4. Internal Auditors and Risk Managers

Teams tasked with monitoring compliance, detecting policy violations, and maintaining audit readiness.

5. HR and Administration Departments

Stakeholders involved in corporate-card issuance, employee training, and enforcing spend discipline.

6. Business Owners and Executives of SMEs and Large Enterprises

Decision-makers who aim to improve financial transparency, minimize fraud, and enhance cost efficiency.

7. IT and ERP System Administrators

Professionals integrating expense management platforms like Creodata's Expense Management into existing financial systems (e.g., Microsoft Dynamics 365).

Final Thoughts

Enforcing spend policies through compliance checks is not just a finance-operation initiative—it's part of a broader governance, culture and technology agenda. Organizations that issue cards must accept that without embedded compliance controls, the convenience of cards can become a liability.

By leveraging an expense-management platform like Creodata's, which supports automated data-capture, configurable workflows, policy-flagging, card-transaction reconciliation, and ERP integration, an organization can significantly improve policy compliance. The advantages—faster processing, reduced errors, stronger audit-trail, better spend visibility—are compelling. But success is not automatic: implementation demands clear policy definition, user training, change-management, and continuous review.

For more information, visit Creodata.com