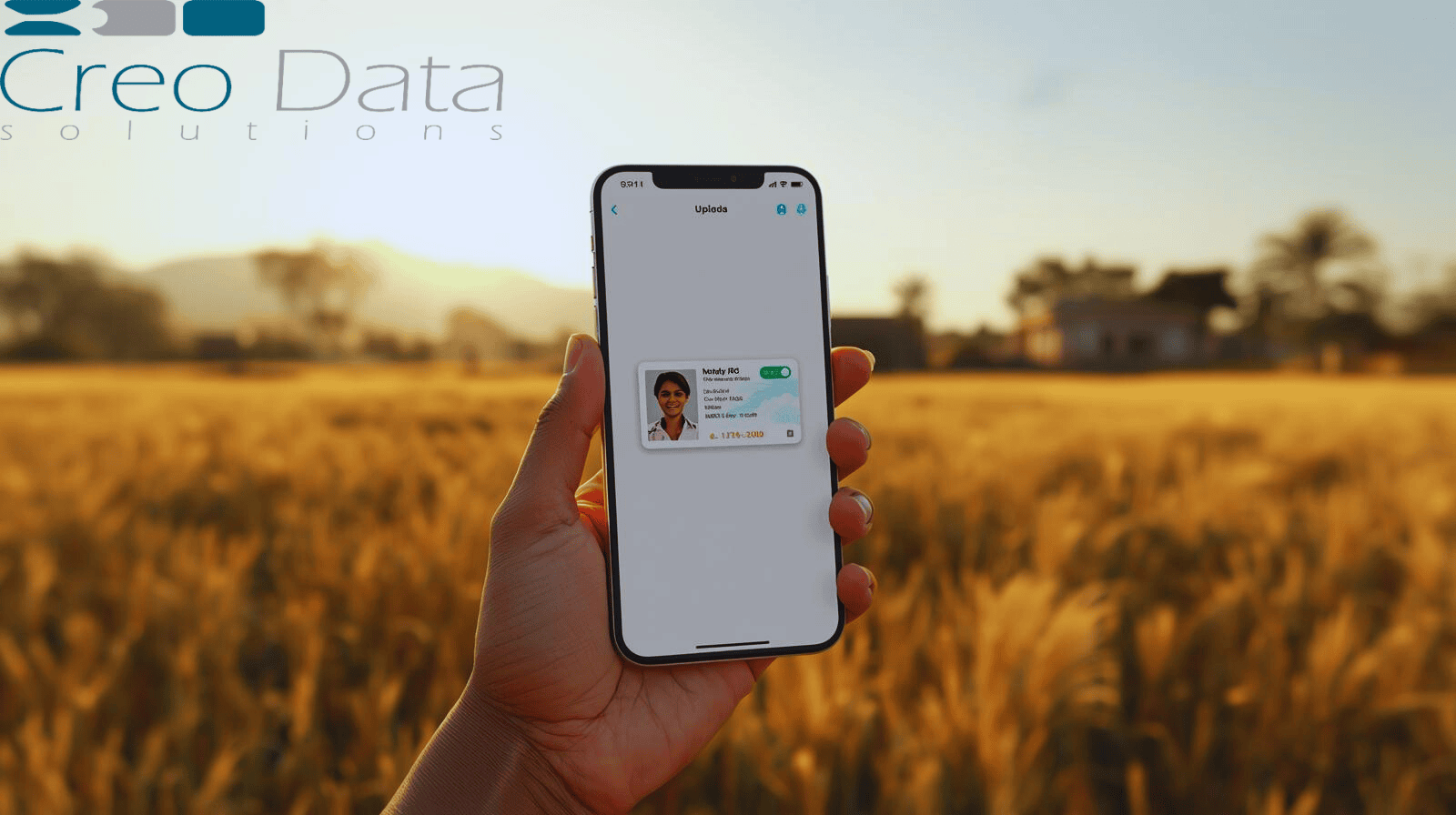

Mobile-Friendly Uploads for Field Operations

Enable field agents to capture and upload loan documents from remote areas with mobile-optimized uploads that work offline and sync when connected.

Introduction

In underserved or rural communities, mobile finance and remote lending fill critical gaps by providing access to credit where traditional banking rarely reaches. A key challenge in these operations is managing documentation efficiently—customers and agents often must upload loan forms, IDs, income proofs, and other paperwork while operating in areas with poor connectivity. Mobile-friendly uploads empower field staff and clients to submit these vital documents using their phones, ensuring smoother, faster, and more secure lending workflows.

This article explores why mobile-enabled uploads are transformative in remote lending, the key features and design considerations necessary for effective implementation, and how Creodata's Loan Management System supports such use cases.

Why Mobile-Friendly Document Uploads Matter in Remote Lending

Reach Extension & Financial Inclusion

Mobile uploads extend lending services into remote or underserved areas, enabling field agents to collect documentation from clients without requiring them to travel to physical branches.

Operational Efficiency

Agents can capture documents on the go, even offline, speeding up the application process and reducing turnaround time—critical for loan approval and customer satisfaction.

User Convenience

Borrowers can simply snap a photo or upload digital documents using their mobile devices, which is user-friendly and minimizes friction.

Accuracy & Compliance

By guiding agents through required document types and providing feedback on upload quality, mobile forms can improve accuracy and completeness, aiding compliance and reducing errors.

Connectivity Resilience

Offline-first upload capabilities allow data to be cached locally and then synchronized when network connectivity returns—ensuring reliability even in low-bandwidth environments.

Key Features of an Effective Mobile-Friendly Upload System

To support remote lending workflows, a robust mobile upload system should include:

Offline-First Upload Design

Allows agents to capture and queue documents without internet connectivity. Once back online, the uploads auto-sync with the central system.

Responsive & Intuitive UI

Optimized forms and interfaces that accommodate photos, attachments, and multiple document types as well as guides to ensure clarity even on small screens.

Automated Validation

Client-side checks—such as image clarity, required document detection, or file size constraints—help minimize rejected or incomplete submissions.

Secure Transmission & Storage

Data encryption in transit and at rest, plus secure local storage (e.g., temporary encrypted cache) protects sensitive document data.

Metadata Capture

Tag uploads with timestamps, GPS coordinates, and agent IDs to support audits, traceability, and fraud prevention.

Progress Indicators & Retry Mechanisms

Feedback on upload status and automatic retry in case of failure help users understand what's happening—even in intermittent networks.

Integration with Core Loan Systems

Once uploaded, documents should be seamlessly linked to customer profiles, loan applications, and KYC workflows in the backend.

Creodata's Loan Management System: Enabling Mobile-Friendly Field Uploads

Creodata's Loan Management System is a cloud-native, Azure-based lending platform tailored to small banks, SACCOs, and microfinance institutions—ideal for mobile finance use cases. It facilitates the end-to-end loan lifecycle—from onboarding through approval and repayment management—with enterprise-grade security and compliance built in.

Although the core product description doesn't explicitly detail mobile or offline uploading, given Creodata's platform characteristics, it's well-positioned to support this use case in several ways:

Cloud & Mobile-Enablement

As a fully cloud-based solution deployed via Azure Marketplace, the platform can be extended with mobile front-end apps or integrated with mobile data-capture tools, aligning well with offline upload flows.

Customizable Workflows & Forms

Creodata's intuitive interface allows tailoring of loan products, workflows, and approval processes. This flexibility means mobile upload flows—for KYC, income documents, etc.—can be built to match field operations.

Secure & Compliant Infrastructure

Leveraging Azure's infrastructure ensures high availability (99.9% uptime), data encryption, role-based access control, audit logging, and compliance with standards like PCI DSS, GDPR, and ISO 27001. This provides a strong foundation for secure document handling.

API & Integration Capabilities

Creodata supports seamless integration with other systems—CRMs, payment gateways, core banking platforms—via APIs. These integration points enable front-end mobile apps to connect to backend workflows, syncing documents and triggering loan processes.

Target Audience

The mobile-friendly upload feature within Creodata's Loan Management System serves a range of stakeholders in mobile finance and remote lending:

- Field Officers / Loan Agents: Responsible for onsite customer interactions, documentation, and loan application initiation

- Microfinance Institutions (MFIs), SACCOs, and Small Banks: Operate in areas with limited branch infrastructure and need efficient mobile-first lending workflows

- Compliance & KYC Teams: Require secure, verified, complete documentation tied to customer profiles and traceable via audit logs

- Operations Managers & Loan Processing Teams: Benefit from streamlined processing, timely document availability, and improved operational metrics

- Technology & IT Leadership: Need a scalable, secure, and integrated loan processing platform that supports mobile and offline capabilities

- Rural and Underserved Borrowers: Gain easier, more inclusive access to financial services through mobile interfaces rather than travel to branches

Advantages of Mobile-Friendly Uploads via Creodata's Platform

| Advantage | Description |

|---|---|

| Improved Accessibility | Field agents can collect and upload documents from remote areas—even offline—accelerating loan onboarding |

| Efficient Loan Processing | Faster and paperless documentation reduces processing delays and improves turnaround |

| Enhanced Security & Compliance | Azure-hosted platform ensures encrypted transmission, access control, and audit trails for document uploads |

| Customizable Field Workflows | Workflows and forms adapted to mobile operations ensure accuracy and consistency in document collection |

| Scalable & Reliable Architecture | Azure-based deployment provides 99.9% uptime and scalable operations to manage spikes in field activity |

| Unified Loan Operations | Collected documents tie directly into the loan lifecycle—onboarding, approvals, disbursement, and repayment |

| Traceable & Auditable Data | Metadata capture (e.g. GPS, timestamps) supports verification and audit during regulatory reviews |

Real-World Scenario: How It Works in Practice

1. Setup

- Institution configures loan product and mobile upload workflow via Creodata's interface

- Mobile app is deployed to field agents' devices

2. Field Document Capture

- Agent visits client, captures required documents via mobile (e.g. photos of ID or income proof)

- App operates offline—images and data are saved locally

3. Metadata and Validation

- The app validates document clarity, enforces required fields, and records GPS location and timestamp

4. Synchronization

- Upon regaining network, uploads securely sync to Creodata's cloud platform

- Documents are automatically linked to the client's loan application

5. Back-Office Processing

- Loan officers review uploaded documents, proceed with approvals or requests for more information

- Audit logs and secure storage ensure compliance visibility

6. Loan Lifecycle Continuation

- Approved loans disbursed, and document data persists for repayment tracking, reporting, and audits

Conclusion

Mobile-Friendly Uploads for Field Operations represent a significant innovation in enabling remote lending and mobile finance. They empower loan agents and borrowers to efficiently and securely submit necessary documentation—regardless of connectivity constraints—thus improving access, operational speed, and compliance.

Creodata's Loan Management System, with its Azure-native architecture, strong security, compliance features, workflow flexibility, and integration capabilities, provides an excellent foundation to support and enhance this use case.

Whether you're a microfinance institution, MFI, SACCO, or small bank aiming to expand into remote lending, adopting mobile-friendly document upload workflows can yield substantial benefits in process efficiency, borrower satisfaction, and regulatory readiness.

For more information, visit Creodata's Loan Management System